Advertiser Disclosure

You’re apparently already accustomed with AAA as a roadside abetment company, but did you apperceive that you can get AAA car insurance, too? In fact, roadside abetment and car allowance are aloof a brace of the abundant programs and casework that AAA provides.

Most Trusted Brand

★★★★★

Get Quote

Our 5th admired provider: Offers a array of discounts and is fabricated up of bounded auto groups.

So should you aggrandize your AAA associates to accommodate car insurance? Well, as a allotment of our analysis into accepted car insurers, we did a little digging into what AAA offers. Of course, AAA auto allowance requires associates to AAA as well, but you can get that for about $50 to $100 per year. Overall, AAA car allowance associates accept acceptable adventures and can booty advantage of some allowances altered to AAA.

In this article:

AAA started as the American Automobile Affiliation in 1902. The affiliation created maps and auberge guides, as able-bodied as aerial academy active class and banal assurance programs. Today, it operates over 1,000 biking agencies, ante lodgings and restaurants, publishes bout guides, and provides discounts for associates at bags of businesses.

When we allocution about AAA car insurance, we’re absolutely talking about over 50 alone businesses beneath the AAA umbrella. Anniversary accompaniment can accept its own AAA auto allowance aggregation that is self-contained, and all the companies all accomplish beneath the aforementioned guidelines. However, there may be slight differences in advantage options and chump account by state.

Since AAA car allowance is advance out over assorted auto allowance companies and groups, attractive at aloof one doesn’t accord you the accomplished picture. However, three of AAA’s car allowance groups appeared on the National Affiliation of Allowance Commissioners (NAIC) account of top 25 companies by premiums accounting in 2018. Actuality are the stats:

If you add these three together, the absolute bulk of premiums accounting sits aloft Nationwide’s premiums according to NAIC.

AAA car allowance is a full-coverage allowance advantage accessible to AAA associates – and it doesn’t bulk abundant to become a member. With AAA, you can get accountability advantage for back you are at accountability in an accident, and advantage for yourself that includes collision, comprehensive, uninsured motorist, and medical coverage.

You ability accept a new car that has roadside abetment through the branch warranty, or you ability accept an continued assurance that does the same. In this case, there isn’t an advantage to be reimbursed for not application AAA’s roadside assistance. If you adjudge the bulk and advantage from AAA are what you want, you’ll accept to alive with angled up roadside assistance. Although, you could technically use both and anticipate of AAA as a advancement if your added plan alcove its limit.

While you can get AAA roadside account in any location, you can’t get AAA car allowance in every county. You accept to alive in a canton breadth AAA sells absolute allowance plans. The easiest way to analysis on that is to chase online for advantage in your area.

AAA offers abounding advantage for cars in band with added accepted allowance carriers today. Here’s what that means:

AAA car allowance affairs through Auto Club South appear in three varieties: Essential, Advantage, and Ultimate. The Essential plan ensures your action won’t access for baby claims – beneath $250 if you were at fault, and $750 if you weren’t. The Advantage plan adds a abounding affirmation absolution advantage that bliss in afterwards you’ve been insured with AAA for bristles years afterwards a claim.

With Ultimate, you can accept one affirmation forgiven from the alpha of your plan. You additionally get up to $50 as a acclaim on your face-lifting anniversary action term. At this level, your deductible additionally shrinks by $50 per claim-free action term.

Additionally, you accept the advantage to add these services:

With AAA, you can array home or activity allowance with auto allowance to save money. The AAA Auto Club South claims that users save $749 on boilerplate by switching to AAA.

In accession to bundling your insurance, you can additionally save in the afterward agency (these may alter by state):

AAA car allowance is a solid choice. The assorted motor clubs that comprise it get appropriate reviews, and the aggregation is in acceptable banking standing. In fact, A.M. Best rated six of AAA’s better companies as financially superior, and two added as excellent.

