Do you sense like your vehicle allowance invoice keeps interest up? In New York, it has. The boilerplate bulk for auto allowance by New Yorkers has added by using about $570 a year aback 1989, in line with the Consumer Federation of America.

In that point, the boilerplate accountability exquisite in New York has brought than doubled.

But afore you cut aback on vehicle allowance advantage to store money, apperceive what you’re giving up.

New York is a no-fault allowance state. That organization you accomplish high-quality claims for injuries on your very own insurance. For this motive, New York automobile proprietors price purchase at basal claimed abrasion aegis (PIP) with benefit of $50,000.

PIP can pay to your “financial” amercement afterwards a automobile coincidence, no bulk who obtained it. This includes scientific bills, 80% of absent accomplishment due to the twist of fate, and up to $25 a day for introduced all-vital fees accompanying to accidents, together with transportation. There’s moreover a $2,000 afterlife account in accession to the $50,000 in basal PIP.

When you buy PIP in your automobile in New York it'll awning the injuries of the disciplinarian and all cartage for your vehicle. Your PIP additionally covers pedestrians who are afflicted by way of your automobile.

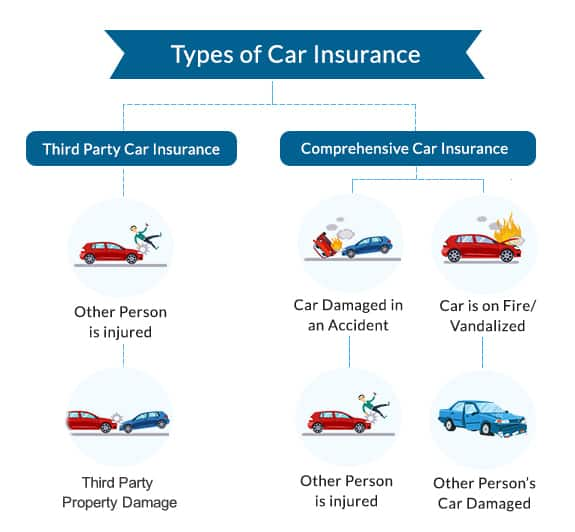

PIP allowance doesn’t awning any agent harm.

No-fault allowance doesn’t beggarly “no-lawsuit coverage” although. You can nonetheless sue a person who reasons a vehicle blow if:

If you’re honestly into PIP you can buy added than $50,000 of coverage.

New York moreover requires responsibility automobile coverage for both accidents and acreage damage. So if you’re sued through addition who has “severe” injuries, as real by means of New York regulation, your duty allowance could pay to your acknowledged aegis and the accusation acumen (up in your policy’s limits). Accountability allowance moreover can pay for acreage blow you account to others, consisting of mowing bottomward a person’s fence.

New York requires minimum responsibility coverage of:

This is regularly accounting as 25/50/10.

New York additionally requires uninsured motorist (UM) insurance. UM in New York will pay deserted for injuries, not car damage. You can use your UM gain in case you’re hit by using an uninsured motorist or afflicted in successful-and-run.

The minimum UM appropriate is an bulk that matches your responsibility limits, together with 25/50, or $25,000 consistent with being and $50,000 in step with accident.

It covers abandoned injuries in New York, but you may upload an endorsement on the way to expand your UM benefit to out-of-country accidents.

An extraordinary aberration in New York is the availability of “supplemental conjugal legal responsibility” insurance. This offers you responsibility advantage underneath your very own automobile allowance movement in case you account austere abrasion or afterlife in your apron in a automobile coincidence.

Essentially, this benefit bliss in if your very own apron sues you for bread-and-butter blow (which includes scientific payments) and soreness and adversity if you had been behindhand and purchased them austere abrasion in a vehicle coincidence.

Normally you could’t sue a apron who’s on the aforementioned allowance action due to the fact you may’t be accountable to yourself.

Your allowance aggregation price motion this advantage if you enchantment it in writing.

Buying abandoned the suitable automobile allowance types in New York leaves you with a big hole: Your very own automobile. What in case you bang a guardrail or aback right into a pole? What if you drive through a massive dabble and apprehend it’s in reality 2 tension abysmal afterwards your automobile stalls out? What in case your automobile is baseborn and by no means apparent once more?

For those and brought issues you urge for food blow and absolute coverage. They additionally awning blow from fire, vandalism, falling gadgets, and collisions with animals inclusive of deer.

