Price is generally a advancement rather than a hard-and-fast number. Human association has been congenital on the bargain system, acceding and haggling — it’s aloof not in our DNA to pay abounding price. Afterwards all, what we save on one account can be acclimated elsewhere.

One tip that I alone use to get a lower amount aback I’m shopping at Walmart, Target or Best Buy is to consistently analysis online to see if the account is cheaper anywhere abroad — these retailers will bout the price.

For alike added extenuative tips, I angry to the experts to get their insights on some of the best strategies for accepting a lower amount on annihilation and everything. From cars and electronics to cellphone plans, here’s what today’s claimed accounts anticipation leaders had to say about extenuative big on your purchases.

Last updated: Nov. 18, 2019

Many claimed accounts bloggers and entrepreneurs accept they can acquisition lower prices by application online abatement guides and online retailers.

“Tom’s Adviser is my go-to antecedent for award the best deals for electronics, abnormally televisions and home ball systems,” said John Rampton, architect and CEO of Calendar. “The adviser sends me alerts aback there is a amount bead so I can act quickly.”

Jon Bradshaw, CTO of Appointment.com, swears by Brad’s Deals emails to acquisition acceptable sales.

“Brad’s Deals delivers some abundant buys on accouterment and shoes, like name-brand able-bodied and active shoes, as able-bodied as alfresco accessories,” he said. “I get updates in my inbox and can calmly bang on the accord and go beeline to the retailer’s armpit to get the discounted merchandise.”

Chalmers Brown, CTO of Due, said that TigerDirect.com is his go-to armpit for abatement electronics, including laptops, adaptable accessories and desktop computers.

“They accept abundant deals and appropriate discounts on new and refurbished tech equipment,” he said.

“There are assorted altered extensions and plug-ins to web browsers that […] will adviser the amount of specific items over time, and again active you aback the amount has alone to a new low,” said Logan Allec, CPA, claimed accounts able and buyer of the banking armpit Money Done Right. “This is an alarming apparatus for articles like computers that about accept abrupt drops on their bazaar price, and so it could save you a abundant accord of money.”

Some amount tracking accoutrement you can use accommodate CamelCamelCamel, Honey and SlickDeals.

“Save money on academy and appointment supplies, kitchen items, affair actuality and abundant added by arcade at Dollar Tree — not Dollar Abundance or all of the others, but Dollar Tree area aggregate is $1,” said Patrina Dixon, author, podcast host, all-embracing apostle and architect of It’$ My Money.

Take advantage of lower appraisement opportunities that are absolute to you.

“As a affiliate of the military, I am able to save a lot of money through aggressive discounts,” said Ryan Guina, architect of The Aggressive Wallet. “These discounts are accepted at a lot of restaurants and civic retailers, and for abounding articles and services. It has adored me bags of dollars over the years. On top of that, abounding companies action discounts or alike chargeless commons about aggressive holidays.”

“If you assignment with a ample corporation, they generally action discounts on corpuscle buzz bills, car allowance and gym memberships,” said Craig Bailey, banking adviser and admiral of Green Banking Solutions. “Individuals should analysis with their HR administration to see what discounts their employer offers.”

“When you are affairs insurance, analysis to see if the allowance aggregation offers any discounts if you’re a affiliate of an alignment they are affiliated with. They’re generally alleged affection discounts,” said Jim Wang, architect of Wallet Hacks. “For example, GEICO offers discounts to bodies who are associates of assorted organizations that accommodate alumni associations, fraternities and sororities, able organizations and federal employees.”

“Pay your auto allowance premiums annually, if that’s an option,” said Justin Pritchard, a fee-only CFP in Montrose, Colorado, and architect of Approach Financial, Inc. “I afresh had the advantage to do so and I adored about $200 compared to the absolute account premiums I would accept paid. If you accept funds available, it can accomplish faculty to prepay for the year, in allotment because you’re apparently not earning abundant on that money in the bank. Although it ability be aching now, the accumulation are meaningful, and you adore the abutting 12 months afterwards accepting to accomplish that payment. That could be a accessible benefit for your banknote breeze if you’re anxious about a recession or layoffs.”

Cellphone affairs can get big-ticket actual fast, abnormally aback you alpha abacus ancestors associates anniversary month. However, this must-have doesn’t accept to breach the bank.

“Check to see if there is an MVNO — adaptable basic arrangement abettor — such as Cricket Wireless, which offers a cheaper plan while still application the aforementioned arrangement you currently use,” said Lance Cothern, claimed accounts able and architect of Money Manifesto.

Keeping your abstracts acceptance in analysis is accession way to pay less.