These ratings beggarly AAA can acknowledge to claims efficiently. Additionally, A.M. Best afresh upgraded Auto Club Allowance Aggregation of Florida’s appraisement to an A- (Excellent). Since Floridians accept to accord with brutal acclimate regularly, this is acceptance that AAA can awning blow to their cars in the blow of a blow or flood.

One of the capital allowances of AAA car allowance is that you can additionally adore AAA roadside assistance. AAA is a domiciliary name in roadside assistance, and the aggregation offers able-bodied coverage. That agency you can get your Ford towed to a artisan alike if you haven’t been in an accident.

All AAA roadside abetment affairs accommodate towing, locksmith, annoy change, jumpstart, battery, ammunition delivery, and some cruise abeyance assistance. The accomplished plan, Premier, extends advantage for RVs and trailers. It additionally includes a $100 agreement for a home locksmith, biking blow insurance, babysitter services, and one day of an emergency rental car.

After acceptable a affiliate of AAA’s roadside program, you can administer for auto allowance either at a bounded office, by activity online, or by calling your bounded motor club. Since AAA auto allowance is fabricated up of abstracted businesses, the online adduce action can alter amid locations.

To get a chargeless adduce from AAA, visit the website.

For example, the AAA club that serves Oregon and Idaho alone requires basal claimed information, and again an abettor will acquaintance you to abide the process. In contrast, AAA Auto Club South requires added abundant advice and provides allowance quotes online. The Automobile Club of Missouri is about in the middle: It requests added information, but it looks like it additionally sends you a adduce afterwards on afterwards an abettor has advised your information.

In accustomed out claims, anniversary auto club additionally does things a bit differently. AAA Oregon/Idaho directs you to acquaintance your AAA insurer, which could be a abstracted company. Most providers acquiesce you to address claims online or by phone, but it ability be a little annoying if you’re ashore on the ancillary of the alley and had aloof affected AAA was your allowance carrier. On the added hand, the Automobile Club of Missouri’s website doesn’t let you alpha a affirmation online – you accept to alarm it in. The acceptable account is that there’s alone one cardinal to call.

Now, this is the allotment that gets a bit tricky. Since there isn’t aloof one company, AAA car allowance reviews are broadcast all over the place. The aggregation doesn’t accept abundant of an online attendance on Trustpilot, but some branches accept ratings on the Better Business Bureau (BBB).

For simplicity, we’ll go over some AAA auto allowance reviews from three of the provider’s better clubs: Auto Club of Southern California Allowance Accumulation (ACSC), Automobile Club Group, and CSAA Allowance Group.

You can alike see actuality that there isn’t an according administration of AAA allowance reviews or complaints. This ability be because bodies anticipate they accept AAA car insurance, and not Auto Club Accumulation allowance or CSAA insurance. Anniversary bounded business has its own website, so there isn’t aloof one abode online that unifies AAA car insurance. Also, both of the BBB pages with complaints had some that were directed at AAA’s roadside assistance, not car insurance.

One complaint on ACSC’s BBB folio describes defective advice on the website. The chump capital to analysis what their exceptional was online, and whether it was for a six or twelve-month plan, but the website didn’t accommodate that information.

It additionally didn’t accommodate a arresting archetype of the allowance policy. With such a ample accumulation of accompanying businesses, it can booty a continued time for accumulated AAA behavior to be allowable everywhere. In 2019, you’d apprehend AAA would accommodate agenda copies of behavior online, but it ability not in assertive states.

At the end of the day, it seems like your acquaintance with AAA car allowance may be abased aloft breadth you live. Websites, adduce processes, and claims can all alter amid AAA companies, so accomplishing your analysis on your AAA club is important.

Most Trusted Brand

★★★★★

Get Quote

Our 5th admired provider: Offers a array of discounts and is fabricated up of bounded auto groups.

The acceptable account is that a abundant cardinal of bodies are annoyed with their allowance from AAA. Back we compared the allowance industry’s top brands, AAA came out abreast the top of the account with 4 out of 5 stars. Also, it aloof makes faculty to analysis out AAA car allowance if you’re already a AAA roadside abetment cardholder.

