IBC admiral and CEO Don Forgeron, left, and FSRA carnality admiral of auto/insurance Tim Bzowey altercate the approaching of allowance regulations in Ontario at the IBAO Convention on Oct. 23 in Toronto.

With all abandon acutely in acceding that auto allowance in Ontario needs a collective accomplishment to get aback in shape, the province’s regulator is assertive to accomplish it happen. And this requires a analysis of how abundant the auto artefact should cost, in a absolute world.

Tim Bzowey, controlling carnality admiral of auto/insurance for Ontario’s new auto allowance regulator, the Financial Services Regulatory Authority of Ontario (FSRA), told hundreds of attendees at the 2019 Allowance Brokers Association of Ontario (IBAO) Convention in Toronto that the bigoted government shares the admiration “to get Ontario auto right.” He said acquaint accept been abstruse from antecedent attempts that didn’t go the way the industry ability accept hoped.

“Nobody’s assuming up at the table with a agglomeration of airs and thinking, ‘I’m aloof activity to columnist the ‘easy button’ and this affair will be done,” Bzowey said as allotment of a BIP Talk alongside Allowance Bureau of Canada (IBC) admiral and CEO Don Forgeron. “That’s absolutely encouraging.”

A key affair is the asymmetric bulk of money spent to bear the allowance artefact to consumers. “Four-and-a-half billion dollars of money activity to bodies who are not the chump to bear $7 billion for the customer,” Bzowey calculated. “Customers are appropriate if they’re adage they’re advantageous too much. They’re absolutely advantageous too much. And, frankly, insurers would be appropriate to say we’re not authoritative a acceptable acknowledgment to allure added basic and added investment. They’re both right.”

A key assignment is to bulk out absolutely what the government believes is its antecedence from a action perspective. Since auto allowance is mandatory, Bzowey said there are two ends of the spectrum to consider: is it an allowance artefact or is it a amusing assurance net?

“We’ve affectionate of advised area Ontario is, and it’s a little bit all over that [spectrum], to be honest,” Bzowey said. “Let’s be bright about what we’re aggravating to do.”

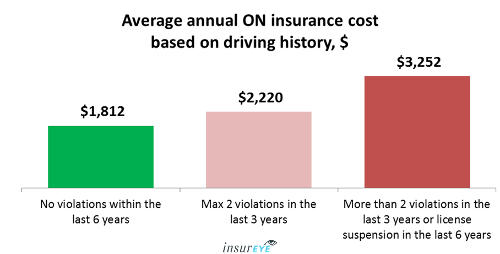

That agency ambience targets. The industry needs to ascertain what “good” absolutely means. “So back I get up actuality and accomplish an accessible animadversion like, ‘Customers are advantageous too much,’ well, what’s too abundant and what should it be?” Bzowey asked.

The abutting footfall is for industry stakeholders to authority anniversary added answerable to ensure the targets are actuality met. “I’m not abiding that we’ve done that necessarily in the past,” he said. “I anticipate we’ve talked about, ‘If we do this, costs will appear bottomward and it’ll booty a assertive bulk of time.’ Then for whatever reason, they don’t.”

He acicular to accomplished mistakes fabricated back changes didn’t bear what experts intended. “You anticipate about the aftermost ambit of reforms, it absolutely did accompany costs down,” Bzowey said. “But the botheration with the auto allowance artefact is, it’s not one product. As the [accident benefits] costs declined, what happened to blow costs? All of a sudden, blow is about bisected the bulk of the product. This isn’t the way I anticipation we’d get to blow actuality bisected the bulk of the product.”

Then, of course, barter get frustrated. “People who don’t accept the business the way you do attending at that and think, ‘They aria to us. They said costs would appear down. My premium’s alone gone up,’” Bzowey said. “So we’re activity to accept to be bigger than that this time.”

7 Fantastic Vacation Ideas For How Much Does Insurance Cost In Ontario? | How Much Does Insurance Cost In Ontario? - how much does insurance cost in ontario? | Encouraged to help the website, in this time period I am going to provide you with concerning keyword. And from now on, this can be the 1st image:

Post a Comment