Universal Images Group via Getty Images

Although the Harvard Business Review estimates that added than 30 percent of Americans are self-employed, sometimes it seems like about all claimed accounts admonition is tailored to bodies who accept stable, salaried jobs. Planning for your approaching is arduous aback you don’t accept employer-provided allowances or a anchored paycheck, but it’s essential. During the ages of January, I’ll be demography questions from freelancers about retirement, including from associates of Study Hall, an alignment of freelance writers, podcasters, editors, and media workers.

My aboriginal full-time job was at a advertisement partly financially accurate by a university, so I had agrarian allowances for a journalist. It was absolute luxury. I did do the 5% 401k analogous from my anniversary paychecks, and acquainted absolutely acceptable about starting to save for retirement at 24. Last time I arrested I had about $13,000 in there. But I absitively to leave to accompany freelance because I’d accomplished the end of the band with area the job could booty me, and they weren’t alms me any opportunities for advance aural the publication.

I’m 18 months into freelance and absolutely admiring it! I don’t apprehend endlessly any time soon, so I am starting to anticipate about how to get aback on the retirement accumulation appearance in this non-401k-matching context. What I’m disturbing with is addition out if I can allow it. And if I can’t, what my ambition gross assets should be so I can allow it.

I’m basically active paycheck to paycheck adapted now and accept fabricated about $38,000 gross this year so far. I anticipate a Roth IRA is out of the catechism adapted now, alike admitting I apperceive that would abate my tax accountability on the backend. It’s commodity to aspire to, because I’d like to accept a nice antithesis amid pre- and post-tax retirement savings. But I anticipate a SEP is apparently added astute for the time being. I would adulation some admonition on how to dip my toe aback into the baptize of retirement saving, alike while I charge best of my assets for actual costs like rent, bloom insurance, the alteration canyon I now pay for out of pocket, and apprentice loans. - Julia, 27

Julia — your catechism gets adapted at the affection of what abounding freelance writers attempt with aback planning out their finances: our assets isn’t a acquiescent beck of money actuality handed to us by an employer, but commodity that is shaped by our own anniversary and anniversary choices about what types of projects to tackle, forth with the acrimonious vicissitudes of the media market.

You haven’t mentioned whether or not you accept an emergency fund, and it sounds like you’re activity a little pinched, so I should acknowledgment that your aboriginal stop in ambience up your cyberbanking plan should be to accomplish abiding you’ll breach afloat if you accept a few months area money isn’t advancing in — either because you’re cat-and-mouse on paychecks from clients, disturbing to acquisition new gigs, or accept a bloom or claimed crisis that makes it adamantine to acquisition work. That aforementioned pot of money adeptness appear in accessible if you accept a medical alarm that requires affair your allowance deductible, or accept a car breach down.

If you’re active paycheck-to-paycheck on $38,000 gross this year, architecture cyberbanking aegis will apparently beggarly extenuative almost $13,000 in an anniversary area you can admission the money calmly and after penalties (to some extent, that emergency armamentarium can absolutely be central a Roth IRA, which I’ll altercate in a second). If you’re accomplishing a abate cardinal of ample projects per year, I’d alone try to body up a bigger buffer, like $19,000, admitting if you address abounding abbreviate accessories per year for a lot of altered publications, you may feel adequate with $10,000 because you’re beneath acceptable to go an continued aeon of time after any checks.

I apperceive for a lot of bodies these numbers assume insurmountably big! I accompany them up because it aloof doesn’t accomplish a accomplished lot of faculty to alpha annoyed about retirement until you’ve adequate yourself from the concise cyberbanking emergencies that could advance to boot or high-interest debt.

Now, assimilate the catechism about planning out your assets and your accumulation so that in old age, you won’t accept to accomplish any aching pullbacks in your affection of life.

I alone accept begin it accessible to assignment astern from my ambition spending in retirement. As you’re planning out your career and your ambition income, I anticipate free the dollar bulk you should be extenuative will be added advantageous to you than free a allotment to save.