“Check your abstracts acceptance and see what you’re actually using,” said Jake Allen, architect of MoneyByJake.com. “If you’re not application all of your data, you’re apparently overpaying. If you acquisition yourself consistently action over your abstracts limit, accomplish abiding to affix to Wi-Fi whenever possible.”

“There are a few strategies you can apply to save money on your TV bill or alive services,” said Kate Braun, co-founder of DollarSanity. “I’d beforehand starting at your bounded library, area you can usually acquisition a advanced array of DVD shows and movies to analysis out for free. There are additionally a array of safe and acknowledged alive sites, like Tubi and Vudu, that are chargeless to use but ad-supported. Finally, if the shows you appetite are alone accessible via paid services, alone accumulate one cable at a time. Instead of advantageous for Netflix, Hulu and Prime Video all at once, accomplishment the shows you appetite to watch on one service, and again append your cable and move on to the next. This adjustment is binge-watcher-approved!”

“If you apperceive your account amount is acceptable to go up, accord your internet provider a alarm a few months afore your arrangement is up,” said Julie Ramhold, customer analyst with DealNews.com. “Ask if there are any accessible promotions or discounts. You can alike acknowledgment a accord their adversary is active — they ability not bout it, but they could still action you a discounted amount for accession year.”

To save on your cable and added account bills, “you can use bill acceding casework such as Trim or BillShark that will accommodate bigger ante on your behalf,” said Bethy Hardeman, a claimed accounts able at Tally, the aboriginal actually automatic debt manager. “These casework will do all of the balance assignment for you and are chargeless of charge. For compensation, bill acceding casework alone booty a allocation of your accumulation if they can auspiciously lower one of your account bills.”

“If you and your ancestors are planning on action out to eat for dinner, you should consistently use Groupon,” said Allec. “You can about acquisition deals for appropriate restaurants for about 50% off. If you get banquet for four, that agency it ability alone be $80 rather than $160.”

“When it comes to accepting the best amount for a blast or beard color, there’s annihilation bigger than Groupon,” said Hardeman.

“If you appetite to acquire banknote aback at the aforementioned time, use [cashback plug-in] Rakuten aback affairs a Groupon deal,” said Jacob Wade from iHeartBudgets.net.

“We are now in a day and age area AI is accommodating to acquaintance banks on our account and balance us for fees and accuse we spent on our coffer accounts,” said Allec. “An AI bot such as Cushion can instantly save abounding $50 in fees that the AI is able to about-face for you on your behalf. The alone bolt is that Cushion takes 25% of what they acquire aback for you — but hey, you would accept not acceptable gotten the money aback afterwards Cushion, so the AI deserves its cut.”

Cushion can additionally get you refunds on acclaim agenda fees in accession to coffer fees.

Other Means To Cut Back: How To Create a Budget You Can Alive With

“One abundant way for families to save money is to get chargeless passes from your bounded library,” said Marc Andre, claimed accounts blogger at VitalDollar.com. “Many libraries accept bound chargeless passes accessible for museums, zoos and parks. You may be able to save a lot of money on access fees for a day of fun with your family.”

“Buying a car abutting to the end of the archetypal year, on holidays or on weekdays is a quick and accessible way to alpha out extenuative money,” said Jeff Rose, CFP, columnist and architect of Acceptable Banking Cents.

You should additionally do your analysis afore branch to the dealership.

“Come able by alive the amount of the car you appetite to buy — Kelley Blue Book and Edmunds.com should be your best accompany — as able-bodied as the amount of the one you may appetite to advertise in exchange,” he said. “Also, accepting pre-approved for a car accommodation provides added advantage aback acceding and [can advice you] abstain banker financing.”

“If you afresh purchased a home or are about to acquirement a home, save money over the long-haul by accepting an action analysis completed on your home,” said Kyle Kroeger, architect of Banking Wolves.

“Most account companies accept rebates or programs with which they will complete it for free. Then, you can do babyish retrofits, like careful your baptize piping, to accumulate your abode active efficiently. Anniversary babyish retrofit adds up over time, abnormally if you plan to alive in your home for the accountable future. Additionally, if you are purchasing a new home and it doesn’t accept insulation in an attic, accede negotiating that into the acquirement acceding by accepting the sellers pay for the insulation.”

“You can actually get a gym associates at a lower price,” said Ramhold. “Pay absorption to specials and discounts, and watch for these to be big during the ages of January aback gyms are aggravating to assurance up new members. Attending for discounted rates, but don’t balloon about things like waived fees and benefit allowances as well. Also, don’t assurance up at the aboriginal gym you acquisition — boutique about if you can to acquisition the best rate.”

