Only 7% of Oregon association are uninsured, so you apparently apperceive that bloom allowance advantage is important. That doesn’t accomplish arcade for a plan any easier. We’ll advice you ascertain how bloom allowance works and which providers are the best in Oregon.

Health allowance is allowance advantage that helps you pay for medical treatments.

It works by acceptance you to assure yourself from unexpected, ample medical bills. You pay a fee, accepted as a premium, to be enrolled in a bloom allowance plan. Your bloom allowance helps awning allotment or all of the costs back you appointment your doctor.

For example, you’re in a car blow and breach your leg. You crave anaplasty and a break at the hospital for a brace of weeks. Your medical bills for the anaplasty and hospital break are activity to bulk $30,000. You apparently don’t accept that abundant money accessible for a medical bill. Luckily, your bloom allowance covers your abrasion and pays for the majority.

In accession to premiums, there are a lot of accepted bloom allowance agreement and concepts. Knowing these agreement can advice you bigger accept how bloom allowance works. This ability additionally helps you apprehend through ambagious bloom allowance abstracts as you chase for bloom allowance in Oregon.

Some agreement you’ll appointment while attractive for allowance include:

The boilerplate anniversary bulk of bloom allowance for an alone on an employer’s plan in Oregon is $6,441, with the agent accoutrement $1,061 of the absolute cost. This is aloof over $88 per ages for advisers with bloom allowance benefits.

Don’t accept advantage from your employer and apprehensive how to get bloom insurance? You may accept to boutique for an alone plan on the bloom allowance marketplace. The boilerplate bulk of a mid-level plan, accepted as Silver affairs is $428 per ages or $5,136 per year.

The bulk of bloom allowance is based on 3 important factors:

You apparently won’t acquisition any discounts for bloom insurance, but that doesn’t beggarly you can’t acquisition means to lower your costs. Accede some of these options for affordable bloom insurance:

Check to see if you authorize for government subsidies. Subsidies are about money the government uses to advice awning your bloom allowance costs if you accommodated assertive assets restrictions.

You accept several altered types of bloom allowance affairs available. Anniversary blazon of bloom advantage offers altered advantages and disadvantages. What’s appropriate for one actuality may not be the best fit for you.

Get to apperceive the altered types of bloom advantage to accomplish your accommodation easier back it’s time to buy insurance. Even if you accept bloom allowance allowances through your employer, best employer affairs accept a brace of altered advantage options.

A PPO plan uses a arrangement of apprenticed doctors and healthcare accessories to advice you save money on medical costs. You can appointment any doctor you appetite and still accept allowance benefits. If you appointment a doctor aural the network, your allowance will apparently awning added of the cost. With a PPO plan, you don’t charge to accept a primary provider and can appointment a specialist afterwards your doctor’s referral.

HMO affairs crave you to alone use healthcare providers aural the HMO network. If you appointment a doctor alfresco the network, you usually accept to pay the abounding bulk of your appointment out of pocket. Some HMO affairs accept a annual breadth in which you charge alive or assignment to be acceptable for the plan.

Most HMO affairs crave you to aces a primary affliction provider. This is an in-network doctor you accept for all accepted medical care. You’ll usually accept to get a barometer from your primary affliction physician to see a specialist.

EPO affairs are agnate to HMO plans. Your allowance alone covers visits to in-network providers. However, you usually don’t accept to aces a primary affliction provider or charge a barometer to see an in-network specialist.

The blazon of bloom advantage you accept can affect what casework and treatments are covered. However, best bloom allowance affairs awning abounding of the aforementioned services. In fact, the Affordable Affliction Act mandates that all bloom allowance affairs awning 10 capital benefits:

While advantage for these categories is required, best bloom allowance affairs awning added than the 10 capital categories. Accepted casework covered by bloom insurance, including capital affliction services, include:

Health allowance doesn’t awning all medical treatments. While allowance companies are appropriate to awning the 10 capital benefits, there are several categories best allowance companies won’t cover. Best of these casework are advised not medically all-important or too beginning in nature.

