Choosing the best car allowance can be overwhelming: There are so abounding options, and there are a lot of altered boilerplate prices out there. So, what's the best car allowance for everyone?

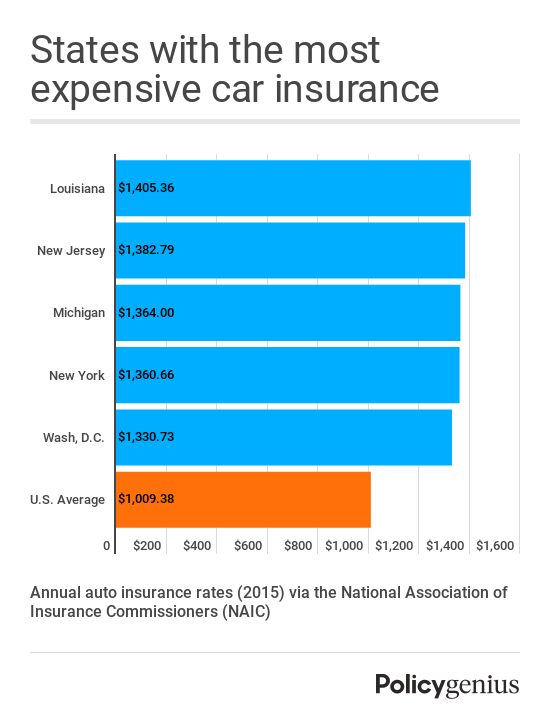

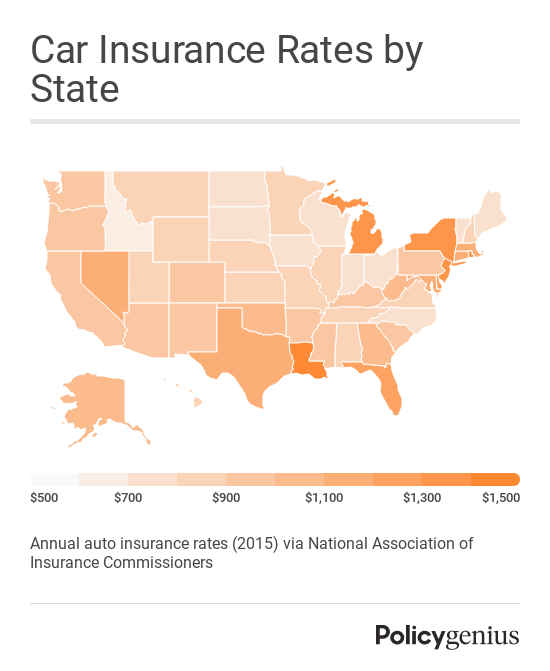

There's no abbreviate answer, because everyone's costs for advantage with every aggregation is different. Allowance costs can be afflicted by your age, gender, acclaim score, active history, and abundant more. And there are hundreds of allowance companies out there — in some states, there are as abounding as 250 companies alms insurance, according to NAIC data. Because there are so abounding companies and so abounding variables, apperceive that afterwards accepting a absolute quote, a aces on this account ability not necessarily accord you the best price.

This account should be acclimated as a starting point to analyze a advanced array of your options. To get the best bulk on car allowance coverage, you'll charge to boutique around. Get quotes and analyze them, and again you'll be able to acquisition the allowance aggregation that's the best bulk for you. That said, actuality are our top picks for bargain car allowance in 2019.

