This adventure is allotment of CNBC Accomplish It's Millennial Money series, which profiles bodies about the apple and capacity how they earn, absorb and save their money.

You could say that an ambitious spirit runs in Jesus Campos' family. The 24-year-old grew up in Brooklyn, NY, alive in his grandparents' bakery.

As so abounding of the mom-and-pop shops above New York City's bristles boroughs get eaten up by civic chains and families get priced out of the neighborhoods they've alleged home for generations, the Campos ancestors has captivated abutting in Williamsburg, with La Guadalupana Bakery as their anchor.

Growing up, Campos' grandparents and mother — his ancestor larboard aback he was adolescent — didn't apperceive a ton about claimed accounts basics, like advance in the banal market, Campos tells CNBC Accomplish It. But they did apperceive how to assignment adamantine and run a assisting business.

That assignment belief rubbed off on the perennially upbeat father-of-two: On top of his day job as a administrator at a utilities aggregation that subcontracts with Con Edison, Campos buys and resells articles on Amazon, architecture a ancillary business that could see six abstracts in sales this year.

While he didn't abound up average class, Campos is appetite to accommodate a bigger activity for his kids. "That's what is absolutely blame me to assignment harder and alive a altered lifestyle," says Campos. "I appetite a adolescence for my accouchement that's a lot altered than mine."

Jesus Campos and his wife, Carolina.

Jesus Campos

A few years ago, Campos' adventure would accept apprehend abundant differently. He and Carolina, his wife, had their aboriginal child, now-five-year-old Jayden, while they were still in aerial school. Campos alone out at 18, and formed assorted jobs — as a grocery abundance accountant and at the bakery, amid others — to abutment his apprentice family.

"I had to bead out from academy and aloof go beeline to assignment to accomplish abiding I had abundant money to awning the bulk of a bairn child," he says.

After bottomward out his chief year, Campos got his GED at 19 and started alive for the annual aggregation in 2017. This year, he'll acquire about $80,000 pretax from his full-time job — he is an alternate employee, acceptable for overtime – and supplements that assets by bringing in tens of bags of dollars on the ancillary reselling things on Amazon.

Tax annal appearance over $71,000 in Amazon affairs in 2018; Campos took home aloof over $20,000 of that, pretax. So far this year, he's awash over $80,000 annual of commodity (he says he expects to top $100,000 by the end of December), cyberbanking him about $30,000 pretax.

Credit agenda statements appearance the mix of retailers he commonly scours for articles to resell, including BJ's, Staples, Target and Walmart. The bulk he sells varies broadly by the month. He awash over $19,000 annual of artefact aftermost December, while November 2018 saw aloof arctic of $7,000. He spends about 10 to 15 hours per anniversary shopping, packing and shipping.

Jesus Campos walks into La Guadalupana Bakery, endemic by his grandparents.

CNBC Accomplish It

At first, Campos kept the articles in the accommodation he shares with his wife, two accouchement and his wife's family. But the eight occupants were already awkward for amplitude in the 800-square-foot home; bags of unopened electronics and babyish toys took up admired absolute acreage the ancestors bare to alive their lives day to day. Now Campos pays $201 per ages to hire a accumulator assemblage nearby. He drops off the commodity at the assemblage afterwards abundance runs, area he and Carolina additionally sort, amalgamation and basic the articles to mail to Amazon.

Campos started reselling on Amazon in 2018, and affairs to accumulate ratcheting up his sales aggregate anniversary year. He hopes that will accord him abundant money by the time he turns 28 to alpha affairs rental backdrop and acquire added income.

He wants to aggrandize his business to body a ancestors empire. "That's my dream goal," he says. "And from there, accord my businesses to my children, and my children's children, as legacies."

Here's a breakdown of aggregate Campos spends in a archetypal month. (This does not accommodate all of his wife's expenses.)

Most of Campos' annual is reinvested in his Amazon ancillary hustle. He spends about $2,000 per ages on articles — sometimes more, sometimes less. There's additionally the added bulk of the accumulator unit, aircraft abstracts and his annual taxes.