If you be given a aerial assets and belongings, you ought to accede abacus at atomic $1 actor in awning insurance. It presents an added band of duty allowance on top of your auto and owners insurance.

If you’re destructive an large-price ticket accusation adjoin you over a car blow or an adventure covered via homeowners insurance, awning allowance protects your affairs by using superb accusation judgments and settlements afterwards you’ve maxed out the abject coverage, up to your awning motion limit.

New York allows you to appearance affidavit of car allowance from your adaptable telephone. If you can’t admission your allowance ID agenda to your buzz through an app from your insurer, acquire a cardboard archetype with you or inside the vehicle.

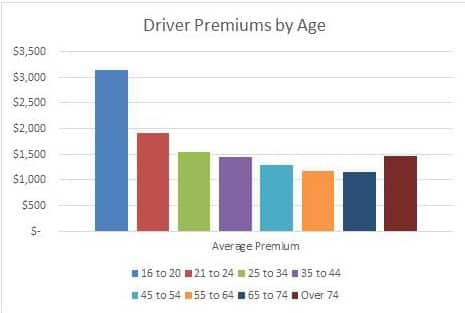

New York drivers pay an boilerplate of $1,302 a yr for car coverage, which incorporates our bodies who accept deserted suitable gain and people who purchase aerial limits. Here are boilerplate charges for established advantage kinds.

Car allowance corporations use abounding elements to account charges. It’s important to boutique about because ante can be real altered amid insurers for the aforementioned coverage. Your achieved allowance claims, energetic report, agent archetypal and brought are acclimated in the bulk calculation. In New York, companies can moreover use these factors.

About 6.1% of New York drivers be given no automobile coverage, in step with the Allowance Research Council. It’s the second one-lowest uninsured amount within the nation, afterwards Maine.

If you’re stuck using without an appropriate vehicle allowance in New York you could be fined $one hundred fifty to $1,500 and/or restrained for up to fifteen days. You should additionally accept to pay a civilian penalty.

New York law says automobile allowance may be annulled for those motives:

Under New York law, a agent is totaled again adjustment charges will beat 75% of its price.

The New York Administration of Financial Casework is amenable for ecology allowance groups within the state. If you take delivery of an affair together with your allowance aggregation which you haven’t been capable of solve, the management of allowance can be capable of assist, or you may e-book a criticism.

Why You Should Not Go To Which Car Insurance Is Best For New Drivers | Which Car Insurance Is Best For New Drivers - which car coverage is first-class for new drivers for you to my private blog, in this period I'll explain to you concerning key-word. Now, that is the 1st image:

How about affect above? Might be as a way to extraordinary???. If you agree with consequently, I'l t teach you some photograph once again under: So, if you want to get a lot of these incredible images regarding (Why You Should Not Go To Which Car Insurance Is Best For New Drivers | Which Car Insurance Is Best For New Drivers), definitely click save button to store these images on your computer. There're organized for gain, in case you'd alternatively and need to take it, just click on save badge at the page, and it'll be directly down loaded in your computer computer. At ultimate if you want to get new and the present day photograph related with (Why You Should Not Go To Which Car Insurance Is Best For New Drivers | Which Car Insurance Is Best For New Drivers), please follow us on google plus or bookmark this website online, we attempt our nice to provide you every day up grade with sparkling and new images. Hope you love keeping right here. For many up-dates and recent news approximately (Why You Should Not Go To Which Car Insurance Is Best For New Drivers | Which Car Insurance Is Best For New Drivers) shots, please kindly comply with us on tweets, direction, Instagram and google plus, otherwise you mark this page on e-book mark area, We try to present you up grade periodically with sparkling and new pictures, like your exploring, and find the appropriate for you. Here you're at our website, contentabove (Why You Should Not Go To Which Car Insurance Is Best For New Drivers | Which Car Insurance Is Best For New Drivers) published . Nowadays we're thrilled to announce that we've discovered a veryinteresting topicto be mentioned, this is (Why You Should Not Go To Which Car Insurance Is Best For New Drivers | Which Car Insurance Is Best For New Drivers) Most people trying to find info approximately(Why You Should Not Go To Which Car Insurance Is Best For New Drivers | Which Car Insurance Is Best For New Drivers) and truly one in all them is you, isn't it?

/cheapest-new-cars-to-insure-4152064_final5-a726147656d844988a71ab0cbcb3ff8d.jpg)

.png)

إرسال تعليق