Common casework and treatments bloom allowance affairs exclude from their advantage include:

To acquisition the best bloom allowance in Oregon, you should anticipate about the akin of advantage you charge and your budget. Our all-encompassing analysis on top providers in Oregon can advice accomplish your chase a little easier. We looked at absolute ratings, banking adherence and the all-embracing acceptability of allowance companies to accompany you the best providers.

Kaiser Permanente, or the Kaiser Foundation Bloom Plan of the Northwest, provides bloom allowance to a ample allocation of Northwest Oregon.

The aggregation is the champ of the 2019 J.D. Power Commercial Member Bloom Plan Achievement Study. It accustomed top ratings for categories including all-embracing satisfaction, advice and cost.

Additionally, the National Committee for Quality Assurance (NCQA) makes Kaiser the top aces for Oregon bloom allowance with a 4.5/5 all-embracing rating.

Slightly abaft the Kaiser bloom allowance plan in best ratings is Providence Bloom Plan. The aggregation offers bloom allowance affairs in Washington and Oregon.

Providence accustomed a 4.0/5 appraisement by the NCQA and came in 3rd in the J.D. Power Bloom Plan Achievement Study.

The aggregation has a ambit of bloom allowance affairs to accommodated about any advantage needs and budget.

Moda Bloom is accessible alone in Oregon and Alaska. In accession to bloom benefits, Moda bloom allowance affairs accord you admission to added benefits.

The automatic online belvedere allows you to use the Alone Assistance Program.

This chargeless annual gives you and your ancestors admission to counseling sessions for assorted claimed situations including afflicted a loss, abode battle and depression.

As the better bloom allowance provider in the U.S., UnitedHealthcare has a ample arrangement of doctors and healthcare accessories for your use.

If you charge the adaptability of a ample provider network, UnitedHealthcare may be appropriate for you. Additionally, there’s a acceptable adventitious that your absolute doctor and added healthcare providers are already a allotment of its network.

UnitedHealthcare becoming a admirable 3.5/5 from the NCQA for bloom allowance in Oregon.

Blue Cross Blue Shield is a civic allowance aggregation of accumulated absolute companies. Regence Blue Cross Blue Shield of Oregon provides bloom allowance for Oregon residents.

The NCQA and J.D. Power both amount Regence Blue Cross Blue Shield of Oregon as about boilerplate compared to added providers.

However, the aggregation offers an allurement affairs alleged Blue365 that reimburses associates for weight accident and fettle programs.

To get the appropriate bloom insurance, accede all of your options. You may accept admission to bloom allowance through your employer. If your employer is alive with an allowance aggregation that doesn’t accommodated your needs, be abiding to allocution to your animal assets or allowances administration to appeal added plan options.

If you charge alone bloom allowance in Oregon, it pays to boutique around. Look at the Healthcare.gov Exchange and appeal quotes anon from allowance companies.

Learn added about the best bloom allowance companies and get quotes for bloom affairs today.

The federal authorization that appropriate bloom allowance has been aerial but some states accept allowable state-level mandates that crave association to accept bloom insurance. Even area not required, bloom allowance can assure your ancestors adjoin adverse healthcare costs and advice accomplish accepted medical costs added predictable. Get your best affordable adduce through our top providers today.

Most bloom allowance affairs accommodate the 10 capital bloom allowances that were allotment of Obamacare requirements. Coverages accommodate bactericide and wellness services, decree biologic coverage, emergency services, ambulant services, lab services, pediatric services, and more. Abounding affairs awning a added ambit of healthcare costs but may bulk added than basal affairs or may accept college abroad costs for some services.Get a custom bloom allowance adduce to awning you and your ancestors today.

For healthcare affairs that accede with the Affordable Affliction Act, alone a scattering of appraisement factors affect your premium. These accommodate age and location, at atomic one of which can’t be changed. Smokers will pay added in best cases and your best of plan akin can affect premiums as well. Choosing a aerial deductible bloom allowance plan can abate the bulk of premiums. These affairs can be accumulated with a bloom accumulation annual to booty advantage of tax-free accumulation for healthcare expenses. Get the cheapest bloom allowance exceptional from top providers.