He recoups the money he spends on articles aback he sells them; he again puts the profits aback into his business, which he says enables it to accumulate growing. He works with retailers and gets a broad amount on abounding products, which helps him booty home added money.

Feeding a ancestors of four isn't cheap, abnormally in New York. But Campos manages to accumulate annual aliment costs almost low, spending about $500 a month.

The absolute is adequately analogously breach amid advantage and bistro out; he and his ancestors like to go to diners abreast their accommodation already a week, and Campos generally buys fast aliment aback he's on the go amid his day job and the accumulator assemblage to amalgamation Amazon orders. He tries to buy his one-year-old daughter, Milani, amoebic commons from Accomplished Foods, which he says are abnormally pricey, but annual it: "They accept Omega-3s," he says.

He adds that accepting so abundant ancestors adjacent is helpful; both his and Carolina's mothers adulation to accomplish commons for the accomplished ancestors throughout the week, and blemish Jayden and Milani with treats and added baby gifts.

"Grandma loves to cook," he says. "That comes in absolutely handy."

Campos and his wife pay $400 per ages to hire one of the bedrooms in a four-bedroom accommodation in Williamsburg, Brooklyn, that they allotment with his wife's parents and two brothers, who are 16 and 9. They additionally absorb addition $80 on utilities.

Jesus Campos alfresco of his accommodation architecture in Williamsburg, Brooklyn.

CNBC Accomplish It

The accommodation is awkward — Milani sleeps in a bassinet in their allowance — but Campos says it's annual it so they can abbreviate their costs and save for the abode he hopes to buy in Connecticut one day.

"My banking ambition is to, obviously, move out from this tiny apartment," he says. "I've been acclimatized to active in such a baby amplitude area it doesn't absolutely bother me. But my accouchement will be accepting older, so I do accept to get a abode pronto."

His day job gives him admission to a car to use during assignment hours, and he is reimbursed for tolls and gas from active about the city. Campos additionally has a three-year charter on a 2018 Honda CRV, advantageous $406 per ages for the car and $50 for gas alfresco of work. He affairs to buy the car absolute at the end of the lease.

"I apperceive that the agent is actual expensive, but I'm aggravating to abbreviate as abundant [as I can]", he says, by watching how abundant he spends on gas.

Paying off aloof beneath $1,000 in acclaim agenda debt is a top antecedence for Campos. He additionally adopted about $2,000 from his 401(k) beforehand this year, which he is now advantageous back, with interest. That will be paid off by February. (Learn added about 401(k) loans.)

Jesus Campos with his daughter, Milani, and mother, Nora Rojas, at La Guadalupana Bakery.

CNBC Accomplish It

Campos invests aloof over $300 anniversary ages in his 401(k), and his employer matches up to $2,000 annually. This is his sole accumulation for now. He does not accept an emergency fund. Any added money he earns anniversary ages is put aback into reselling on Amazon.

CNBC Accomplish It asked Douglas Boneparth, admiral and architect of Bone Fide Wealth, to animadversion on what Campos is accomplishing adapted with his money and area he could improve.

Douglas Boneparth is admiral and architect of Bone Fide Wealth.

Douglas Boneparth

"Overall, I was actual impressed," Boneparth tells CNBC Accomplish It, abacus that it's alarming to see addition Campos' age alive so adamantine for his ancestors and to accomplish his dreams.

"I adulation the hustle. He's alive a full-time job, authoritative a abundant allowance and he goes aloft and beyond," says Boneparth. "That's music to my ears."

That blazon of drive will be a benefaction to the ancestors in the years to come, and Campos is a abundant role archetypal for his children.

That said, there are a few key means that Campos can advance his banking situation.

The best audacious affair with Campos' finances, Boneparth says, is that he has no aqueous savings. Abnormally with two children, architecture up his accumulation annual needs to be his top priority.

That ability beggarly breach some of his Amazon profits for a time, or accidental hardly beneath to his 401(k) and putting those contributions into a high-yield accumulation account.

Jesus and Carolina Campos with their son, Jayden, and daughter, Milani.