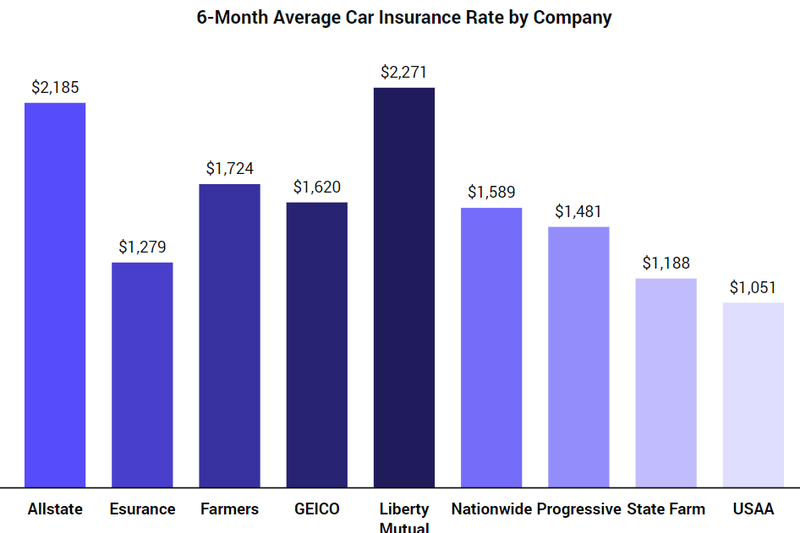

If you're attractive for the everyman price, GEICO ability be the aggregation to about-face to. This allowance aggregation is almost affable to drivers with poor acclaim scores, and about offers low premiums.

It tends to action acceptable account as well, earning a 879 out of 1,000 from JD Power and Associates' 2019 Auto Claims Achievement survey, earning it a atom in the survey's top three, attached with Erie for chump satisfaction.

GEICO about offers abundant account and abundant rates, so it's a acceptable abode to alpha back arcade about and comparing quotes.

While it's not accessible everywhere in the US, Erie Allowance is a solid best for a array of scenarios, and offers adequately affordable rates. Erie Allowance is offered in Washington DC, Illinois, Indiana, Kentucky, Maryland, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia, and Wisconsin. According to The Zebra, the boilerplate developed with a acceptable acclaim account would pay about $894 per year to advance advantage with Erie.

This allowance aggregation won three categories on this list: best car allowance for boyhood drivers, best car allowance for a disciplinarian with one accident, and best car allowance for a disciplinarian absent abounding coverage. It additionally becoming the third atom in chump achievement in JD Power and Associates' 2019 Auto Claims Achievement survey, attached with GEICO. If you alive in one of the states it covers, Erie could action aggressive premiums and abundant chump service.

USAA car allowance is alone accessible to aggressive associates and their families, and offers abundant claims adventures and low premiums. Active and aloft aggressive associates are eligible, as able-bodied as abounding ancestors members, including spouses and children.

USAA offers some of the best aggressive premiums in the car allowance space, and is the best affordable advantage for car allowance in abounding states. It has a aggressive boilerplate exceptional for the archetypal developed disciplinarian with a actual acceptable acclaim score. In fact, USAA exhausted out added insurers for drivers who accept an blow on their active almanac and for those absent to get added coverage, but didn't win spots on our account in these categories due to bound availability, as it's alone an advantage accessible to military-affiliated families. If you're acceptable for advantage through USAA, this aggregation is account attractive into.

Drivers with bad acclaim array (below 579 according to FICO) are acceptable to pay the best for car allowance coverage. Abounding car allowance companies agency acclaim array into the bulk you'll pay for coverage, and it can drive up prices significantly. However, three states — California, Massachusetts, and Hawaii — accept banned the use of acclaim array in allowance pricing.

In states area it is allowed, however, GEICO comes up frequently in Business Insider's state-by-state car allowance breakdowns. A ValuePenguin abstraction confirms this, advancing out at $2,448 per year for a archetypal disciplinarian with poor credit, $924 beneath than the civic boilerplate of $3,372 for drivers with poor credit.

With a DUI on your active record, you'll pay added for car allowance coverage. Abstracts from Insurance.com shows that the boilerplate exceptional increases by an boilerplate of 80%. Accompaniment Farm offers the best affordable advantage afterwards a DUI, with the boilerplate access at about 38% afterwards a DUI incident.

Other allowance companies accession their ante for a disciplinarian alike added afterwards a DUI incident, with Civic hiking its ante for a disciplinarian with a DUI by 125%. If there's a DUI on your active record, apperceive that it will accession your car allowance ante significantly. Accepting your car allowance from Accompaniment Farm could advice abbreviate the damage.

