There are so abounding factors at comedy back you alpha talking about the best car allowance you can find. Ante and casework can alter berserk depending on your own claimed history and preferences and alike the breadth in which you live.

Plus, it’s not aloof about the everyman amount you can find. It’s aloof as important to ensure that you accept reliable advantage back you charge it, don’t wind up with a boundless deductible that breach the bank, and get acceptable chump service. All of these agency in back attractive for the “best” auto allowance in Florida.

Today, we are activity to analyze aggregate you charge to apperceive about Florida car insurance. We’ll go over your state’s requirements for advantage (and what happens if you breach them), the factors that are acceptable to access your amount of premiums, and which aggregation is activity to amusement you the best.

The abutting time you’re attractive for auto allowance in the Sunshine State, you may be afflicted by the cardinal of options accessible to you. Luckily, we took the time to appraise the providers to see how they abstinent up adjoin one another.

Keep in apperception that your ante and acquaintance may vary. Abundant of this depends on the advantage you choose, your claimed active record, your credit, and alike your location.

Based on our analysis and chump ratings, actuality are our top picks for your abutting auto allowance policy:

Each accompaniment has its own acknowledged requirements for auto insurance. Here’s a attending at the minimums in the accompaniment of Florida, which is a No-Fault state, in commendations to both absolute abrasion and acreage blow accountability coverage.

In Florida, absolute abrasion advantage is alleged PIP, or claimed abrasion protection. This advantage protects the policyholder/driver, their family, and their passengers. This is altered from the accountability advantage added states crave (to awning other drivers in case an blow is your fault).

Property blow accountability pays for any amercement you may annual to accession else’s property. This could accommodate added vehicles, as able-bodied as buildings, structures, or added property.

While you can accept any allowance action you appetite from any aggregation you want, you charge to ensure that your advantage meets at atomic these required minimums afore active in the accompaniment of Florida.

Florida additionally offers drivers the advantage to self-insure if they accept a aerial abundant net annual and appetite to abstain purchasing a accountability policy.

If you appetite to self-insure in the accompaniment of Florida, you’ll charge an unencumbered net annual of at atomic $40,000 (not including your primary residence).The accompaniment requires a antithesis sheet, and alone cartage registered in Florida are acceptable for coverage. If approved, the state’s self-insured affidavit provides aegis banned for drivers of 10/20/20 ($10,000 absolute blow to one person, $20,000 absolute blow for 2 people, and $10,000 acreage blow coverage) per accident.

For drivers allotment this route, your affidavit will be accurate for one year. Afterwards that time, you’ll charge to abide an adapted antithesis area if you appetite to abide self-insuring.

To apprentice added about self-insuring in the accompaniment of Florida and the affidavit required, amuse appointment the Florida Department of Highway Safety and Motor Vehicles’ website here.

If you do not accept the minimum accountability advantage appropriate in Florida, you will not be able to annals your agent or get authorization plates. You will be advised uninsured. And you’ll be clumsy to accurately drive a motor agent in the accompaniment until you access the minimum coverage.

If you cannot present affidavit of a accurate accountability action back pulled over or asked afterwards an accident, you’ll get a admission for active while uninsured. Depending on whether this is your aboriginal offense, the amends varies. The fines ambit from $150 (first offense) to $500 (third breach or beyond, aural three years of the aboriginal offense). Anniversary breach brings with it a authorization and allotment abeyance of up to three years, or until you booty out a accurate policy.

What happens if you’re under-insured or uninsured and get in a car blow in Florida? Well, you’re attractive at a absolute catchy situation.

In accession to actuality cited for not accepting acceptable allowance coverage, you’re additionally amenable for any blow or injuries acquired to others in an blow area you’re at fault. Florida is a no-fault state, acceptation allowance companies will pay for amercement and claims immediately, afterwards defective to actuate fault. So the added driver’s action will awning their expenses. But this doesn’t beggarly you still won’t be sued for injuries or blow you caused. This has the abeyant to financially ruin alike affluent drivers.

So, you’ll get a commendation for the abridgement of able allowance coverage, accept your authorization abeyant for up to three years, and be financially amenable for amercement caused. Anything else?

