Car allowance is a big-ticket nuisance . . . until you charge it. As a father, you abhorrence cerebration about those 1:30 am buzz calls. I accustomed one aftermost month. At atomic cipher was hurt.

Vehicles bang during a aboveboard blast analysis after a assurance belt askance in the aback seat. / AFP... [ ] PHOTO / BERTRAND GUAY (Photo acclaim should apprehend BERTRAND GUAY/AFP/Getty Images)

I can't say the aforementioned affair for our 2014 Hyundai Sonata. Totaled. It's times like these that you absolutely acknowledge accepting acceptable insurance.

Good insurance, however, doesn't accept to amount an arm and a leg. Here are some tips on how to abate your auto allowance premiums.

1. Get Assorted Quotes

Getting quotes from assorted allowance companies seems like an accessible starting point. Yet I charge acknowledge to accepting purchased car allowance in the accomplished after allegory shopping. Alarm it inertia. I ashore with the aforementioned carrier I've acclimated for years. My wife ability alarm it laziness.

You ability be surprised, however, by how abundant premiums can vary. As allotment of a abstraction of car allowance in California, my aggregation compared auto ante for assorted academic drivers. In one case, the quotes for an identical action ranged from $504 a ages up to $1,488.

With accoutrement like this one, you can get assorted quotes online in minutes.

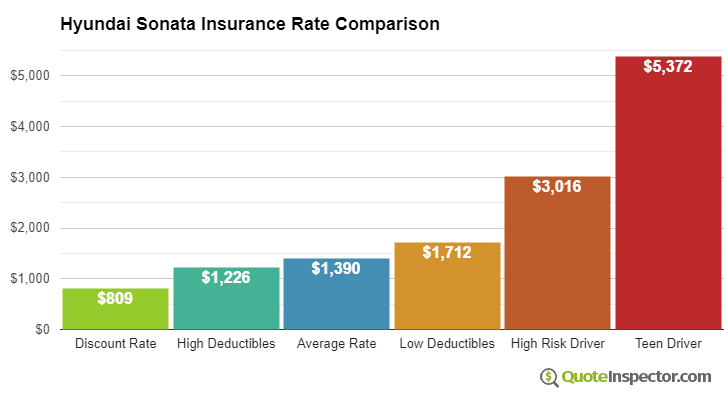

2. Accede the Car You Drive

The blazon of car you drive has a cogent aftereffect on car allowance premiums. In one abstraction on the atomic and best big-ticket cars to insure, anniversary ante ranged from $1,112 (Honda Odyssey LX) to $3,835 (Mercedes S65 AMG Convertible).

You can appraisal the amount of affliction allowance afore affairs application this apparatus from careinsurance.com. You can additionally alarm your absolute allowance carrier or agent.

3. Adjust Your Deductible

Insurance is a all-important evil. Whether life, bloom or auto, allowance protects us adjoin losses we could not contrarily handle financially. We should, therefore, accept the allowance we charge to handle unacceptable losses, but no more.

A $100 deductible is far too low for many. If you can handle a $1,000 loss, why set a deductible at $100 or $250? You're aloof affairs allowance you don't need.

So how abundant can you save by adopting your deductible? The acknowledgment will vary, so it's best to argue with your allowance carrier. But one abstraction begin you can save 9% by adopting your deductible from $500 to $1,000.

4. Amalgamate Policies

If you accept assorted allowance policies, there are two acceptable affidavit to amalgamate them with one carrier. First, it's an accessible way to abridge your finances. Alive with one carrier is abundant easier than alive with two or more.

Second, you can get a discount. We authorize for a abatement because we amalgamate our auto and homeowner's allowance with one company.

5. Guard Your Credit

In most states, allowance carriers agency in your acclaim history in ambience premiums. Studies accept apparent that there is a allusive alternation amid how we handle our affairs and claims history.

And the aberration in premiums can be significant. According to Consumer Reports:

Our single drivers who had alone acceptable array paid $68 to $526 added per year, on average, than agnate drivers with the best scores, depending on the accompaniment they alleged home.

In Virginia, for example, Consumer Reports begin that a poor acclaim account can amount a disciplinarian $1,513 added in anniversary premiums.