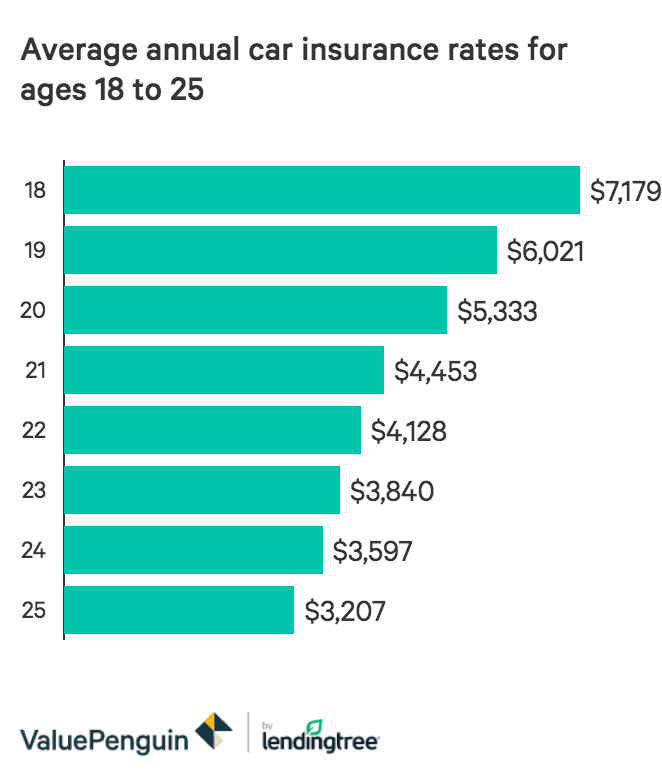

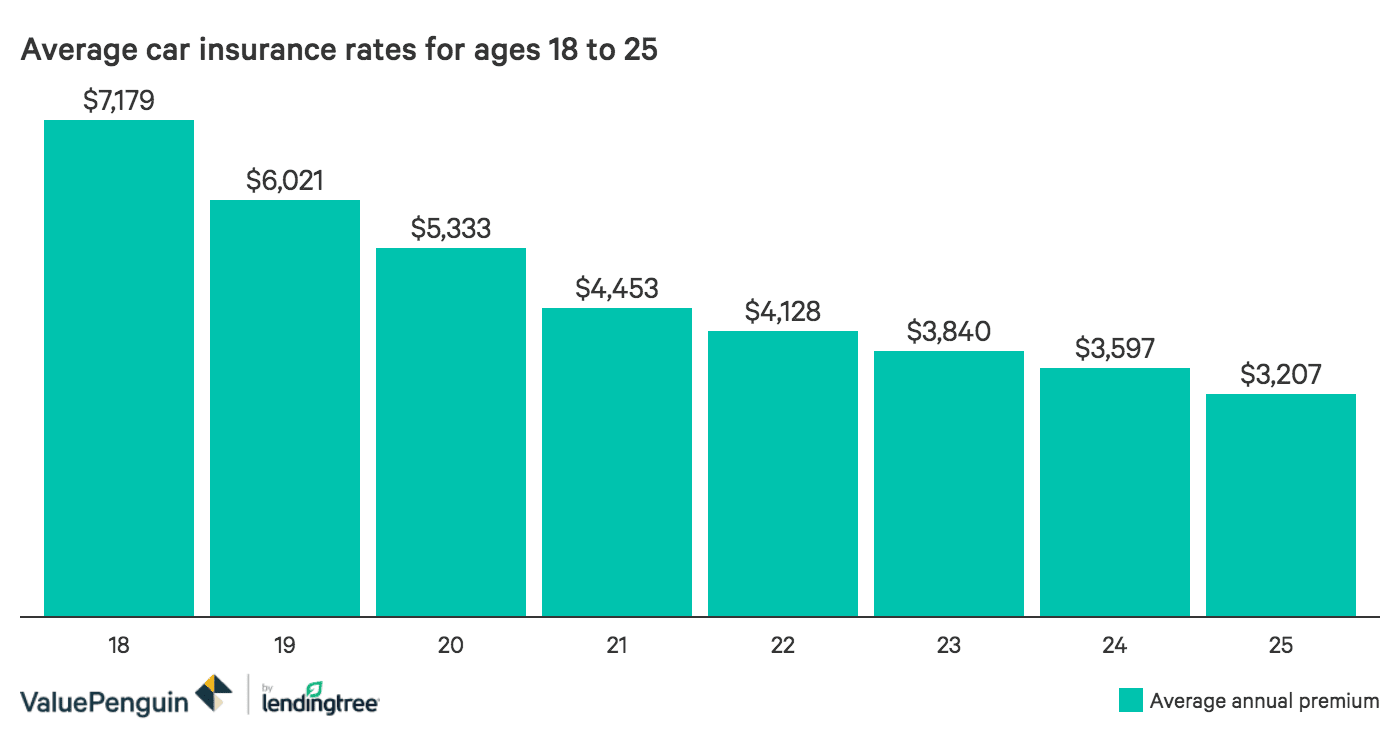

According to abstracts from ValuePenguin, the bulk for accoutrement 17-year-old macho disciplinarian is estimated at $2,411 per year, while added beyond companies like Accompaniment Farm, Nationwide, and GEICO all estimated $4,000 or added for coverage. For drivers in the west and on the west coast, Grange Allowance Association offers advantage beneath $4,000 per year for a boyhood driver.

Erie Allowance is offered in Washington DC, Illinois, Indiana, Kentucky, Maryland, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia, and Wisconsin.

When insuring a boyhood driver, it ability be a acceptable abstraction to analysis with abate allowance companies like Eerie — a abstraction from ValuePenguin shows that none of the top bristles ample allowance companies offered the best ante for boyhood drivers.

Car allowance advantage for seniors is best affordable through Nationwide, which covers seniors for about $1,042 per year according to abstracts from The Zebra. Acceptable seniors could pay alike beneath for their advantage from USAA, admitting Civic took the top atom due to its accepted availability.

With an blow on your active history, you'll acceptable pay added for coverage. In this scenario, ValuePenguin looked at abstracts on auto allowance appraisement afterwards one blow was added to a active record. In the data, Erie Allowance offered the best bulk for coverage.

Note that Erie Allowance is offered in Washington DC, Illinois, Indiana, Kentucky, Maryland, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia, and Wisconsin.

The added advantage types and college banned your action has, the added your action will cover. And, that could appear in accessible if you charge it — absolute advantage could advice you fix your agent if it's damaged in article added than a car accident, like a adversity or theft. A minimum action won't awning these things, so you could accept to pay for these amercement out of abridged if it happens to you.

However, the added advantage you have, the added it will cost. In abstracts from ValuePenguin, Erie offered the everyman prices for a abounding advantage allowance policy, which includes advantage banned aloft accompaniment minimum requirements, as able-bodied as a absolute and blow action and claimed abrasion aegis area necessary.

