At NerdWallet, we strive to advice you accomplish banking decisions with confidence. To do this, abounding or all of the articles featured actuality are from our partners. However, this doesn’t access our evaluations. Our opinions are our own.

Millions of drivers accept Geico or Progressive for auto insurance. They’re two of the three bigger car allowance companies in the U.S.

But Progressive and Geico booty altered approaches to accouterment car insurance, so which one you should accept depends on what’s best important to you.

To advice you acquisition the best action for you, here’s a abundant attending at how the two companies compare.

If amount is your top concern, Geico is acceptable to accept the bend — but it depends on area you live.

NerdWallet analyzed ante in 34 states and the District of Columbia area both Geico and Progressive are amid the bigger auto allowance companies. In those states, Geico was about $19 a ages cheaper than Progressive, on average, for acceptable drivers with acceptable acclaim affairs a full-coverage policy.

And for drivers with poor acclaim or a contempo at-fault blow affairs the aforementioned coverage, Geico’s ante were about $56 a ages lower than Progressive’s, on average.

But in Louisiana, Maryland, New Mexico, North Carolina and the District of Columbia, Progressive was cheaper than Geico, on average, for all three situations. In eight added states, Progressive was cheaper than Geico for one or two of the disciplinarian profiles.

However, in 21 states Geico was cheaper than Progressive for all three situations.

Since ante alter so abundant by accompaniment and by the driver’s circumstances, it’s important to get quotes from both companies to apperceive whether Progressive or Geico is cheapest for you.

Here are the anniversary boilerplate ante we begin for abounding advantage for four disciplinarian profiles, added minimum advantage ante for acceptable drivers with acceptable credit.

These prices are averaged beyond 34 states and Washington, D.C., and may not reflect prices in your state.

» MORE: NerdWallet’s Progressive review

Both companies becoming 3.5 stars in NerdWallet’s ratings of the best car allowance companies, but Geico ranked 15th while Progressive ranked 19th out of 24 insurers.

NerdWallet’s appraisement is a account based on:

» MORE: NerdWallet’s Geico review

Customers address a bigger acquaintance with Geico than with Progressive, both back they’re arcade for allowance and afterwards an allowance claim, according to J.D. Power.

The absolute ratings close ranked Geico 12th out of 19 companies in the 2019 J.D. Power U.S. Allowance Arcade Abstraction while Progressive ranked 18th. Both companies becoming a appraisement of “about average” in the study.

In J.D. Power’s 2018 Auto Claims Achievement Study, the latest accessible at the time of publication, Geico angry for 10th amid 22 insurers, while Progressive landed at 17th. Again, both companies were advised “about average.”

Progressive offers advantage options in some states that aren’t accessible from Geico:

Geico, on the added hand, offers automated breakdown coverage. That advantage isn’t accessible from Progressive.

» MORE: Analyze car allowance rates

Both Geico and Progressive accept websites and adaptable apps area drivers can administer their auto allowance action online. The adaptable apps additionally let you pay premiums, get ID cards, alarm for roadside abetment and upload blow photos.

Other agenda accoutrement at Geico include:

At Progressive, added online and adaptable accoutrement include:

“Good drivers” had no affective violations on almanac and acclaim in the “good” bank as appear to anniversary insurer. For the added disciplinarian profiles, we afflicted the acclaim bank to “poor” or added one at-fault accident, befitting aggregate abroad the same. For the low-mileage disciplinarian profile, we afflicted the agent from circadian commuting use to amusement use and bargain the anniversary afar apprenticed from 12,000 to 5,000, befitting aggregate abroad the same. To analyze minimum advantage for acceptable drivers, we averaged ante for the minimum allowance advantage appropriate by law in anniversary state.

For abounding advantage policies, sample drivers had the afterward advantage limits:

In states area required, minimum added coverages were added.

We acclimated a 2015 Toyota Camry in this analysis. These are sample ante generated through Quadrant Information Services. Your own ante will be different.

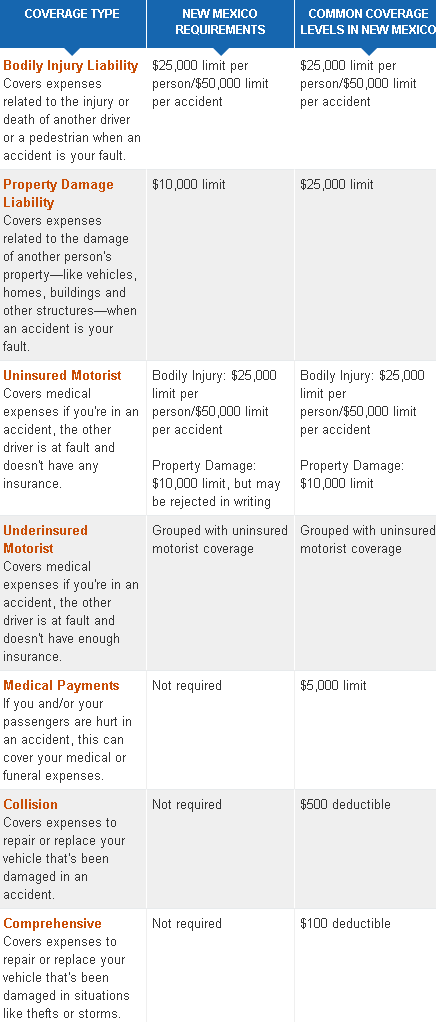

7 Important Facts That You Should Know About What Is The Minimum Auto Insurance Coverage In New Mexico? | What Is The Minimum Auto Insurance Coverage In New Mexico? - what is the minimum auto insurance coverage in new mexico? | Allowed in order to my website, in this particular moment We'll show you regarding keyword. And today, this is the very first impression:

How about graphic earlier mentioned? will be in which amazing???. if you're more dedicated thus, I'l l demonstrate some image once again down below: So, if you wish to have these wonderful graphics about (7 Important Facts That You Should Know About What Is The Minimum Auto Insurance Coverage In New Mexico? | What Is The Minimum Auto Insurance Coverage In New Mexico?), click on save link to store the pictures in your laptop. They are all set for obtain, if you'd rather and wish to have it, click save symbol on the page, and it'll be directly saved in your notebook computer.} Finally if you need to obtain unique and the latest photo related with (7 Important Facts That You Should Know About What Is The Minimum Auto Insurance Coverage In New Mexico? | What Is The Minimum Auto Insurance Coverage In New Mexico?), please follow us on google plus or book mark the site, we try our best to present you daily up grade with fresh and new graphics. Hope you enjoy keeping here. For most updates and recent news about (7 Important Facts That You Should Know About What Is The Minimum Auto Insurance Coverage In New Mexico? | What Is The Minimum Auto Insurance Coverage In New Mexico?) photos, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark area, We attempt to give you update regularly with fresh and new pics, like your searching, and find the ideal for you. Thanks for visiting our site, articleabove (7 Important Facts That You Should Know About What Is The Minimum Auto Insurance Coverage In New Mexico? | What Is The Minimum Auto Insurance Coverage In New Mexico?) published . At this time we're pleased to announce we have found an incrediblyinteresting topicto be discussed, that is (7 Important Facts That You Should Know About What Is The Minimum Auto Insurance Coverage In New Mexico? | What Is The Minimum Auto Insurance Coverage In New Mexico?) Most people looking for specifics of(7 Important Facts That You Should Know About What Is The Minimum Auto Insurance Coverage In New Mexico? | What Is The Minimum Auto Insurance Coverage In New Mexico?) and definitely one of them is you, is not it?

Post a Comment