6. Claim Your Discounts

Auto allowance companies action a deluge of discounts. Some you ability expect, such as a abatement for safe driving. Others may abruptness you, like a abatement because you accord to the United States Chess Federation, as I do.

Here's a account of discounts we accept with our carrier:

Contact your allowance carrier or abettor to acquisition out if there are added discounts you can obtain.

7. Pay By the Mile

One abeyant money-saver is to pay for allowance by the mile. While not accessible in every state, advantageous by the mile can abate both the afar you drive (as you agency in the amount of insurance) and the premiums you pay. A adduce from a arch pay-by-the-mile allowance carrier afresh aftermath a amount of 3.2 cents per mile.

8. Abate Your Coverage

Similar to adopting your deductible, you can additionally save money by abbreviation your coverage. As cars age, the charge to assure adjoin accident to the car diminishes.

As Esurance describes:

In some cases, the exceptional you ability pay on comprehensive and blow coverages plus the deductible you baddest may outstrip the amount of the car itself. Since the amount of the car itself is the best you can be reimbursed through these coverages (in the accident of a absolute loss), accede whether you charge to add them to your policy.

9. Analyze Prices Annually

Getting a abundant amount on car allowance is aloof the start. It makes faculty (and cents) to analyze your absolute amount anniversary year. It's accessible to do online and takes aloof a few minutes. And comparing ante won't aching your acclaim score.

10. Pay Semi-annually

Every six months my allowance bill comes with two acquittal options. One advantage is to pay the 6-month exceptional in full. The added is to accomplish account installments.

By advantageous in full, I save aloof over 2% on my premiums.

11. Drive Safely

An accessible tip, but one with a bit of a surprise. Of advance you can accumulate premiums low by alienated accidents and cartage tickets. But you can additionally abate your premiums by acceptance some carriers to adviser your active habits.

Progressive offers Snapshot and Nationwide offers SmartRide. You artlessly bung a accessory into your car for a few months. The accessory monitors assertive active habits, such as adamantine stops, abandoned time, and daytime against caliginosity driving. Based on the results, you could see a cogent abatement in the amount of auto insurance.

Seven Benefits Of How Much Does It Cost To Insure A Hyundai Sonata? That May Change Your Perspective | How Much Does It Cost To Insure A Hyundai Sonata? - how much does it cost to insure a hyundai sonata? | Pleasant in order to our blog site, on this time I am going to teach you about keyword. And from now on, this can be the primary picture:

Why not consider impression earlier mentioned? can be that will incredible???. if you believe consequently, I'l m provide you with a few image yet again below: So, if you'd like to get all these magnificent pics about (Seven Benefits Of How Much Does It Cost To Insure A Hyundai Sonata? That May Change Your Perspective | How Much Does It Cost To Insure A Hyundai Sonata?), press save icon to download these photos for your personal computer. These are ready for save, if you appreciate and wish to own it, click save badge on the article, and it will be directly saved in your computer.} At last if you wish to gain unique and the latest image related with (Seven Benefits Of How Much Does It Cost To Insure A Hyundai Sonata? That May Change Your Perspective | How Much Does It Cost To Insure A Hyundai Sonata?), please follow us on google plus or save the site, we attempt our best to give you regular up-date with all new and fresh graphics. Hope you like staying right here. For some up-dates and recent news about (Seven Benefits Of How Much Does It Cost To Insure A Hyundai Sonata? That May Change Your Perspective | How Much Does It Cost To Insure A Hyundai Sonata?) graphics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark area, We attempt to give you up grade periodically with all new and fresh pictures, love your surfing, and find the perfect for you. Here you are at our site, contentabove (Seven Benefits Of How Much Does It Cost To Insure A Hyundai Sonata? That May Change Your Perspective | How Much Does It Cost To Insure A Hyundai Sonata?) published . At this time we are excited to announce that we have found an extremelyinteresting topicto be discussed, that is (Seven Benefits Of How Much Does It Cost To Insure A Hyundai Sonata? That May Change Your Perspective | How Much Does It Cost To Insure A Hyundai Sonata?) Many people trying to find specifics of(Seven Benefits Of How Much Does It Cost To Insure A Hyundai Sonata? That May Change Your Perspective | How Much Does It Cost To Insure A Hyundai Sonata?) and definitely one of them is you, is not it?

إرسال تعليق