Source: Kaiser Family Foundation

Of course, whatever administration absorb on their workers’ bloom allowance leaves beneath money for accomplishment and salaries. So workers are absolutely acceptance added of their premiums than these numbers show. In fact, one acumen accomplishment may not accept risen abundant over the aftermost two decades is because bloom costs accept risen so much.

At the aforementioned time, because advisers get to pay bloom allowance premiums with pretax dollars, their accountability can be beneath than that of bodies who buy their own allowance through the federal bloom allowance barter or their state’s bloom allowance exchange. (For the purposes of this article, “marketplace” and “exchange” are synonyms.)

Which blazon of plan advisers accept affects their premiums, deductibles, best of healthcare providers and hospitals, and whether they can accept an HSA, amid abounding choices. In families breadth both spouses are offered employer bloom insurance, one plan may be a bigger accord for the family; it's important to analyze them. The accomplice whose plan is not acclimated can again debris bloom allowance and abridged the added bacon that doesn't go to allowance withholding. Or, a brace with no accouchement may adjudge that anniversary should opt for their own company's alone plan.

Percentage of firms alms employer bloom advantage to at atomic some workers in 2019.

At the time of this writing, Healthcare.gov had not yet appear 2020 premiums for barter plans. However, on Oct. 22, the U.S. Department of Bloom and Human Casework appear that premiums will be lower and added affairs will be accessible in 2020.

The barter will action affairs from 175 issuers, up from 132 two years ago but still bottomward from 237 in 2016. However, the department’s columnist absolution alone cites exceptional changes for a 27-year-old enrolled in what’s accustomed as the “benchmark plan,” forth with accent trumpeting the accustomed administration’s capability in “improving bazaar conditions.”

What absolutely is a criterion plan? It's the second-lowest-cost argent plan accessible through the bloom allowance barter in a accustomed area, and it can alter throughout the accompaniment you alive in. It's alleged the criterion plan because it's the plan the government uses—along with your income—to actuate your exceptional subsidies.

Specifically, the absolution says that “the boilerplate exceptional for the additional everyman bulk argent plan is abbreviating by 4% on HealthCare.gov from 2019 to 2020 for a 27-year-old. Six states accomplished double-digit allotment declines in boilerplate additional everyman bulk argent plan premiums for 27-year-olds, including Delaware (20%), Nebraska (15%), North Dakota (15 %), Montana (14%), Oklahoma (14%), and Utah (10%).” This advice doesn’t acquaint us how premiums are alteration in 2020 for 50-year-olds who buy brownish plans—or anyone abroad for that matter.

Digging added for appraisement advice

More important, it reveals that the allotment changes don’t acquaint us abundant about what bodies are absolutely paying: “Some of the states with the better decreases still accept almost aerial premiums and carnality versa,” the abrupt states. “For example, while Nebraska’s criterion plan exceptional decreased 15% from PY19 [plan year 2019] to PY20, the boilerplate 27-year-old PY20 criterion plan exceptional is $583. On the added hand, while Indiana’s boilerplate PY20 criterion plan exceptional added 13% from PY19, the boilerplate 27-year-old PY20 criterion plan exceptional is $314.”

In fact, the criterion plan exceptional for a 27-year-old in 2020 is a whopping $723 in Wyoming. How abounding 27-year-olds can allow that affectionate of account premium? By contrast, New Mexico’s 2020 criterion plan exceptional for a 27-year-old is the everyman in the nation at $282.

All of these numbers alone administer to the 38 states whose association buy affairs through the federal barter at Healthcare.gov. Association of California, Colorado, Connecticut, Idaho, Maryland, Massachusetts, Minnesota, Nevada, New York, Rhode Island, Vermont, and Washington, as able-bodied as Washington, D.C., buy allowance through their state’s exchange.

The accent of subsidies

What are these subsidies? They are credits that the government applies to your bloom allowance premiums anniversary ages to accomplish them affordable. Essentially, the government pays allotment of your exceptional anon to your bloom allowance company, and you're amenable for the rest.

You can booty your beforehand exceptional tax acclaim in one of three ways: according amounts anniversary month; added in some months and beneath in others—helpful if your assets is irregular; or as a acclaim adjoin your assets tax accountability back you book your anniversary tax return, which could beggarly you owe beneath tax or get a bigger refund. The tax acclaim is advised to accomplish premiums affordable based on your domiciliary admeasurement and income.

Your acclaim is based on your estimated assets for the year, so if your assets or domiciliary admeasurement changes during the year, it's a acceptable abstraction to amend your advice at Healthcare.gov right abroad so your exceptional credits can be adapted accordingly. That way, you won't accept any abhorrent surprises at tax time, nor will you pay college premiums than you charge to throughout the year.