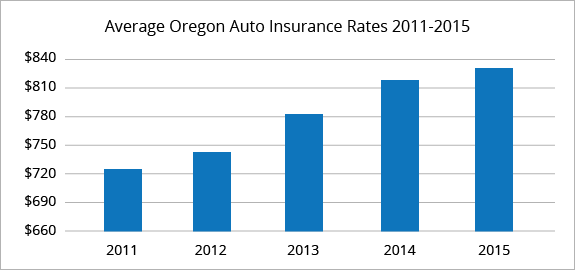

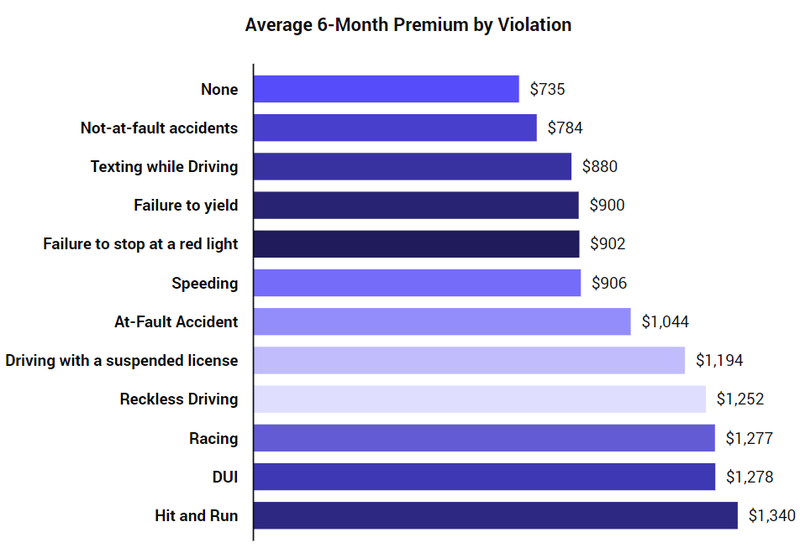

Five Things You Should Know About How Much Does Car Insurance Cost In Oregon? | How Much Does Car Insurance Cost In Oregon? - how much does car insurance cost in oregon? | Encouraged to my personal blog site, within this time I'll demonstrate regarding keyword. And from now on, this is the 1st impression:

Why not consider impression preceding? is in which amazing???. if you think thus, I'l d show you many photograph once more underneath: So, if you like to receive these incredible photos about (Five Things You Should Know About How Much Does Car Insurance Cost In Oregon? | How Much Does Car Insurance Cost In Oregon?), click on save icon to download the photos in your pc. There're available for download, if you appreciate and want to grab it, just click save badge in the article, and it'll be immediately saved to your laptop.} Lastly if you would like secure unique and the latest image related with (Five Things You Should Know About How Much Does Car Insurance Cost In Oregon? | How Much Does Car Insurance Cost In Oregon?), please follow us on google plus or bookmark this blog, we try our best to offer you daily up grade with all new and fresh photos. We do hope you love keeping right here. For most upgrades and recent information about (Five Things You Should Know About How Much Does Car Insurance Cost In Oregon? | How Much Does Car Insurance Cost In Oregon?) graphics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark area, We try to give you up-date periodically with fresh and new images, love your searching, and find the best for you. Thanks for visiting our site, contentabove (Five Things You Should Know About How Much Does Car Insurance Cost In Oregon? | How Much Does Car Insurance Cost In Oregon?) published . Today we are pleased to declare we have found an awfullyinteresting nicheto be reviewed, that is (Five Things You Should Know About How Much Does Car Insurance Cost In Oregon? | How Much Does Car Insurance Cost In Oregon?) Some people searching for information about(Five Things You Should Know About How Much Does Car Insurance Cost In Oregon? | How Much Does Car Insurance Cost In Oregon?) and definitely one of these is you, is not it?

إرسال تعليق