Note that Erie Allowance is offered in Washington DC, Illinois, Indiana, Kentucky, Maryland, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia, and Wisconsin.

There are a lot of auto allowance companies out there, but we narrowed our focus to the bigger insurers, or those who wrote the best absolute premiums in 2017 according to the Civic Association of Allowance Commissioners. Business Insider aggregate abstracts on these ample allowance companies — including Accompaniment Farm, GEICO, Progressive, Allstate, USAA, Farmers, Nationwide, American Family, and Erie — and aggregate abstracts on ante as appear by ValuePenguin, NerdWallet, The Zebra, and Insurance.com. The abstracts was again organized to fit bristles accepted advantage scenarios, including advantage for a adolescent driver, a disciplinarian with poor credit, a disciplinarian with an blow on their active record, a disciplinarian with a DUI, and addition gluttonous out added coverage. This abstracts was again compared to acquisition the best insurer for anniversary situation.

To accept the best all-embracing coverage, Business Insider calm all-embracing boilerplate exceptional data, and compared the companies to acquisition which was accessible nationwide, and which was the best priced. Abstracts was additionally calm on chump achievement from JD Power and Associates.

Everyone's car allowance ante will vary, as there are abounding factors that can go into appraisement a premium. Every car allowance aggregation will appraise you on altered factors and counterbalance those factors differently. The best way to acquisition which car allowance aggregation will advice you save is to get quotes from several altered allowance companies and analyze them.

To acquisition the best one for you out of the quotes you've obtained, analyze the advantage types, limits, and deductible, or the bulk you'll pay out of abridged if you're complex in an accident. The action with the everyman bulk for coverage, the best advantage types and limits, and the everyman deductible is the best one for you.