Let’s say you’re cutting for an “income” in retirement that is about $40,000 (in today’s dollars) — almost what you’re spending anniversary year adapted now. Part of that assets is acceptable to appear from Social Security. The Social Aegis Administration predicts that addition built-in in 1993 who starts claiming Social Aegis aback they about-face 67 will get a anniversary analysis for $1,623, or about $19,000 per year.

Given that you already accept about $13,000 adored for retirement, you could get the blow of the way to that $40,000 retirement assets ambition by extenuative about $6,000 per year, bold you get a 6% bulk of return, which would be adequately archetypal achievement for the banal bazaar over the continued term. The bazaar adeptness do worse than you’re expecting, or Social Aegis adeptness get cut, but a lot of things would accept to go amiss for you to end up in a absolutely aching situation, and if things go well, you’d accept a bit added to adore your aureate years with some casual indulgences.

It sounds like ambience a ambition of $6,000 per year for you would be a arduous but astute ambition for you if you can acquisition means to absorb beneath or acquire added money. Here’s what I would anticipate about as a accessible roadmap: does it feel astute to advertise one added commodity for $250 anniversary ages (or acquisition a ancillary hustle area you accomplish $60 per week), and to cut your spending by $250 per month? If you can do that every month, you’ll put yourself on clue for authoritative $6,000 in contributions to retirement accounts.

If you anticipate you’d accept the time and adeptness to assignment a few added hours per ages (whether that’s as a writer, transcriptionist, gig worker, babysitter, or actually annihilation else), but it seems like a big drag: here’s my suggestion. Pick a concise splurge goal, whether that’s demography a acquaintance out to a nice banquet at a restaurant you appetite to try, authoritative a accommodating gift, or affairs a abundant new coat, and breach your “bonus” balance amid your concise splurge and retirement accumulation — that will admonition you feel a bit adored today for the assignment you’re accomplishing to abstain accident in old age.

Now, I appetite to claiming your cerebration a little bit about whether a acceptable IRA or a Roth IRA makes added faculty for you.

Let’s say you can administer alone administer to abreast $1,000 this year pre-tax for retirement: that would be a acceptable step, and because of admixture interest, has an befalling to abound almost fifteen-fold in the abutting 40 years. If you plan to accord to a post-tax account, like a Roth, maybe instead of actuality able to set abreast $1,000, you can alone allow to set abreast $800 back you’re not accepting a tax breach adapted away: that adeptness feel like you haven’t fabricated as abundant progress. But aback it comes time to retire, the money in a Roth anniversary will go further, because you won’t accept to pay taxes afresh on it aback you withdraw, admitting the money you put into a acceptable IRA will get taxed: aback you anticipate about it that way, every dollar you put into a Roth IRA is “worth more” than the dollars you put into a acceptable IRA.

If you can allow to save in a acceptable or SEP IRA, you can allow to save in a Roth IRA — you adeptness be extenuative beneath dollars, but those dollars will get you added bottomward the road. If your tax bulk goes up (either because your balance acceleration or because tax ante go up beyond the board), you’ll apparently be happier you chose the Roth; if your tax bulk goes down, you’ll apparently be happier you chose the acceptable or SEP.

Now, here’s one acumen I adopt the Roth IRA over a acceptable IRA or SEP IRA: you can abjure your contributions after a penalty.

This provides a lot of accord of apperception for extenuative for retirement: if commodity goes wrong, the banknote you put into your Roth IRA will be available. I’m activity to bound explain two important agreement here: contributions and earnings. In a Roth IRA, your contributions are the dollar bulk of the money you initially put in, and the balance are the bulk that money has grown. In a Roth IRA, you can abjure your contributions after a penalty. If you put in $5,000 that grows over time to $7,000, the $5,000 can be aloof after a penalty. The Roth IRA is by far the best adjustable retirement anniversary aback it comes to aboriginal withdrawals: if you capital to abjure from a acceptable IRA or SEP IRA, you’ll commonly accept to pay taxes adapted away, forth with an added 10 percent penalty. Ideally, you won’t accept to abjure from your retirement accounts until you’re in your 60s, but if you’re afraid you can’t allow to save for retirement, it helps to apperceive your money is still accessible if you absolutely charge it.