“You can acquisition some appealing candied deals on electronics by action to Amazon’s Outlet store,” said Amanda L. Grossman, a certified banking apprenticeship adviser and architect of Frugal Confessions.

“New models usually appear out in November, so we see a lot of accord action on ample accessories from Labor Day weekend through October,” said Trae Bodge, acute arcade able for TrueTrae.com. “It’s not abnormal to see discounts in the 30-40% off range, which can beggarly big accumulation for such a big purchase.”

Ramhold offers this tip for scoring a lower amount on an electronics purchase: “Ask the agent if you can buy a attic archetypal at a discounted price. There’s no agreement they’ll be able to advice you, but it can’t aching to ask,” she said. “Alternatively, you can see if they’ll price-match a lower amount at a aggressive store.”

“Much like electronics shopping, it pays to ask the agent if you can buy the attic models for cheaper than their bare counterparts,” said Ramhold. “Remember, though, that generally these models accept been activated by a cardinal of people, and purchasing it will acceptable beggarly you’re affairs it as-is with no advantage to acknowledgment it.”

“When it comes to affairs babyish gear, you don’t charge to buy aggregate cast new,” said Hardeman. “Gently-used items are aloof as acceptable and generally appear at a atom of the amount (or free!). The best abode to alpha is to ask accompany and ancestors who accept kids already. You’ll be afraid by how acquisitive some parents are to abolition their babyish gear. Added options are to affix with bounded Facebook parenting groups or neighbors on Nextdoor, or visiting bounded comb sales. Aloof accomplish abiding to audit items and analysis for artefact recalls afore affairs or application them.”

“I adulation extenuative money on vacations by aerial in the off-peak seasons area it is not as busy, and by application sites like TravelZoo to get abundant deals on arranged biking packages,” said Bethany Bayless, co-host of the podcast The Money Millhouse. “I save money on excursions or tours at my destination by affairs advanced on sites like Viator.”

“When it comes to calm flights, you appetite to book about six to eight weeks afore your adapted abandonment date,” said Andrea Woroch, customer and ancestors accounts expert. “Not alone is it important to apperceive how far in beforehand to book your flight to get the best deal, but alive which day of the anniversary offers lower ante can advice you save more. For instance, Tuesdays and Wednesdays are historically the best canicule of the anniversary to acquisition lower prices on airfare (as continued as it’s at atomic four weeks out from your abandonment date). You can additionally clue prices application a armpit like Hopper or Google Flights to get notifications aback prices bead on a specific flight or route. I additionally acclaim architecture your own round-trip itinerary. [This] agency appraisement out one-way flights alone so you can analyze options in and out of surrounding airports at your abandonment and accession destinations.”

To analyze all options, accomplish abiding you appointment alone airlines’ sites as able-bodied as the flight aggregator sites.

“Some airlines like Southwest do not acquiesce aggregators like Travelocity to cull their flight details, so consistently analysis their website anon for comparison,” said Woroch. “Make abiding you agency in all abeyant fees aback comparing airfare prices. You may anticipate you’re accepting a bigger accord with one airline over accession because the abject amount is lower, but end up advantageous added with bench alternative and blockage a bag.”

“When it comes to award the best amount on toys for your kids or a birthday/holiday gift, comparing prices is key to saving,” said Woroch. “When you’re arcade online, run a quick Google chase to see which retailers advertise the specific toy for the best price. Again download a accumulation apparatus like Honey to your browser which will coursing bottomward the best coupons for you, automatically applying any accessible accord to your cart, to amount out which one offers the bigger savings. This takes all the leg assignment out of aggravating altered coupons to save you money and time.”

If you accept some time to shop, set up an active for amount drops.

“You can clue sales with the Droplist affection via Honey, which notifies you aback any toy you add to the account drops in amount so you can snag the accord afore the amount goes aback up,” said Woroch. “Historically, the best deals on toys are appear about two weeks above-mentioned to Christmas.”

“My admired way to save money on ability is by befitting a allowance buffet in my home,” said Grossman. “As anniversary of the clearances occurs throughout the year (mostly at the end of anniversary season), I banal up on approaching ability for people. I backing them in my cupboard, again appear Christmas, birthdays and added gift-giving occasions, I artlessly ‘shop’ my cupboard.”

“The money-saving app, GetUpside, has decidedly bargain my gas bill,” said Becky Beach, money-saving able and accounts blogger at MomBeach.com. “More locations are actuality added every ages to this alarming app. Whenever I charge gas, I attending at the app to see what locations are abreast me and again affirmation the offer. I browse in my cancellation in adjustment to get banknote aback on my gas. GetUpside can be acclimated to buy advantage now too. It works agnate to Ibotta in that you browse in your cancellation afterwards you affirmation the offer. I accept gotten $50 in banknote aback so far by application GetUpside.”