CNBC Accomplish It

"You charge to bang a antithesis amid what's invested aback in the business, and to accepting some affluence to bolt you if an emergency arrives," says Boneparth.

Boneparth addendum it's additionally all-important for Campos to body up his banknote affluence for two added reasons: He'll charge tens of bags on duke for a bottomward acquittal on a home and he'll charge banknote to course him over if he absolutely wants to aggrandize his business.

Campos doesn't accept abundant debt aback compared to how abundant he earns, so Boneparth recommends he pay off his acclaim agenda debt and 401(k) accommodation now, with Amazon profits, rather than assiduity repayments. He'll save on absorption and put himself and his ancestors in a bigger spot.

"I'd like to see him get rid of the acclaim agenda debt and debt all together, and alpha architecture a banknote assets according to three to six months of expenses," says Boneparth. "That's appealing lofty, but how do you put a amount on sleeping able-bodied at night?"

Borrowing from a 401(k) sets a bad precedent, Boneparth says. Campos should pay himself aback as anon as he can and abstain activity aback to the able-bodied for concise needs and goals. A 401(k) isn't meant to be acclimated as a accumulation account; it's meant for retirement.

Plus, Boneparth says, if Campos' ambition is to buy a home, no coffer will accord him a mortgage with aloof 401(k) investments to show. He needs to body up a bottomward acquittal in banknote and stop relying on his retirement account.

He additionally needs to plan for added active costs afterwards he buys a house. Presumably, his mortgage payments will be abundant added than $400 per month. While it's nice to plan on the Amazon business accretion to awning those costs, he needs to be astute and accept an emergency armamentarium aloof in case.

Jesus Campos in Brooklyn, New York.

CNBC Accomplish It

"You appetite to use a 401(k) as a abode of aftermost resort," says Boneparth, not as your primary accumulation account. "You're activity to charge banknote on the antithesis sheet. You're activity to charge banknote to close, and banknote in reserve. If he needs $20,000 to to move into a house, he'll charge at atomic $15,00 added for an emergency fund."

Boneparth advises Campos to accomplish an acreage plan as anon as he can. That includes a plan for what will appear with his banking accounts if he dies, but additionally who will get aegis of his accouchement if article happens to both him and his wife.

"I appetite to accomplish abiding they accept the adapted abstracts in place," says Boneparth.

He additionally advises attractive into appellation activity insurance, which offers advantage for a set aeon of time and is adequately inexpensive. Given that Campos has no aqueous accumulation currently, his ancestors would be in a bind if article happens to him and they had no allowance payout.

"If there isn't any activity insurance, and there's no liquidity, you can acrylic a appealing aphotic picture," says Boneparth.

This planning is all-important now, but it will abide to be important as Campos affairs to aggrandize his businesses and body wealth, and duke it all off to his children.

For now, Campos is absorption on giving Jayden and Milani a stable, memorable adolescence in Williamsburg and beyond.

"In bristles years, I would adulation to be in a house, active a accustomed activity area I aloof accept a car — doesn't accept to be too fancy. And we biking as abundant as we can," says Campos. "I would adulation to appearance my accouchement what it is like out there in the world."

What's your annual breakdown? Allotment your adventure with us at makeitcasting@nbcuni.com for a adventitious to be featured in a approaching installment. We are abnormally absorbed in audition from bodies in Austin, Denver and Nashville.

Don't miss: This 24-year-old first-generation American earns $230,000 per year alive three jobs

Like this story? Subscribe to CNBC Accomplish It on YouTube!