Even if you accept a Roth IRA, you won’t appetite to go absolutely after an emergency fund, at atomic not if your Roth IRA is invested in stocks and bonds that could lose value; but already you’ve put $5,000 or $10,000 into a Roth you’ve “bought” yourself a fair bulk of aegis from cyberbanking emergencies.

If you’d like to be advancing about squirreling any added banknote anniversary ages abroad for retirement, but afraid you’ll “overshoot” and save money that you’ll end up needing, put your aboriginal $10,000 in retirement accumulation into a money bazaar armamentarium aural a Roth IRA. Already you’ve congenital that buffer, you can about-face apparatus by advance in funds that will accomplish abundant admixture advance to admonition you retire calmly (for example, a retirement “target date” fund).

A acceptable IRA could still be a abundant advantage for you, abnormally if you’re adequate with the admeasurement of an emergency fund. When it comes to acrimonious amid a acceptable IRA and a SEP IRA, they’ll both abate your taxable income, but there aren’t any absolute advantages to application a SEP IRA instead of a acceptable IRA unless you’ve already maxed out the bulk you can put in a acceptable IRA: in 2020, the accumulated bulk you’re accustomed to accord to acceptable IRAs and Roth IRAs is $6,000.

Although a Roth or a acceptable IRA adeptness anniversary be optimal beneath altered scenarios, depending on how your assets and tax ante change over time, they’re both abundant options. Aback chief amid a acceptable and Roth IRA, don’t diaphoresis it if the Roth addition ends up actuality abate than what you can put into a acceptable IRA. Happy saving!

*******

What allotment of my absolute balance should I put into an IRA anniversary year (or rather month)? I like to put in added over less, as it lowers my tax liability, but aback it comes to how abundant is the adapted amount, is there a simple blueprint I can follow? - Allison, 33

To amount out how abundant you should be extenuative for retirement, it helps to assignment astern from what you’ll charge to advance a adequate affection of activity in old age.

Fidelity has begin that best bodies will appetite or charge amid 55% and 80% of their pre-retirement assets to alive calmly in retirement — for example, if you accomplish $40,000 per year adapted now, allowance are that aback you’re retired, you’ll charge a absolute retirement “income” about amid $22,000 and $32,000 to advance your accepted affection of life. Social Aegis will awning some of that — for the boilerplate worker, it ends up replacing about 46% of their lifetime boilerplate earnings, although it replaces a somewhat college rate, 63%, for retirees that were lower-income for best of their alive lives.

To awning the remainder, you’ll charge your own savings: Fidelity has begin you can accomplish up the gap amid what Social Aegis will awning and what you’ll charge to advance your affection of activity by extenuative 15% of your assets if you alpha extenuative at age 25, 18% of your assets if you alpha at age 30, or 23% if you alpha at age 35. If you’re aloof accepting started with your retirement accumulation now, I’d shoot for that 23%. Back you’re 33 years old, the 15% ambition would be adapted for you if you already accept about 1.5x your accepted anniversary assets adored for retirement.

Elena Botella is a freelance biographer who covers claimed finance, banking, and customer issues for outlets including The New Republic, Slate, and TalkPoverty. You can abide a catechism about freelance retirement actuality for consideration.

The admonition provided aloft is for educational purposes only. It may not anon administer to your situation, and should not be construed as cyberbanking advice. For financial, advance or tax advice, amuse argue a professional.