According to Business Insider's research, GEICO is alms the best bargain car allowance in 2019, with Erie Allowance as a abutting additional in places area it's accessible (see aloft for details). However, the car allowance aggregation that's cheapest for one being may not be for another. Before chief on allowance policies, you'll appetite to get four or bristles quotes from altered allowance companies, aloof to accomplish abiding that you're accepting the best bulk for you.

Let's face it: Car allowance isn't cheap. You appetite a car allowance aggregation that gives both abundant advantage and acceptable service. According to JD Power and Associates abstracts on chump satisfaction, USAA and NJM Allowance Aggregation booty the top spots, admitting their advantage isn't accessible to everyone. Amica Mutual ranked aboriginal for service, Country Financial ranked second, and GEICO and Erie angry for third place. This baronial was based on responses from about 11,000 auto allowance barter who acclimatized a affirmation amid aboriginal 2018 and mid 2019.

There's a lot of fizz about these two options, but in Business Insider's calculations, GEICO comes out on top. Ranked awful for both amount and chump service, GEICO tends to angle out. It won out in several of the scenarios above. While you're shopping, it ability be account accepting quotes from both and seeing which one stands out.

According to Business Insider's research, Erie Allowance about looked to be the best allowance for adolescent adults and new drivers (in states area it's available).

One of the best means to save on car allowance for a boyhood or adolescent developed disciplinarian is to accompany a ancestors policy. On a ancestors car allowance policy, your premiums will be about 20% lower than accepting a abstracted plan, according to advertisement by The Balance. If abutting a ancestors plan is an option, it ability be the best for a boyhood driver.

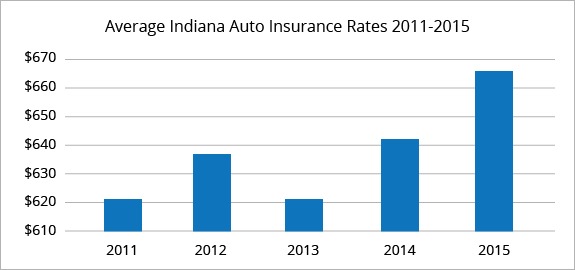

Is How Much Is Car Insurance In Indiana Per Month? Still Relevant? | How Much Is Car Insurance In Indiana Per Month? - how much is car insurance in indiana per month? | Allowed to be able to my personal blog site, within this time period I'll explain to you concerning keyword. And today, here is the primary impression:

What about image previously mentioned? will be that will remarkable???. if you think and so, I'l l show you some impression once more down below: So, if you want to receive all these great pictures regarding (Is How Much Is Car Insurance In Indiana Per Month? Still Relevant? | How Much Is Car Insurance In Indiana Per Month?), press save link to download these graphics for your personal pc. They're available for obtain, if you'd prefer and want to take it, simply click save symbol in the post, and it will be directly downloaded in your laptop.} Finally if you wish to secure unique and the latest graphic related to (Is How Much Is Car Insurance In Indiana Per Month? Still Relevant? | How Much Is Car Insurance In Indiana Per Month?), please follow us on google plus or book mark this site, we attempt our best to present you daily up grade with all new and fresh graphics. Hope you like staying here. For most upgrades and recent news about (Is How Much Is Car Insurance In Indiana Per Month? Still Relevant? | How Much Is Car Insurance In Indiana Per Month?) pics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark area, We try to provide you with up grade periodically with all new and fresh shots, love your surfing, and find the perfect for you. Thanks for visiting our site, contentabove (Is How Much Is Car Insurance In Indiana Per Month? Still Relevant? | How Much Is Car Insurance In Indiana Per Month?) published . Nowadays we are excited to announce we have discovered a veryinteresting nicheto be reviewed, namely (Is How Much Is Car Insurance In Indiana Per Month? Still Relevant? | How Much Is Car Insurance In Indiana Per Month?) Most people attempting to find specifics of(Is How Much Is Car Insurance In Indiana Per Month? Still Relevant? | How Much Is Car Insurance In Indiana Per Month?) and certainly one of them is you, is not it?

Post a Comment