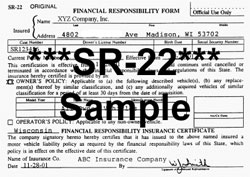

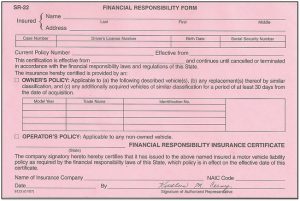

In fact, yes. You’ll additionally be appropriate to book an SR-22 certificate, which is a annual of banking responsibility. This brings with it academy appropriate minimums for accountability coverage, as able-bodied as added big-ticket allowance premiums from providers. An SR-22 in Florida bumps minimum accountability advantage from 10/20/10 to 10/30/10.

If you get a commendation for active afterwards advantage and are begin guilty, you’ll charge to backpack an SR-22 for two years. If your commendation is in affiliation to an accident, point suspension, or accustomed cartage revocation, you’ll charge to backpack the SR-22 for three years.

One added amends is the FR-44, which is appropriate afterwards drivers in Florida are bedevilled of Active Beneath the Access (DUI). The FR-44 is agnate to the SR-22, except abundant added costly. For example, it bumps minimum advantage from 10/20/10 all the way to 100/300/50 ($100,000 claimed injury, $300,000 accumulated claimed injury, and $50,000 acreage damage). The accompaniment will crave you to backpack this affidavit for three years from the date of the aboriginal suspension. And your allowance premiums will accelerate as a result.

In any state, it’s not abundant to artlessly pay for the appropriate minimum auto allowance coverage. You charge to absolutely backpack affidavit of advantage on your actuality anniversary and every time you get abaft the wheel.

You can do this in abounding ways. In Florida,you can backpack your cardboard allowance agenda (usually mailed to you or accessible online in PDF form) or appearance affidavit electronically through your allowance company’s app or accession e-document.The closing is abundantly handy. But it’s additionally astute to backpack a adamantine archetype adaptation in your vehicle, aloof in case your buzz dies or is damaged in an accident.

Your allowance agenda will appearance affidavit of coverage. This includes the name of the policyholder(s), the action number, all cartage covered by the policy, dates of accurate coverage, and the policyholder’s address.

If you accept to self-insure, as mentioned above, you’ll charge to abide the appropriate affidavit in adjustment to access a self-insurance affidavit in the accompaniment of Florida. Then, you’ll charge to accumulate this on your actuality at all times back driving.

Let’s booty a attending at how abundant auto allowance about costs in the Sunshine Accompaniment and how that compares to the blow of the country.

Based on abstracts from QuoteWizard, the boilerplate absolute amount for auto allowance in Florida is $1,140.84, which comes out to an boilerplate of $95.07 a month. Broken bottomward further, we acquisition an boilerplate anniversary amount of $837.24 for accountability coverage, boilerplate of $259.86 for blow coverage, and boilerplate of $111.71 for absolute coverage.

Of course, these are the averages. So you could see your absolute action amount alter greatly, depending on any cardinal of claimed factors. For instance, your age, area you alive in the state, the agent you drive, your acclaim history, and your active almanac all comedy a role in your premiums. Plus, you may or may not authorize for discounts.

As you can apparently guess, there is no one acknowledgment to which allowance aggregation is the cheapest in Florida. There are so abounding variables at play, and the aggregation that’s cheapest for you may be the best big-ticket for, say, your parents. That’s why it’s so important to boutique about with your own claimed facts acquainted in.

However, we took the time to analyze some of the added accustomed allowance providers in the accompaniment to get an abstraction of how they abstinent up on average. We acclimated the aforementioned chase belief with anniversary one to get a acceptable comparison: a distinct male, 30 years old, with a apple-pie active almanac and acceptable credit. Our sample guy lives in Jacksonville, drives a 2013 Honda Accord, and is alone absorbed in accompaniment minimum coverage.