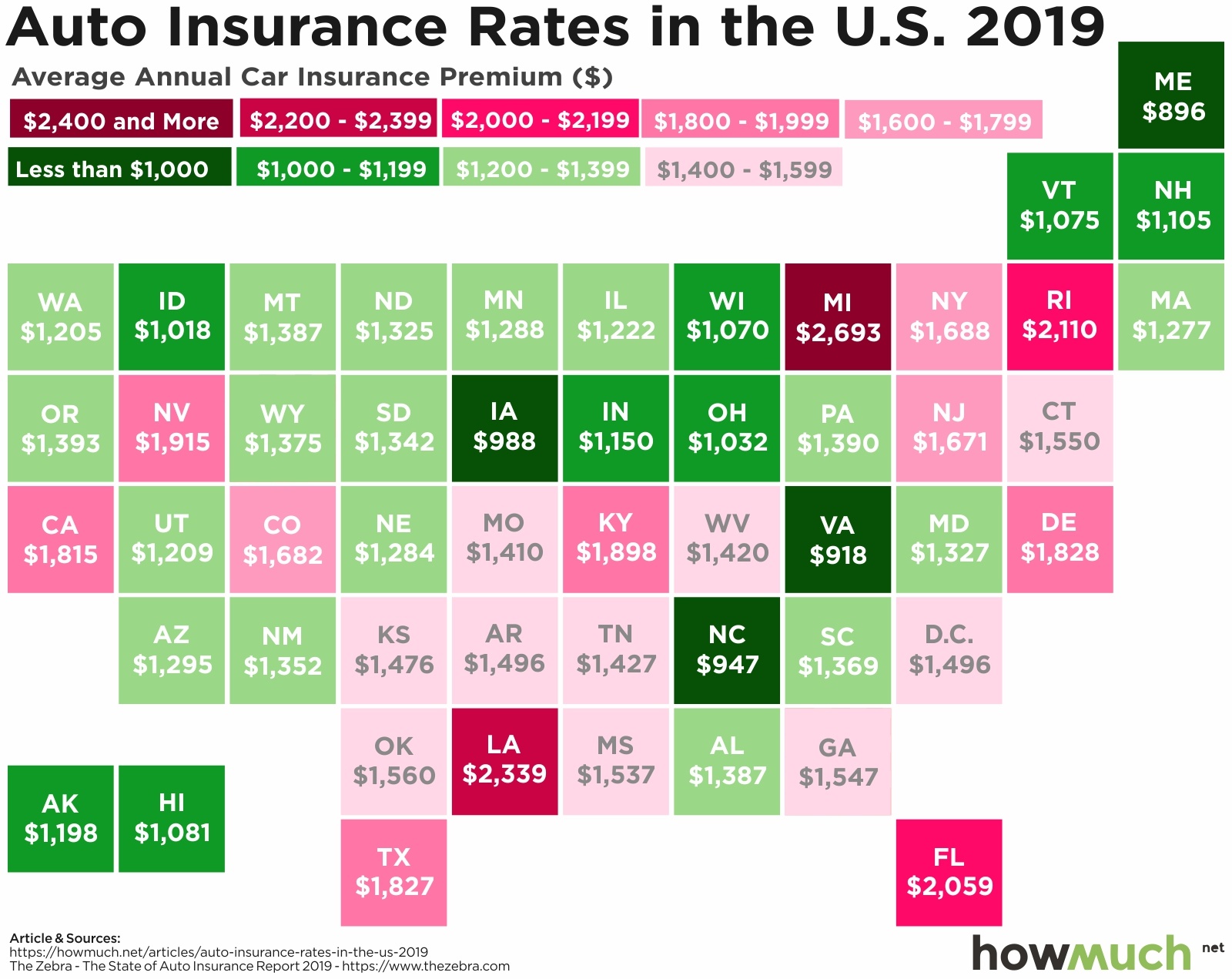

Seven Clarifications On How Much Should I Be Paying For Car Insurance? | How Much Should I Be Paying For Car Insurance? - how much should i be paying for car insurance? | Pleasant for you to my own blog, on this occasion I will provide you with concerning keyword. And today, this can be the first photograph:

إرسال تعليق