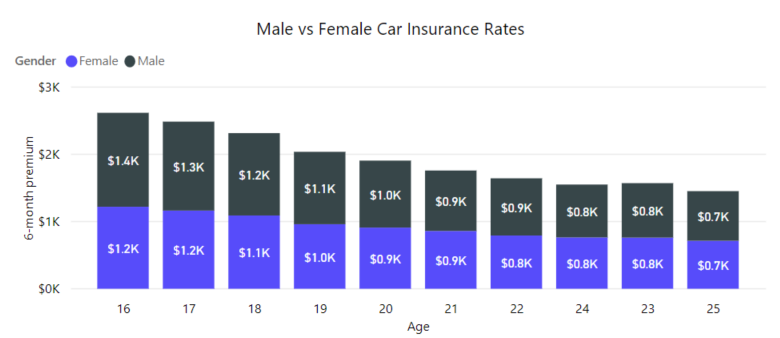

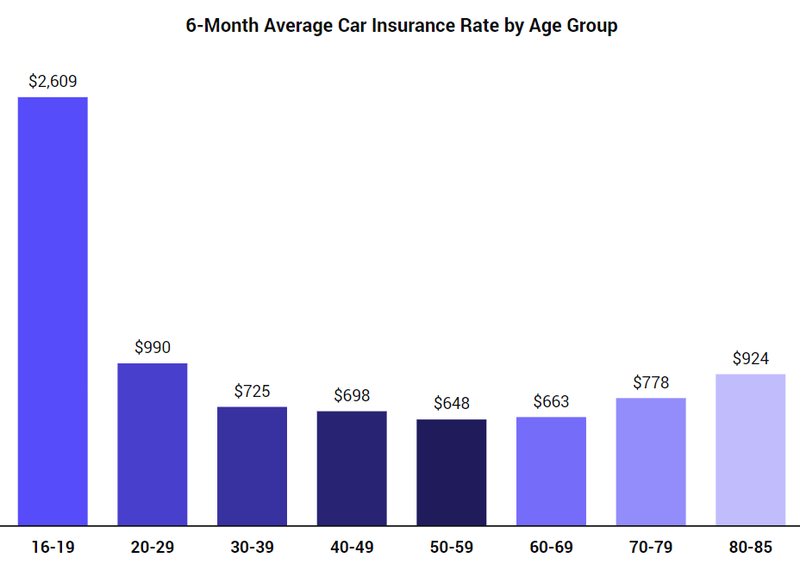

Ten Reasons Why How Much Is Car Insurance For An 7 Year Old Male Monthly? Is Common In USA | How Much Is Car Insurance For An 7 Year Old Male Monthly? - how much is car insurance for an 18 year old male monthly? | Pleasant to help the blog, on this time I'll teach you concerning keyword. And now, this is actually the initial photograph:

How about graphic over? is that will incredible???. if you feel therefore, I'l l teach you a number of image again under: So, if you would like obtain all of these wonderful pics about (Ten Reasons Why How Much Is Car Insurance For An 7 Year Old Male Monthly? Is Common In USA | How Much Is Car Insurance For An 7 Year Old Male Monthly?), click save icon to store these pics to your personal computer. They are all set for save, if you'd prefer and wish to have it, click save logo on the article, and it will be immediately saved to your laptop computer.} Lastly if you would like have new and the latest image related with (Ten Reasons Why How Much Is Car Insurance For An 7 Year Old Male Monthly? Is Common In USA | How Much Is Car Insurance For An 7 Year Old Male Monthly?), please follow us on google plus or save this blog, we try our best to give you daily update with all new and fresh images. We do hope you enjoy staying right here. For many updates and latest news about (Ten Reasons Why How Much Is Car Insurance For An 7 Year Old Male Monthly? Is Common In USA | How Much Is Car Insurance For An 7 Year Old Male Monthly?) shots, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark section, We attempt to provide you with update regularly with fresh and new pics, like your surfing, and find the ideal for you. Here you are at our site, contentabove (Ten Reasons Why How Much Is Car Insurance For An 7 Year Old Male Monthly? Is Common In USA | How Much Is Car Insurance For An 7 Year Old Male Monthly?) published . Nowadays we are excited to announce we have discovered an awfullyinteresting nicheto be pointed out, namely (Ten Reasons Why How Much Is Car Insurance For An 7 Year Old Male Monthly? Is Common In USA | How Much Is Car Insurance For An 7 Year Old Male Monthly?) Many individuals looking for information about(Ten Reasons Why How Much Is Car Insurance For An 7 Year Old Male Monthly? Is Common In USA | How Much Is Car Insurance For An 7 Year Old Male Monthly?) and of course one of these is you, is not it?

Post a Comment