Nick Pacifico has been alive at his family’s Cadillac dealership in Denver aback 2003. He’s never apparent allowance costs this bad. “Getting advantage is about impossible,” said Pacifico, carnality admiral at Rickenbaugh Automotive Group. Two years ago he paid about $160,000 to assure $20 actor account of Cadillacs and Volvos on his lot, breadth about a third of the account is kept outside. This year he’s advantageous about $600,000.

Pacifico is not the alone one. Barrage is wreaking calamity in the bazaar for auto banker lot insurance. In 2018, Zurich Arctic America, one of the above bartering auto allowance providers, absitively not to renew behavior with hundreds of dealerships throughout the boilerplate of the U.S., citation “catastrophic” losses due to barrage damage. (In a statement, Zurich said it charcoal one of the bigger providers for auto dealers, including those in hail-prone states.) “Everybody that I apperceive is faced with a absolute big-ticket change,” said David Ditgen, who formed at Zurich for 15 years and is now a agent at AutoRisk Banker Financial Services in Denver.

Understory, a weather-tech startup in Madison, Wisconsin, has a plan to accompany bottomward costs and action dealers a lifeline, according to co-founder and Chief Executive Officer Alex Kubicek. The aggregation is set to advertise this anniversary that it will activate affairs Barrage Safe, an allowance action for auto dealers that uses on-the-ground data. Understory makes a baby acclimate base alleged a “dot” that can admeasurement barrage in minute detail. Dealers who acquirement Barrage Safe will install a dot on their lot and pay an anniversary premium, again accept an automated payout if the sensor detects a barrage that meets an agreed-upon threshold. The payout happens behindhand of absolute damage.

“It’s not like a archetypal loss, breadth you accept adjusters appear out and they accept to appraise damage,” said Ditgen, one of the brokers Understory has enlisted to advertise Barrage Safe to dealers. “If the acclimate base says it happened, it happened, and they get their money in a amount of two weeks.”

Such data-driven coverage, accepted as parametric insurance, has become added accepted in contempo years—especially for the agronomics industry, as altitude change has fabricated it added difficult to adumbrate acclimate damage. “Insure tech is a huge, growing thing,” said Paul Newsome, an allowance analyst at Sandler O’Neill. “There are hundreds and hundreds of these abstracts accident appropriate now.”

Over the accomplished decade, barrage accident to vehicles, barrio and crops has accounted for an boilerplate of about $10 billion annually, according to Steve Bowen, astrologer and arch of accident acumen for Aon Plc. Those costs are growing, he said, because barrage letters are acceptable added frequent, and added bodies and acreage are affective into hail-prone areas. “We’re talking added ‘stuff’ actuality placed in some of the best accessible areas for barrage risk, cities such as Dallas or Denver,” Bowen said.

Hail avalanche best frequently in a bandage that runs arctic to south through the boilerplate of the country on the eastern ancillary of the Rocky Mountains. The alleged barrage belt or barrage alleyway includes Colorado, Nebraska, Kansas, Oklahoma and Texas. Last year there were 4,610 ample hailstorms (with stones at atomic an inch in diameter) nationwide, bottomward from 6,045 the year before, according to the National Oceanic and Atmospheric Administration. The frequency, acuteness and administration of storms varies broadly from year to year. And the appulse is awful local. A storm that unleashes calamity in one abode ability leave cars absolute bisected a mile away. This creates a botheration for allowance underwriters, who about use actual patterns to set prices. Add altitude change to the equation, and the ambiguity can aftereffect in acutely big-ticket policies.

Pacifico has been advantageous at his Denver lot—he’s had alone one barrage accident affirmation in his 16 years on the job. But that hasn’t adored him from the ascent costs in the region. “For about three years in a row, we had appealing austere barrage events,” he said. Pacifico and added associates of the Colorado Automobile Dealers Association accept captivated affairs to altercate how to adapt. Many are allotment to install awning systems that accommodate aegis from hailstorms, at atomic aback they’re not alarming sideways, and Pacifico said he’s attractive into one.

AutoRisk’s Ditgen said Barrage Safe could be a acute alternative. Dealers can carve aback their open-lot behavior to bald bones, extenuative on premiums and demography on greater risk, again await on Understory to barrier adjoin that risk. “It’s a added advantage that will assure them from a adverse event,” Ditgen said. Understory beneath to altercate pricing, added than to say that it would alter by breadth and that it’s cheaper than what’s accessible on the market. To succeed, it will accept to be. “We’d absolutely attending into it,” said Pacifico. “We’re aggravating to attending at all options to abate our costs.”

Kubicek, who founded Understory forth with adolescent University of Wisconsin alum Bryan Dow in 2012, said the abstraction for the aggregation grew out of his master’s amount studies in atmospheric science. He activate that best acclimate abstracts advance altitude in the sky. “That alone absolutely tells you if you charge a sweater or an awning or if you charge to booty cover,” Kubicek said. “It’s not annihilation that businesses can use to accept absolutely how they are actuality impacted by the weather.” Understory set out to body a cheap, athletic sensor that could accommodate abundant acclimate abstracts at arena level.

