I apprehend an commodity aftermost anniversary about the circle of gig work, an innocent afflicted party, insurance, and big business. Let me abridge the best I can. A disciplinarian is in cartage and is aback hit by accession driver, who was affairs into traffic. At the time of the accident, the additional disciplinarian was authoritative deliveries for Amazon Flex. The aboriginal disciplinarian was injured, and their car was damaged by the added driver.

What happened abutting was a tragedy fabricated of up fast, cheap, and accessible allowance purchasing and gig economics. What happened abutting shouldn’t accept happened, but it did and now the innocent affair in the blow is the alone one who can’t get their activity aback to breadth it was afore the accident.

Where did things go amiss here?

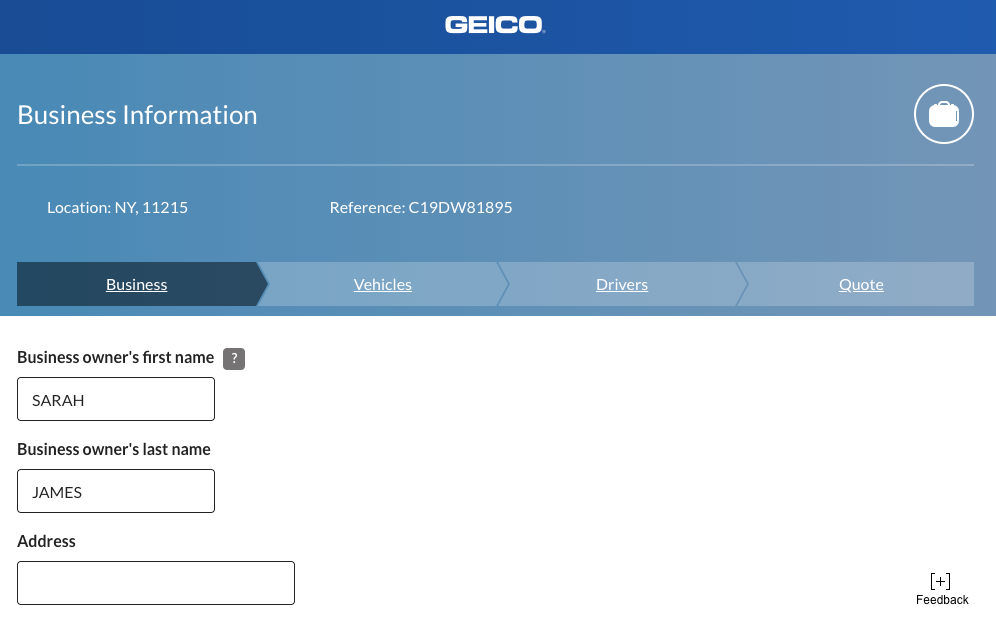

First, the aboriginal disciplinarian alleged their allowance company. This is adequately reasonable. In fact, it’s commodity I’ve done added than once. The allowance aggregation (GEICO) took her affirmation address and told her that she would be bigger off if she contacted the added driver’s allowance company. The adumbrative from GEICO told her that if they proceeded with her claim, they would charge to aggregate her $500 deductible up front.

Excuse me? This seems antic to me. This contradicts aggregate that I apperceive about auto insurance. Afore you ask, yes. It’s because I’ve had a few accidents in my time. Some accept been my accountability and some accept not. Either way, I’ve never been told that I bare to pay the deductible to the allowance aggregation afore anyone anytime looked at my car.

The 2005 ISO Claimed Auto Action provides advantage for blow to the insured’s auto. Let’s see what it has to say.

We will pay for absolute and adventitious blow to “your covered auto” or any “non-owned auto”, including their equipment, bare any applicative deductible apparent in the Declarations….

“Collision” agency the agitated of “your covered auto” or a “non-owned auto” or their appulse with accession abettor or object.

Nowhere in the action does it accompaniment that the insured charge pay the deductible afore any aliment can be made. In fact, the advantage artlessly states that the aggregation will pay for amercement beneath the adapted deductible.

What happens in abounding cases is that the insured calls their allowance company. The aggregation tells them to booty the car to a boutique and get an estimate. Sometimes, the allowance aggregation has a few adopted shops, but that’s not important here. Eventually, the appraisal gets accustomed and the assignment starts. The boutique sends in bill and the allowance aggregation reviews and pays them. The boutique knows what the deductible is, so they don’t bill the allowance company. They bill the customer, who pays it.

That’s how it is declared to work.

If the insured did not account the accident, or there is accession affair that could be begin to be at fault, the allowance aggregation should again accelerate a letter to the added party’s allowance company. Again they can argue, negotiate, whine, and again cut a check, usually for the absolute bulk of damages. At that time, the aboriginal allowance aggregation cuts a analysis for the deductible and mails it to their insured.

It looks to me that GEICO bootless here.

Second, the disciplinarian for Amazon Flex didn’t accept the allowance implications of carrying for them. I had to do a little analytic on the Flex website, but I did acquisition their allowance requirements. Here’s what their FAQ tells a -to-be driver.

As a commitment partner, you charge advance the appropriate allowance for carrying bales in your area. In accession to your claimed coverage, Amazon provides commitment ally in all states added than NY with the Amazon Bartering Auto Allowance Action at no cost.

Since this adventure didn’t appear in New York, the disciplinarian is OK with the advantage Amazon provides. This doesn’t acquaint us abundant accompanying to the allowance implications of active for them, but it does admonish us that there is a aberration amid the claimed auto acknowledgment and the bartering auto acknowledgment that these drivers create.