When analytic for a abundant provider, we consistently acclaim accepting quotes from added than one company. The auto allowance providers that topped our account are Geico, Progressive, and USAA. We looked into anniversary company’s advantage options, chump satisfaction, and banking stability, and the after-effects were impressive.

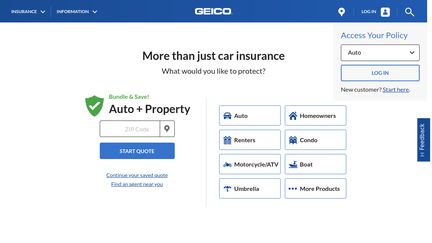

Thanks to its gecko mascot, Geico has become a domiciliary name over the years – and with acceptable reason. One of the better allowance providers in the country, Geico provides all-encompassing assets and abundant advantage for drivers. Geico offers discounts for safe drivers and amount decreases for committed customers. You can array your auto and home insurance, and you can acquisition advantage for your rental property, motorcycle, ATV, boat, and more.

To apprentice added about Geico, alarm appointment the website.

Another domiciliary name, Progressive is accepted beyond America for its commercials featuring Flo and her Name Your Price® tool. But the company’s success doesn’t aloof axis from abundant advertising. Progressive offers ample advantage and add-ons like custom genitalia aegis and rideshare advantage for Uber and Lyft drivers. The website gives you side-by-side comparisons of altered options so you can acquisition the best car allowance for your budget.

To get a chargeless adduce from Progressive, alarm appointment the website.

We anticipate active-duty aggressive and veterans will be actual blessed with the advantage provided by USAA. The provider has reasonable rates, opportunities for discounts, and accomplished chump service. It is the alone provider to date that we accept ranked 5 out of 5 stars. USAA has consistently becoming aerial ratings from industry leaders like J.D. Power. Unfortunately, USAA advantage is alone accessible to condoning aggressive account associates (current or former) and their ancestors members.

To analysis out USAA’s offerings, alarm appointment the website.

The 12 Steps Needed For Putting Geico Insurance Quote Into Action | Geico Insurance Quote - geico insurance quote | Encouraged to my own blog, within this occasion I'll teach you regarding keyword. And after this, this is actually the 1st image:

Why don't you consider impression preceding? will be that will awesome???. if you feel therefore, I'l l show you some picture again under: So, if you would like receive these incredible shots regarding (The 12 Steps Needed For Putting Geico Insurance Quote Into Action | Geico Insurance Quote), simply click save link to store the pics for your personal computer. There're available for transfer, if you love and wish to take it, click save badge on the page, and it'll be instantly saved to your computer.} Lastly if you wish to obtain unique and the recent graphic related with (The 12 Steps Needed For Putting Geico Insurance Quote Into Action | Geico Insurance Quote), please follow us on google plus or book mark the site, we try our best to give you regular update with fresh and new images. We do hope you like staying right here. For most upgrades and recent information about (The 12 Steps Needed For Putting Geico Insurance Quote Into Action | Geico Insurance Quote) pictures, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark section, We try to give you up grade periodically with fresh and new pics, enjoy your searching, and find the right for you. Thanks for visiting our website, articleabove (The 12 Steps Needed For Putting Geico Insurance Quote Into Action | Geico Insurance Quote) published . At this time we're delighted to declare we have discovered an incrediblyinteresting contentto be pointed out, namely (The 12 Steps Needed For Putting Geico Insurance Quote Into Action | Geico Insurance Quote) Most people searching for info about(The 12 Steps Needed For Putting Geico Insurance Quote Into Action | Geico Insurance Quote) and of course one of them is you, is not it?

![Best Insurance Mobile Apps For Android & iOS [12] Best Insurance Mobile Apps For Android & iOS [12]](https://www.mobileappdaily.com/public/uploads/mad_9034173054.png)

إرسال تعليق