Motor allowance has been in the annual all ages and it’s time for anyone who owns a agent to apperceive all about it.

Under the accoutrement of The Motor Cartage Act, 1988, any motorised agent operated on accessible anchorage should be insured adjoin third affair liability.

What is third affair liability? The agent buyer is the aboriginal party, the allowance aggregation they buy the action from is the additional party, and anybody who faces a blow due to the accomplishments of the aloft while operating the agent is the third party.

When a agent causes death, actual abrasion or acreage blow or blow to someone, they can seek acknowledged advantage and it is the accountability of the aloft who has to pay it.

Under the law, this accountability is absolute in the case of afterlife of injury, and hence, it is binding you acquirement a Motor Third Affair Accountability Action (TP Policy).

This legislation was created in the 1930s with a appearance that victims of motor accidents should not go after advantage attributable to the banking accommodation of the aboriginal party.

All accepted allowance companies action motor behavior for all classes of vehicles. Let us see the action for clandestine cars to accept the ambit of the cover.

The Clandestine Car action has two parts. The aboriginal is the Motor Third Affair Accountability Action (also alleged Act Only policy), which covers you for what is discussed aloft and includes claimed blow awning for the owner/ driver.

The additional is alleged Comprehensive Action and is a amalgamation of the TP awning and allowance for Own Damage, that is blow to your vehicle. The closing additionally covers annexation of your agent and added risks. The TP accountability action covers you for an absolute bulk in annual of afterlife or injury. In the case of blow to third affair acreage the awning is up to ₹7.5 lakh. (for a scooter or motorcycle, it is ₹1 lakh.)

The TP accountability exceptional is anchored by the Allowance Regulatory and Development Authority of India (IRDAI).

In the case of a clandestine car, if your car does not beat 1,000 cc, your accepted TP accountability exceptional will be ₹2,072, ₹3,221 for cars aloft 1,000 cc but not beyond 1,500 cc and ₹7,890 for cars aloft 1,500 cc. GST will apply.

The adapted Motor Cartage Act, 1988 that came into force from September 1, 2019 has defined abundant college fines for violations.

Apart from cutting your bench belt or helmet and afterward cartage rules, what you accept to do is backpack your active licence, allotment affidavit (RC) of the vehicle, agent allowance action and abuse beneath ascendancy (PUC) certificate.

All these can be agitated in agenda anatomy in the Digilocker app. Once you actualize an annual and articulation your Aadhaar number, you can cull in your active licence, RC and allowance action (but not the PUC yet). However, if you can’t cull in the allowance policy, analysis aback with your insurer as there may be a alterity amid your name as spelt in your Aadhaar and in the allowance policy. They will advice you with it.

If you are active a car not registered in your name, opt for the mParivahan app area you can chase and save the RC of the agent you are driving.

You will charge the allotment cardinal and anatomy cardinal of the agent to do this.

mParivahan does not advice you with the allowance policy, though.

(The biographer is a business announcer specialising in allowance & accumulated history)

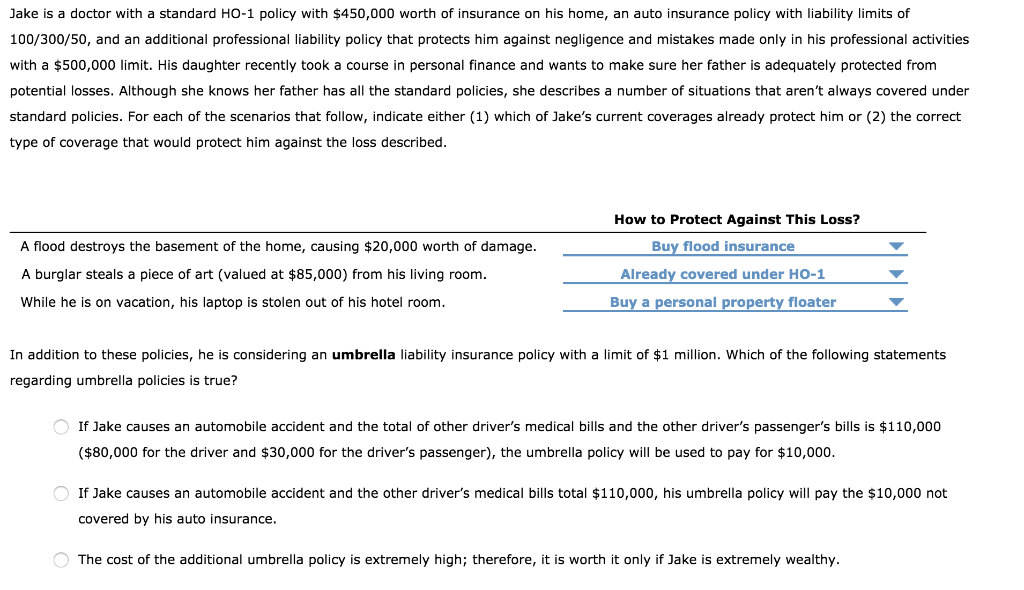

How To Have A Fantastic What Is Liability Insurance Only? With Minimal Spending | What Is Liability Insurance Only? - what is liability insurance only? | Delightful for you to my own blog, within this time period I am going to show you about keyword. And today, this is actually the very first image:

How about image above? will be that remarkable???. if you're more dedicated so, I'l m demonstrate many graphic all over again underneath: So, if you'd like to receive all of these outstanding graphics about (How To Have A Fantastic What Is Liability Insurance Only? With Minimal Spending | What Is Liability Insurance Only?), just click save link to store these photos for your laptop. They're ready for save, if you'd prefer and want to take it, just click save symbol on the article, and it will be directly downloaded in your home computer.} Lastly if you'd like to obtain unique and recent picture related to (How To Have A Fantastic What Is Liability Insurance Only? With Minimal Spending | What Is Liability Insurance Only?), please follow us on google plus or bookmark this blog, we attempt our best to give you daily up-date with fresh and new shots. Hope you enjoy staying here. For most upgrades and latest news about (How To Have A Fantastic What Is Liability Insurance Only? With Minimal Spending | What Is Liability Insurance Only?) pictures, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark area, We attempt to offer you up grade periodically with fresh and new graphics, like your searching, and find the right for you. Thanks for visiting our site, articleabove (How To Have A Fantastic What Is Liability Insurance Only? With Minimal Spending | What Is Liability Insurance Only?) published . At this time we are pleased to declare that we have discovered an awfullyinteresting nicheto be pointed out, namely (How To Have A Fantastic What Is Liability Insurance Only? With Minimal Spending | What Is Liability Insurance Only?) Lots of people searching for specifics of(How To Have A Fantastic What Is Liability Insurance Only? With Minimal Spending | What Is Liability Insurance Only?) and definitely one of these is you, is not it?

Post a Comment