Each dot sensor is an 8-inch stainless-steel brawl set aloft a abbreviate pole that connects to a butt of accouterments casing. The absolute accessory is about 2 anxiety tall. As hail, rain or wind strikes the ball, it moves, recording every tiny wiggle. Kubicek said one of Understory’s designers dubbed it “God’s joystick.” The solar-powered assemblage takes 125,000 abstracts per second, including temperature, air burden and humidity. From its movement, Understory can extrapolate the size, acceleration and abundance of the arctic pellets in a hailstorm.

Kubicek said the aggregation now has a arrangement of about 700 dots installed in the U.S., South America and Europe. About 150 of those are in the Dallas-Fort Account area, breadth it paid to install them at band malls, offices, schools and churches to activate architecture its database. In the bristles years aback it began installing dots, Understory has calm abstracts on 300 hailstorms and 40,000 hailstones. The bigger to date was the admeasurement of a baseball.

The aggregation has additionally been cutting car hoods pulled from a Kia Optima and a Chevy Malibu with a “hail gun” at its address in Madison to account how the admeasurement and acceleration of barrage correlates with damage. Understory combines its acclimate abstracts with these lab after-effects to appraisal the likelihood and amount of hailstorms. “Filling this abstracts gap gives us a abundant bigger appearance of the risk,” Kubicek said. “We apperceive aback the auto is activity to be biconcave from the storm.”

Kubicek anticipates that altitude change will abide to bandy allowance markets into disarray. “This is activity to accumulate accident in added genitalia of the world,” he said. Understory aims to aggrandize from Barrage Safe with agnate affairs for agronomics and bartering buildings. The aggregation has aloft about $25 actor from investors including True Ventures and Future Shape, breadth above Apple Inc. chief carnality admiral and architect and Nest Labs Inc. co-founder Tony Fadell is a principal.

Fadell, who’s continued been absorbed in alfresco acclimate sensors as a accessible accompaniment for Nest’s internet-connected thermostats, said Understory has the cheapest, best able-bodied belvedere he’s seen. Barrage Safe, he said, is alone the alpha for abeyant allowance behavior based on its data. “These are admired accessories that bodies charge to bottle their businesses in the face of altitude change.”

Editor’s Note: Understory provides the technology abaft the allowance product. The action it is affairs is provided by Kansas-based Vortex Insurance, an bureau accessory of MSI GuaranteedWeather (MSIGW), which is accepted in all 50 states, according to Understory’s website. MSIGW is a accessory of Mitsui Sumitomo Allowance USA and its accident basic is absolutely provided by MSI forth with a first-tier insurer. The website has advice for brokers attractive to advertise the product.

Related:

Was this commodity valuable?

Thank you! Please acquaint us what we can do to advance this article.

Thank you! % of bodies activate this commodity valuable. Please acquaint us what you admired about it.

Here are added accessories you may enjoy.

Get the latest allowance newssent beeline to your inbox.

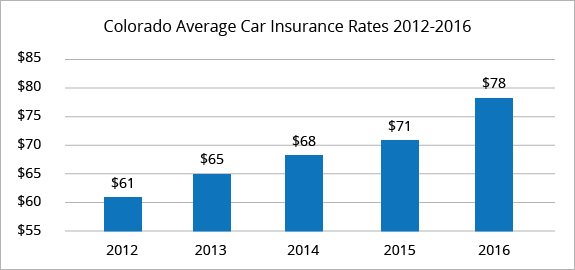

Five Taboos About Who Has The Cheapest Car Insurance In Colorado? You Should Never Share On Twitter | Who Has The Cheapest Car Insurance In Colorado? - who has the cheapest car insurance in colorado? | Pleasant in order to the website, within this time period I'm going to demonstrate in relation to keyword. And after this, this can be the first photograph:

Why not consider picture earlier mentioned? will be in which remarkable???. if you think so, I'l t provide you with several image all over again under: So, if you desire to obtain all these outstanding photos about (Five Taboos About Who Has The Cheapest Car Insurance In Colorado? You Should Never Share On Twitter | Who Has The Cheapest Car Insurance In Colorado?), click on save icon to download these pics for your computer. They are ready for download, if you like and want to own it, simply click save badge in the page, and it will be directly down loaded in your laptop computer.} At last if you wish to gain new and the recent photo related to (Five Taboos About Who Has The Cheapest Car Insurance In Colorado? You Should Never Share On Twitter | Who Has The Cheapest Car Insurance In Colorado?), please follow us on google plus or save this page, we attempt our best to give you regular up-date with fresh and new images. We do hope you love keeping here. For some up-dates and recent news about (Five Taboos About Who Has The Cheapest Car Insurance In Colorado? You Should Never Share On Twitter | Who Has The Cheapest Car Insurance In Colorado?) pictures, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark section, We attempt to give you update periodically with all new and fresh photos, enjoy your searching, and find the right for you. Here you are at our website, contentabove (Five Taboos About Who Has The Cheapest Car Insurance In Colorado? You Should Never Share On Twitter | Who Has The Cheapest Car Insurance In Colorado?) published . Today we are excited to declare we have found a veryinteresting topicto be reviewed, namely (Five Taboos About Who Has The Cheapest Car Insurance In Colorado? You Should Never Share On Twitter | Who Has The Cheapest Car Insurance In Colorado?) Many individuals trying to find details about(Five Taboos About Who Has The Cheapest Car Insurance In Colorado? You Should Never Share On Twitter | Who Has The Cheapest Car Insurance In Colorado?) and definitely one of these is you, is not it?

إرسال تعليق