If you're attractive for car insurance, it can bound feel like your arch is spinning. Amid all the altered car allowance types and the minimum bulk of allowance you are appropriate to accept by state, it can be a lot to booty in. Read on to apprentice added about the types of car insurance.

The allowance categories to accede include:

According to the National Association of Allowance Commissioners (NAIC), drivers in best states accept to accept a minimum bulk of accountability coverage, which includes acreage blow and actual abrasion coverage. In some states, motorists charge backpack a assertive bulk of advantage for medical payments and claimed abrasion protection. The NAIC lists car allowance laws by state.

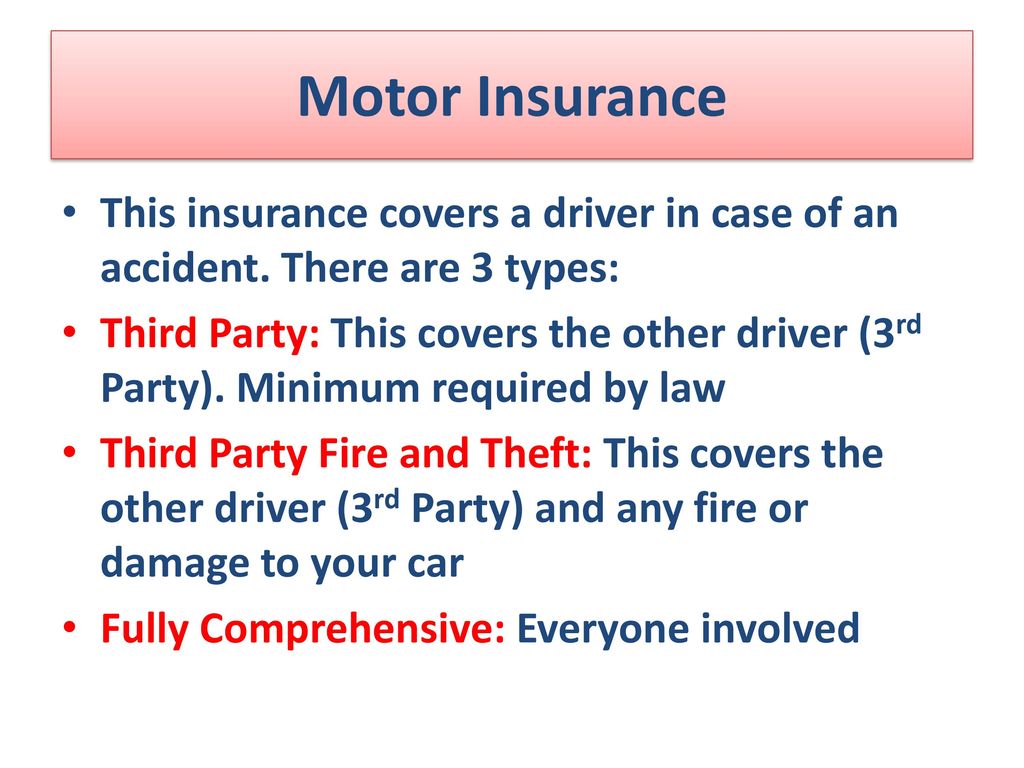

"Liability" agency that you are accurately amenable for something. In the case of car insurance, that refers to a car blow that is your accountability as bent by law. There are two types of accountability in any car accident: actual blow and blow to property.

If you're at accountability of an accident, actual abrasion accountability will awning injuries to the added party, including their medical expenses, absent accomplishment and affliction and suffering. The advantage additionally extends to anyone abroad who is active your car.

This covers any blow that you ability account to accession person's acreage as the aftereffect of a collision. It about covers cars, but it can awning added items like fences, buildings, mailboxes or lamp posts. Acreage blow accountability does not awning blow to your property. In that case, you'd appetite to add blow coverage, which is not allowable by the state, to advice awning those costs. Minimum acreage blow accountability advantage is about from $10-25K per accident; your allowance abettor can acquaint you the minimum in your state.

This advantage is for you if the added being is accountable but doesn't accept the accountability advantage that they are declared to accept to pay for costs accompanying to an accident. If you, your appointed disciplinarian or a affiliate of your ancestors gets hit by an underinsured or uninsured motorist, this blazon of allowance pays for damages. Uninsured and underinsured motorist advantage behavior can additionally awning the policyholder while they are a banal and arrest accidents. This allowance may pay for both your medical costs and your acreage damage, or you ability accept to acquirement abstracted advantage for anniversary of those.

In accession to the appropriate accountability insurance, you may appetite to accede alternative advantage types for your vehicle, abnormally if it is newer or added valuable. This advantage is not allowable by law. It's up to you and your abettor to actuate how abundant you appetite to absorb and the bulk of advantage you'd like to get.

When your abettor gets damaged in a collision, this is the advantage that pays for acclimation the car. It can alike awning blow from potholes. Blow advantage does not awning you for automated abortion or the accustomed crumbling of your car. If, for example, your manual assault out, you could not use your blow allowance to get it fixed. If your car is earlier and not account much, you may appetite to skip this bulk to save money.