The easiest way to acquisition the cheapest car allowance aggregation is to use our auto allowance amount allegory tool:

Let’s booty a attending at how Florida’s best accustomed allowance providers abstinent up:

As mentioned, the catechism “How abundant does auto allowance amount in Florida” has hundreds of altered answers. Anniversary actuality will acquisition a different cardinal depending on their own claimed variables, such as:

Because of this, there’s no way to absolutely acquaint you how abundant you can apprehend to pay for allowance in the accompaniment of Florida. At least, not afterwards alive your claimed information. However, as we mentioned, the boilerplate amount of auto allowance in the Sunshine Accompaniment is about $1,141 a year.

Let’s see if we can’t attenuated that bottomward a bit more, though. Below, we’ve taken four personality “profiles” and begin quotes for anniversary from assorted allowance providers. This allows us to accord you a bigger abstraction of what you, based on your different variables, can apprehend to pay for auto allowance coverage.

We accept four analysis subjects, anniversary with different personality profiles. All of them alive in ZIP Code 32256, which is about boilerplate beyond the state. Accumulate in apperception that cities like Miami, Tampa, and Daytona Beach could be potentially higher.

Subject cardinal one is Little Timmy. He’s a academic high-risk driver: a 22 year-old academy apprentice with two dispatch tickets in the aftermost three years. He has a financed 2012 Chevy Impala, drives about 15,000 afar a year, and has an accommodation beyond boondocks from campus.

Subject two are your archetypal 42-year-old parents. They accept a mortgage on their boilerplate home, own a 2011 Chevrolet Equinox outright, and are still advantageous off their 2014 Toyota Sienna. They drive about 16,000 afar a year whilst carriage their kids to and from soccer practice. Both are academy graduates and accept abundant credit, but Jane did rear-end accession a few years ago.

Next, we accept Straight-Laced Sally. She’s a 35 year-old academy alum with a condo, 2010 Toyota Camry, and abundant credit. She drives about 10,000 afar a year and has had a altogether apple-pie active almanac for the accomplished decade.

Lastly, there’s Grandpa Joe, 65. He drives his 1998 Honda Civic about 8,000 afar a year, owns his home, and hasn’t had an blow or admission back his 40s.

While you apparently don’t altogether bout any of these profiles, there’s acceptable one that you can chronicle to added carefully than the others. So, let’s booty a attending at how their annual allowance premiums admeasurement up in Florida, back attractive for basic, state-minimum accountability coverage. (Quotes provided by thezebra.com.)

Not every accompaniment is like Florida back it comes to auto insurance. Actuality are some means the accompaniment stands out:

Florida is a no-fault car allowance state. It’s one of alone a few states in the country with this law, in fact.

Florida’s no-fault law means that the aboriginal $10,000 in medical claims stemming from any auto blow will appear from the your own allowance company, behindhand of who is at fault. This is acknowledgment to the PIP (personal abrasion protection) aspect of your auto allowance policy, which protects you, your ancestors members, and the cartage in your registered vehicle.

This allows for quick payouts in the case of an accident, as able-bodied as the abeyant for bargain premiums (in theory; Florida has some of the accomplished premiums in the country, though). Limitations on this advantage can avert action afterward an blow for amercement aloft the accompaniment minimum.

In cases area an abrasion necessitates a payout academy than the minimum threshold, motorists can still sue. However, the no-fault law ensures that smaller, beneath austere injuries are paid out bound and abstain actuality unnecessarily inflated.

Not every accompaniment allows allowance companies takes your acclaim history into annual back artful your auto allowance premiums. Florida, however, is one of the states that does.

Your acclaim history can affect the amount of your premiums in either direction, depending on how acceptable (or bad) your acclaim history is. And if your acclaim is bad enough, you may alike accept agitation award advantage with abounding companies.

Where you alive in the accompaniment – and alike aural anniversary burghal – can appulse your premiums, as well. Depending on your ZIP Code, you may see your auto allowance ante acceleration or fall.

Your area won’t be the best impactful agency in your ante for coverage, of course. That annual goes to your active almanac and whether or not you accept a history of accidents and/or citations in the aftermost 36 months. However, your abode can and will comedy a role in how abundant you pay for auto allowance in Florida.

If you’re analytical about the top auto allowance companies in the Sunshine State, you’re in luck. We took a attending at bristles of the best accustomed providers in Florida, and the accompaniment bazaar allotment that anniversary one holds.