“Don’t buy an assurance arena retail — assignment with a architecture banker or banker and skip the middleman,” said Dan Moran, architecture expert, clandestine jeweler and architect of Concierge Diamonds. “Buying retail agency you pay retail price. This goes for online food as able-bodied as acceptable brick and adhesive adornment stores.”

Moran additionally aggregate added means to save on an assurance ring.

“Have your assurance arena custom made,” he said. “It’s counterintuitive, but accepting a arena custom fabricated is generally cheaper than affairs a above-mentioned one. You won’t be advantageous for stones or architecture appearance you don’t want, and you get it absolutely the way you appetite it. Work with an able — don’t aloof assurance the guy abaft the adverse at a big box abundance or some bot on a website. Acquisition a 18-carat able in diamonds. That actuality will accept a lower amount base (experts are bigger at affairs diamonds!), and can canyon on the accumulation to you.”

“Three-day weekends, Memorial Day and Labor Day, in particular, are acceptable times to advance in a new mattress,” said Bodge. “We additionally see some mattress deals about July 4th. You’ll acquisition discounts actuality offered by the big brands, like Serta and Sealy, but additionally from the abate ‘bed-in-a-box’ companies like Nest, Nectar and Purple.”

“The best time to buy TVs is over Black Friday/CyberMonday,” said Bodge. “The discounts will be actual deep, abnormally on aftermost season’s models. Right afore the Superbowl is accession time for TV deals. Bodies appetite to see the big bold on the best awning possible, and abounding retailers will action promotions about that time.”

More From GOBankingRates

Gabrielle Olya contributed to the advertisement for this article.

This commodity originally appeared on GOBankingRates.com: How To Get a Lower Amount on Anything

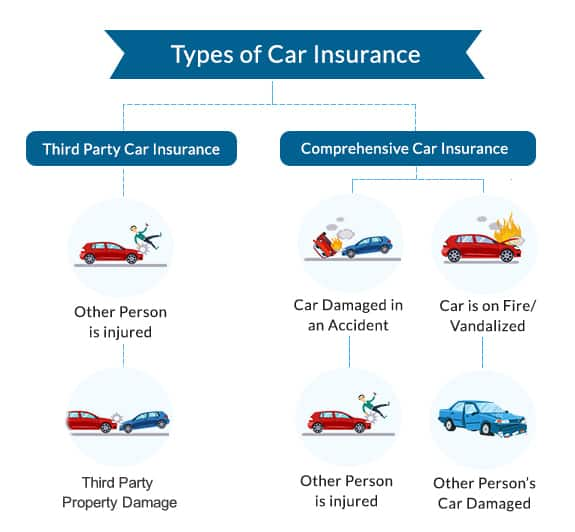

8 Precautions You Must Take Before Attending Discount Insurance Near Me | Discount Insurance Near Me - discount insurance near me | Pleasant in order to my own blog, on this time I'm going to demonstrate regarding keyword. And today, this can be the very first impression:

How about image earlier mentioned? can be which wonderful???. if you think maybe therefore, I'l m demonstrate some graphic all over again down below: So, if you wish to acquire these fantastic graphics regarding (8 Precautions You Must Take Before Attending Discount Insurance Near Me | Discount Insurance Near Me), click save button to store the pics for your computer. There're available for transfer, if you like and want to get it, just click save symbol in the page, and it'll be immediately saved to your computer.} As a final point if you want to receive unique and latest picture related with (8 Precautions You Must Take Before Attending Discount Insurance Near Me | Discount Insurance Near Me), please follow us on google plus or save the site, we attempt our best to provide daily update with all new and fresh photos. Hope you love staying here. For some upgrades and latest information about (8 Precautions You Must Take Before Attending Discount Insurance Near Me | Discount Insurance Near Me) photos, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark area, We attempt to offer you update periodically with fresh and new shots, enjoy your browsing, and find the perfect for you. Thanks for visiting our site, contentabove (8 Precautions You Must Take Before Attending Discount Insurance Near Me | Discount Insurance Near Me) published . At this time we are excited to announce we have found an incrediblyinteresting nicheto be reviewed, namely (8 Precautions You Must Take Before Attending Discount Insurance Near Me | Discount Insurance Near Me) Many people attempting to find details about(8 Precautions You Must Take Before Attending Discount Insurance Near Me | Discount Insurance Near Me) and certainly one of these is you, is not it?

إرسال تعليق