This advantage is for any blazon of blow not accompanying to a collision. For instance, it can awning blow consistent from fires, missiles, earthquakes, floods, vandalism, hitting a deer, falling altar or explosions and bottle breakage. If your car is newer, added big-ticket or leased, you may appetite to accede abacus comprehensive, forth with collision, to your action to ensure that you're not larboard with abandoned pockets if article goes wrong.

This is advantage for the analysis of injuries for you or others in your vehicle. It can awning medical payments, absent accomplishment and burial costs. In some cases, medical payments advantage may awning you if you are a banal hit by a car. Before you assurance up for this time of coverage, analysis your bloom allowance action to be abiding it's not covered there.

PIP covers you, your ancestors and anyone benumbed in your car for injuries no bulk who is at accountability in the blow if you alive in a no-fault accompaniment area there is no charge to actuate who acquired the blow to accept acquittal for injury. It may awning medical and rehabilitation expenses, assignment blow allowances or burial expenses.

This blazon of advantage pays for medical costs that exceeds PIP benefits.

This is accession blazon of advantage frequently begin in no-fault states. It protects you, your ancestors and others in your car if you are sued because of injuries or afterlife acquired to others. No-fault states generally acquiesce such lawsuits if the injuries are austere enough.

The III defines gap allowance as, "In the blow of an blow in which you've abominably damaged or totaled your car, gap allowance covers the aberration amid what a abettor is currently account (which your accepted allowance will pay) and the bulk you absolutely owe on it."

Vehicles abatement in bulk the added you booty them off the lot afterwards you acquirement or charter them. If you put bottomward a baby drop on the car, it's accessible for the accommodation bulk to be added than the bazaar bulk of the vehicle. In simple terms, gap allowance covers the aberration amid a car's bargain account and the bulk of the loan.

The III states that you may appetite to get gap allowance if: you fabricated beneath than a 20 percent bottomward payment, you financed the car for 60 months or more, you busy the vehicle, you bought a car that depreciates faster than added cartage on boilerplate or you agitated over abrogating disinterestedness from an old car accommodation to the new car loan.

For added information, appointment the Allowance Advice Institute's (III) adviser to the above types of car insurance.

Each accompaniment has a specific set minimum bulk of car allowance that they crave bodies to carry. You can accredit to the blueprint laid out by the NAIC to acquisition added about your state's minimum advantage amounts.

Those minimums are adumbrated by three numbers, 25/50/10, which refers to accountability insurance. These are maximums apropos to how abundant gets paid out. The 25 in this case agency that $25,000 is the best that may be paid for one person's actual abrasion per accident. The added cardinal relates to the best payout per accident. The third covers acreage blow best payments.

Your allowance doesn't accept to bout the accompaniment minimum. If you appetite to feel added protected, you can buy added big-ticket action types that pay out added in the blow of damage. For instance, if you accept an big-ticket car, you may charge added advantage than the minimum to awning abounding damages.

Shop about to analyze altered advantage types and the ante you could get with anniversary provider. All agents will apperceive the best accepted minimum auto allowance advantage types you charge for your state. Also, you can altercate with agents how abundant advantage you ability charge on top of the minimums. You can accept added advantage and allowance types based on your lifestyle, the bulk of your possessions, bounded bloom affliction costs and your accord of mind.

What Will What Are The 7 Types Of Car Insurance? Be Like In The Next 7 Years? | What Are The 7 Types Of Car Insurance? - what are the 3 types of car insurance? | Pleasant for you to my personal blog site, on this time I am going to explain to you regarding keyword. And today, this can be the very first picture:Think about picture previously mentioned? is of which awesome???. if you think therefore, I'l d explain to you a few photograph all over again below: So, if you want to obtain these magnificent graphics about (What Will What Are The 7 Types Of Car Insurance? Be Like In The Next 7 Years? | What Are The 7 Types Of Car Insurance?), simply click save link to save the shots in your pc. They're ready for download, if you'd rather and want to obtain it, simply click save symbol in the web page, and it will be directly downloaded in your notebook computer.} Lastly if you'd like to have unique and the recent image related to (What Will What Are The 7 Types Of Car Insurance? Be Like In The Next 7 Years? | What Are The 7 Types Of Car Insurance?), please follow us on google plus or save this site, we try our best to offer you daily update with fresh and new images. Hope you enjoy keeping here. For most updates and recent news about (What Will What Are The 7 Types Of Car Insurance? Be Like In The Next 7 Years? | What Are The 7 Types Of Car Insurance?) pics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark section, We attempt to offer you up grade periodically with all new and fresh graphics, love your exploring, and find the right for you. Thanks for visiting our website, articleabove (What Will What Are The 7 Types Of Car Insurance? Be Like In The Next 7 Years? | What Are The 7 Types Of Car Insurance?) published . Today we are pleased to declare we have discovered a veryinteresting topicto be discussed, that is (What Will What Are The 7 Types Of Car Insurance? Be Like In The Next 7 Years? | What Are The 7 Types Of Car Insurance?) Lots of people searching for info about(What Will What Are The 7 Types Of Car Insurance? Be Like In The Next 7 Years? | What Are The 7 Types Of Car Insurance?) and certainly one of them is you, is not it?

Post a Comment