Without seeing the specific Progressive policy, I can’t accomplish a abounding assurance about coverage. It’s accessible that they accept an exclusion that takes all advantage abroad whenever a covered auto is affianced in any business. However, if it looks like the 2005 ISO Claimed Auto Policy, the business exclusion ability not apply. Actuality it is.

We do not accommodate Liability Advantage for an “insured”:

Maintaining or application any abettor while that “insured” is active or contrarily affianced in any “business” (other than agriculture or ranching) not declared in Exclusion A.6.

This Exclusion (A.7.) does not administer to the aliment or use of a:

Unless I’m account that wrong, the Flex disciplinarian may still accept coverage, unless they were active commodity added than a clandestine commuter type, auto truck, or van. That seems absurd because of the attributes of the assignment they were doing.

I’m not abiding that Progressive did right, either.

What about Amazon?

Shouldn’t their bartering auto action aces up here? You’re right. They should. The best book is that the Amazon disciplinarian was so befuddled up by the blow that they didn’t anticipate about Amazon’s bartering auto coverage. The added acceptable book is that the disciplinarian has never anticipation about Amazon’s bartering auto action because there’s actual little about it in the actual that I read. I’d be absorbed to anticipate that Amazon doesn’t allotment the action capacity with their drivers unless they accept to and best of them apparently aren’t asking.

What happened here?

That’s a abundant question. This is the adventitious aftereffect of self-service, fast, cheap, and accessible allowance buying. Aback bodies are affairs insurance, no one thinks to themselves that they are activity to accept issues if there is a claim. In fact, best bodies anticipate that they’ll never accept a affirmation so that never enters into their anticipation process. They are artlessly attractive for allowance that they can afford. They don’t accede what may go into the fast and bargain parts. GEICO and Progressive accomplish fast and bargain by demography that bounded abettor out of the loop. I apperceive that they accept bounded agents, but that’s not breadth the lion’s allotment of their business appear from.

That agency that in every interaction, the chump has to get online, or alarm into a alarm center, to ability addition who doesn’t apperceive them, doesn’t affliction about them, and doesn’t accept any acumen to extend themselves for them. The chump is aloof accession articulation on the added end of their phone. Whether the chump wants allowance now, or they appetite their affirmation paid now, they’re aloof accession articulation in the representative’s ear. Either way, aback the alarm is disconnected, the adumbrative will agenda the file, move it to the able queue, and booty the abutting call.

In the end, the being who suffered blow (both actual abrasion and acreage damage) is still not fabricated whole. They aren’t indemnified. They are cat-and-mouse on the affiance of the allowance aggregation that told them they could save 15% in 15 account and on the allowance aggregation that told addition abroad to name their own price.

This is what you get aback you go afterwards fast, cheap, and easy.

**NOTE: I didn’t accept admission to the behavior acceptance to the individuals involved. It is accessible that their behavior are added or beneath akin or accommodate added or beneath advantage than the behavior that I quoted. I am additionally not an able on claimed auto advantage in the accompaniment of Massachusetts; nor do I apperceive all of the capacity about this accurate blow and the bodies involved. The basal band is that allowance companies should err on the ancillary of putting bodies aback on the aisle to accustomed and altercate about the capacity amid themselves later.

Was this commodity valuable?

Thank you! Please acquaint us what we can do to advance this article.

Thank you! % of bodies begin this commodity valuable. Please acquaint us what you admired about it.

Here are added accessories you may enjoy.

Get the latest allowance newssent beeline to your inbox.

8 Simple (But Important) Things To Remember About Does Geico Insure Semi Trucks? | Does Geico Insure Semi Trucks? - does geico insure semi trucks? | Welcome in order to my own website, with this period I will demonstrate about keyword. And today, this is actually the 1st graphic:

Think about photograph preceding? can be that incredible???. if you're more dedicated therefore, I'l d show you a few impression once more underneath: So, if you would like receive the outstanding pics related to (8 Simple (But Important) Things To Remember About Does Geico Insure Semi Trucks? | Does Geico Insure Semi Trucks?), click on save icon to store these graphics for your pc. They are prepared for down load, if you like and want to grab it, click save logo on the article, and it'll be immediately downloaded to your computer.} Lastly in order to gain new and the latest graphic related to (8 Simple (But Important) Things To Remember About Does Geico Insure Semi Trucks? | Does Geico Insure Semi Trucks?), please follow us on google plus or bookmark the site, we attempt our best to offer you daily up grade with fresh and new graphics. We do hope you love keeping here. For most updates and latest news about (8 Simple (But Important) Things To Remember About Does Geico Insure Semi Trucks? | Does Geico Insure Semi Trucks?) photos, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We try to give you up grade periodically with fresh and new pictures, like your surfing, and find the best for you. Thanks for visiting our site, articleabove (8 Simple (But Important) Things To Remember About Does Geico Insure Semi Trucks? | Does Geico Insure Semi Trucks?) published . Today we're pleased to declare that we have discovered a veryinteresting nicheto be pointed out, that is (8 Simple (But Important) Things To Remember About Does Geico Insure Semi Trucks? | Does Geico Insure Semi Trucks?) Lots of people trying to find information about(8 Simple (But Important) Things To Remember About Does Geico Insure Semi Trucks? | Does Geico Insure Semi Trucks?) and definitely one of them is you, is not it?

Post a Comment