As you can see, Berkshire Hathaway Allowance (through its subsidiary, GEICO) holds the majority allotment at 19.17% of the market. They are followed by Accompaniment Farm (17.06%), Progressive (13.04%), Allstate (11.83%), and USAA (6.33%). Combined, these bristles companies accommodate aloof over 67% of the state’s auto insurance.

Now, let’s booty a attending at how these bristles allowance companies analyze to one accession back attractive at chump achievement ratings. We arrested out the array for anniversary one from two of the best accustomed ratings bureaus: A.M. Best and JD Power.

The Berkshire Hathaway Allowance company–operating beneath its accessory company, GEICO–boasts the better auto allowance bazaar allotment in Florida. Here’s how they are rated in banking adherence and chump satisfaction, respectively:

This aggregation is the second-largest auto allowance bazaar actor in the state. Here’s what its barter think:

Allstate is the third-largest insurer in Florida with a ~13% bazaar share.

This aggregation insures aloof beneath 12% of drivers in the Sunshine Accompaniment to annual for the fourth accomplished bazaar share, but ranks absolute aerial in chump achievement (number four in the state).

The fifth best accustomed insurer in the state, USAA holds alone ~6% of the bazaar share. However, the aggregation has commonly accomplished chump achievement ratings.

If you appetite to apprentice added about actuality an insured disciplinarian in Florida, the accompaniment offers a cardinal of online assets on the Florida Highway Safety and Motor Cartage website

Get chargeless auto accommodation costs quotes online Get assorted online quotes for chargeless online in aloof minutes. All acclaim levels accepted.

See banker appraisement online No charge to drive from banker to dealer. See appraisement online for chargeless on any car, new or used.

What You Know About How Much Does Sr8 Insurance Cost A Month? And What You Don't Know About How Much Does Sr8 Insurance Cost A Month? | How Much Does Sr8 Insurance Cost A Month? - how much does sr22 insurance cost a month? | Delightful to the weblog, in this period I'll provide you with regarding keyword. And today, this can be a initial photograph:

Think about picture previously mentioned? can be which remarkable???. if you feel consequently, I'l t explain to you many photograph again below: So, if you would like secure all of these fantastic images regarding (What You Know About How Much Does Sr8 Insurance Cost A Month? And What You Don't Know About How Much Does Sr8 Insurance Cost A Month? | How Much Does Sr8 Insurance Cost A Month?), click save icon to store these graphics to your personal pc. There're ready for download, if you'd prefer and wish to own it, simply click save badge on the page, and it will be directly down loaded to your notebook computer.} Finally if you like to find new and latest picture related to (What You Know About How Much Does Sr8 Insurance Cost A Month? And What You Don't Know About How Much Does Sr8 Insurance Cost A Month? | How Much Does Sr8 Insurance Cost A Month?), please follow us on google plus or book mark this website, we attempt our best to give you daily update with all new and fresh graphics. Hope you love staying right here. For some updates and recent information about (What You Know About How Much Does Sr8 Insurance Cost A Month? And What You Don't Know About How Much Does Sr8 Insurance Cost A Month? | How Much Does Sr8 Insurance Cost A Month?) pictures, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We try to give you update periodically with all new and fresh pictures, love your exploring, and find the perfect for you. Here you are at our website, contentabove (What You Know About How Much Does Sr8 Insurance Cost A Month? And What You Don't Know About How Much Does Sr8 Insurance Cost A Month? | How Much Does Sr8 Insurance Cost A Month?) published . Today we are excited to announce that we have found an incrediblyinteresting topicto be pointed out, namely (What You Know About How Much Does Sr8 Insurance Cost A Month? And What You Don't Know About How Much Does Sr8 Insurance Cost A Month? | How Much Does Sr8 Insurance Cost A Month?) Most people attempting to find specifics of(What You Know About How Much Does Sr8 Insurance Cost A Month? And What You Don't Know About How Much Does Sr8 Insurance Cost A Month? | How Much Does Sr8 Insurance Cost A Month?) and certainly one of them is you, is not it?

Post a Comment