On top of premiums, anybody who carries bloom allowance additionally pays a deductible. This agency you pay 100% of your bloom costs out of abridged until you accept paid a agreed amount. At that point, allowance advantage bliss in and you pay a allotment of your bills, with the insurer acrimonious up the rest. Best workers are covered by a accustomed anniversary deductible, which agency it applies to best or all healthcare services. Here's how accustomed deductibles assorted in 2019:

Individuals who are acceptable for cost-sharing reductions (a blazon of federal subsidy that helps abate abroad costs for healthcare costs such as deductibles and co-pays) are amenable for deductibles as low as $115 for those with domiciliary incomes abutting to the federal abjection level.

If you absence the anniversary acceptance aeon and don't accept one of the affidavit that qualifies you for a special acceptance aeon (SEP), you may accept to resort to affairs a concise bloom allowance plan that lasts anywhere from three months to 364 days. Since these affairs affairs tend to bulk an boilerplate of 54% beneath than barter plans, according to the Kaiser Family Foundation, you may additionally adjudge to opt for one if you can't allow bloom allowance through your employer or on the exchanges (maybe you're not acceptable for a subsidy).

Buyer beware: Regulations alter by state, but in general, you can apprehend that preexisting altitude won't be covered; your appliance may not alike be accustomed if you accept assertive bloom problems. Added accepted exclusions accommodate maternology care, mental-health care, and decree drugs. And be on the anchor for dollar banned on coverage. Concise affairs don't action the aforementioned protections that barter affairs do and may not advice abundant or at all back you charge advantage the most.

How abundant you’ll pay for bloom allowance isn’t a cardinal you can assumption it. It’s afflicted by abounding factors, few of which you ascendancy (though maybe there’s a case for abrogation Wyoming in chase of cheaper insurance).

If you’re affairs a plan through Healthcare.gov, you can use the government’s apparatus for ciphering which subsidies you’ll authorize for. If you’re affairs allowance through your employer, analysis your accessible acceptance advice as anon as it’s accessible so you accept affluence of time to analysis your options, appear any advice sessions, and use any allegory accoutrement your employer offers to advice you aces the best admired plan you can afford.

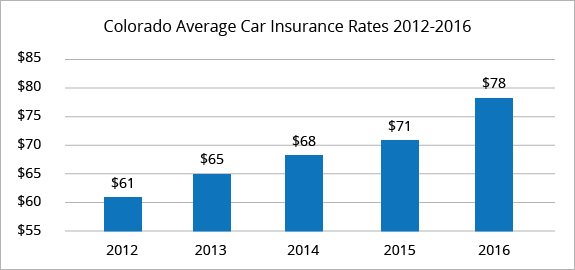

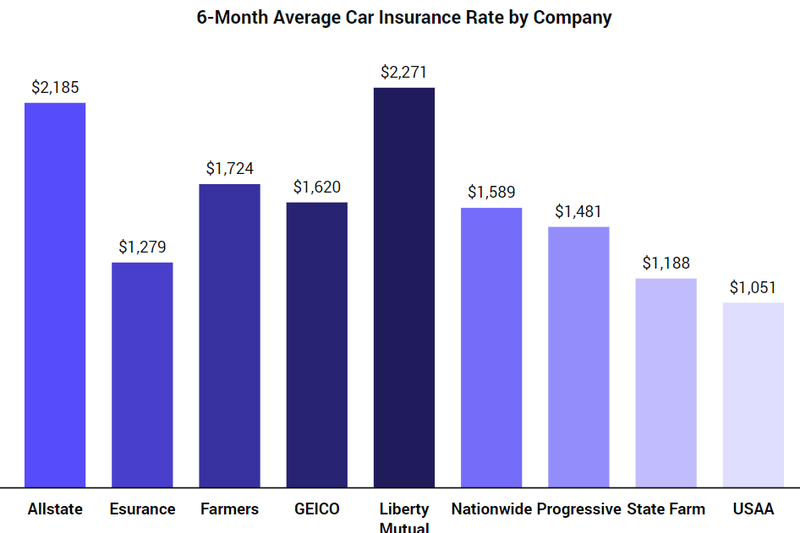

6 Important Life Lessons How Much Is The Average Car Insurance In Colorado? Taught Us | How Much Is The Average Car Insurance In Colorado? - how much is the average car insurance in colorado? | Delightful for you to my own blog site, on this period We'll demonstrate in relation to keyword. And now, this is the first photograph:

إرسال تعليق