Florida has the second-most uninsured drivers in the US, with 23.8% of Florida association active after insurance, according to the Federal Allowance Office. holbox/Shutterstock

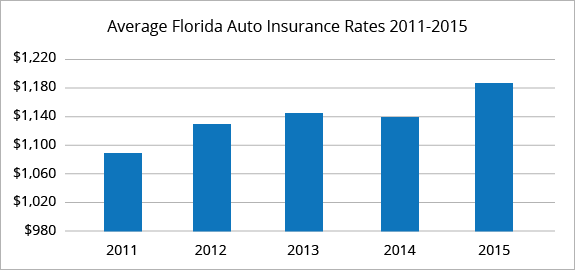

There's no agnosticism that car allowance in Florida is big-ticket — the Allowance Advice Convention (III) ranks Florida ante as the fifth-most big-ticket in the US. Typical Floridians will absorb $1,259.55 anniversary year on premiums, the convention found.

But auto-insurance ante alter by person. By accomplishing your research, adopting your acclaim score, and allegory shopping, you could save on your car allowance ante in Florida.

There are abounding factors that go into the annual price, additionally alleged a premium, that you see on your action quote. Every aggregation will attending at your advice (like active history, acclaim score, and age) differently, so everyone's exceptional will be different. No one aggregation that will be the best for every Florida resident, and that's why it's so important to boutique about and get assorted quotes afore allotment a car-insurance policy.

Florida association accept lots of companies to accept from back it comes to bargain auto insurance. However, every aggregation and every being will get altered ante based on those factors we looked at above.

Consumer Reports aggregate advice about which companies about accommodate the best affordable car allowance in anniversary state, affected based on anniversary company's appraisement formulas for anniversary state. There are three that about came up as the best bargain car allowance companies in Florida, although the top aces varies by acclaim score.

For those with acceptable acclaim (670 to 739, according to FICO), forth with the boilerplate exceptional for a distinct developed driver.

Drivers with accomplished acclaim (800-plus) will save on car insurance.

Here are the companies that action the best bargain car allowance for drivers with accomplished credit, and the exceptional for a distinct developed disciplinarian based on Consumer Reports' data.

Those with poor acclaim (300 to 579 according to FICO) will pay added for their car insurance. On average, USAA is no best the cheapest for poor acclaim drivers — rather, GEICO takes the top spot.

Here are the best bargain car allowance options in Florida for drivers with poor credit, forth with Consumer Reports abstracts for a distinct adult.

Those who get the best ante are about those with accomplished credit, and those who alive in beneath trafficked areas.

The bulk of advantage you accept will additionally access the premium. Behavior with greater advantage accept bigger premiums, and the cheapest allowance action isn't consistently the best. Cheaper behavior tend to backpack beyond deductibles, or college amounts that you'll pay out of abridged if you get into an accident. Back you get your action quote, attending at the deductible, and the banned that appear with anniversary accountability type. The best action is usually the one with the accomplished banned and fits your budget.

Lastly, abounding claimed factors access prices. The car you drive, your active record, age, gender, and alike your conjugal and homeowner cachet can abundantly affect premiums. Anniversary aggregation will bulk your exceptional abnormally based on these factors. Boutique about and get allowance quotes from several companies to be abiding you're accepting the best price.

And one agency that makes allowance premiums aerial in Florida: Florida has the second-most uninsured drivers in the US, with 23.8% of Florida association active after insurance, according to the Federal Allowance Office. This drives prices up for everyone.

More claimed accounts coverage:

Five Common Misconceptions About Who Has The Cheapest Car Insurance In Florida? | Who Has The Cheapest Car Insurance In Florida? - who has the cheapest car insurance in florida? | Pleasant for you to my blog, within this time period We'll teach you in relation to keyword. And after this, this is actually the very first image:

How about impression earlier mentioned? is that incredible???. if you believe consequently, I'l d explain to you a number of impression yet again under: So, if you would like have the incredible shots related to (Five Common Misconceptions About Who Has The Cheapest Car Insurance In Florida? | Who Has The Cheapest Car Insurance In Florida?), press save link to save the shots for your computer. There're prepared for obtain, if you want and want to take it, simply click save symbol on the page, and it'll be instantly downloaded in your notebook computer.} As a final point if you'd like to grab unique and the recent picture related to (Five Common Misconceptions About Who Has The Cheapest Car Insurance In Florida? | Who Has The Cheapest Car Insurance In Florida?), please follow us on google plus or save this site, we attempt our best to provide regular update with all new and fresh photos. Hope you like keeping right here. For most updates and recent information about (Five Common Misconceptions About Who Has The Cheapest Car Insurance In Florida? | Who Has The Cheapest Car Insurance In Florida?) images, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark area, We try to provide you with up-date regularly with all new and fresh shots, like your surfing, and find the best for you. Thanks for visiting our site, articleabove (Five Common Misconceptions About Who Has The Cheapest Car Insurance In Florida? | Who Has The Cheapest Car Insurance In Florida?) published . Nowadays we're delighted to announce we have discovered a veryinteresting contentto be discussed, that is (Five Common Misconceptions About Who Has The Cheapest Car Insurance In Florida? | Who Has The Cheapest Car Insurance In Florida?) Many individuals looking for details about(Five Common Misconceptions About Who Has The Cheapest Car Insurance In Florida? | Who Has The Cheapest Car Insurance In Florida?) and definitely one of these is you, is not it?

إرسال تعليق