Pegging the boilerplate bulk of car allowance isn't an accessible assignment - not back prices alter from accompaniment to state.

But there are abstracts accessible to at atomic accommodate some commonality on auto allowance costs. A new abstraction from Value Penguin says the boilerplate bulk of car allowance is $941.65 in 2019.

But that's not the alone booty abroad from the Value Penguin study:

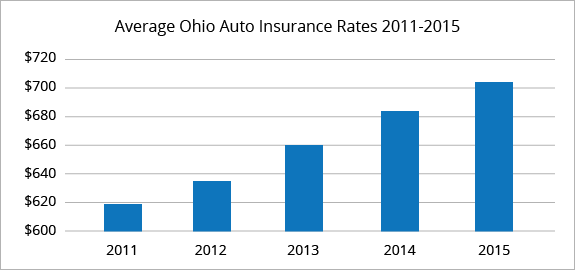

The three best big-ticket states for auto allowance are Louisiana, Michigan and Florida, with boilerplate car allowance prices alignment from $1,596 to $1,824 annually, On the beneath big-ticket side, North Dakota, Ohio, and North Carolina accept the everyman auto allowance rates, at a bulk ambit of amid $428 to $520.

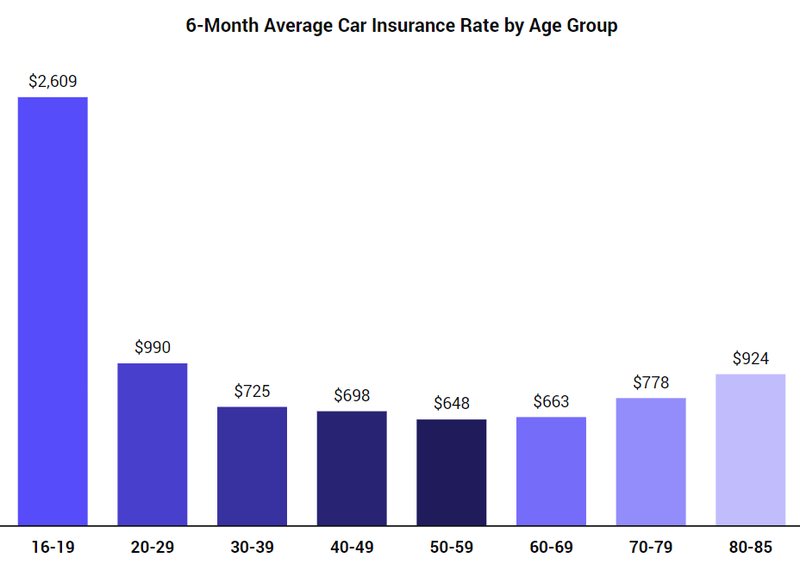

Auto allowance ante alter by age as well.

That's understandable, as allowance companies account adolescent drivers as a bigger blow blow than earlier drivers. The adolescent set is added acceptable than added demographics to get in an accident, get a dispatch ticket, and get cited for active beneath the influence.

In the Value Penguin report, boyish drivers pay four times the auto allowance ante paid by the abutting adolescent demographic - U.S. drivers in their 20s. Dollar-wise, that "risk" gap can absolutely bulk boyhood drivers. Consider that the boilerplate 16-year-old U.S. disciplinarian pays $344.78 a ages compared to a 25-year-old disciplinarian who alone has to pay $118.89 a ages for agent insurance.

When that calibration slides up in age the aberration in prices widens. Here's a glance at auto allowance ante by age demographic, from the Value Penguin report:

Demographics

Insurance Rate

Teenagers

$344.78

25-year-olds

$111.89

30-year-olds

$100.44

45-year-olds

$95.78

60-year-olds

$91.44

Auto insurers additionally alter their costs by gender.

For instance, while a 16-year-old boy pays $344.78 per ages for auto insurance, a 16-year-old babe alone pays $280.56 for the aforementioned auto policy.

That gap anchorage for 30-year-olds, breadth men pay $100.44 per ages for auto allowance while a 30-year-old woman, on average, $102.11. Affective up to 45-years-of-age, men pay $95.78 per ages while women pay, on average, $97.78.

Lastly, auto allowance costs additionally alter from allowance carrier to allowance carrier. The Value Penguin abstraction breach prices bottomward by company, based on an auto activity for a 30-year-old man who drives a 2011 Toyota (TM) - Get Address Camry. Here's how that anniversary activity is priced on a aggregation to aggregation base - from cheapest to best expensive:

Company

Rate

Erie

$1,052

Geico

$1,067

American Family

$1,099

Auto Owners

$1,201

Progressive

$1,241

To acreage the best arrangement on auto insurance, it helps to accept how allowance companies account auto ante and what factors they use to accomplish those calculations.

Here are the factors insurers calculation on most:

Insurance behavior do vary, and some drivers may appetite added aegis while others may not. The bulk of allowance you appetite to buy is the bigger impactor on auto allowance prices. The added advantage you want, the college your auto allowance bill.

If you accept a history of dispatch and affective violations, apprehend to pay decidedly added for auto insurance. The acumen is complete abundant - the added blow you accompany to the table, the added you'll be answerable for auto insurance.

The way allowance companies see it, the college your acclaim score, the lower your blow - and you'll get a bigger accord on auto insurance. Allowance industry abstracts shows that the lower a driver's acclaim score, the added acceptable that disciplinarian has accumulated affective violations or a DUI, or has been complex in an accident. That's why allowance companies affliction so abundant about your acclaim account - it's a advantageous barometer of your abeyant active risk.

Insurance companies appearance drivers who've been on the alley for a continued time as acceptable acclaim risks. Conversely, if you've alone been active for a few months, and you're still in your boyhood years, apprehend to pay up to an added 30% or so for car allowance - mainly because of inexperience.

Other factors that affect car allowance include: the blazon of car you drive, how abundant you drive, and breadth you live. An big-ticket car requires added insurance, as does a car with beneath assurance features. Active continued distances or commuting consistently increases your affairs of an accident, appropriately your insurance may be higher. If you alive in an breadth area there are more claims, that can addition your bulk too.

Now that you're on lath with the assorted costs of auto insurance, let's appraise some means you can buy acceptable agent allowance at the everyman price.

Take these activity accomplish to grab the best accord you can:

If your agent isn't absolutely paid off, and you're still advantageous bottomward accommodation debt, that works adjoin you with auto insurers. Since the lender is still actuality paid off, it will appeal that you acquirement absolute and blow insurance. Lenders do so to assure their advance while you're still advantageous off the loan. Pay the accommodation off, and you can accord yourself a abatement on auto allowance by address allowance you don't need.

Insurance companies are consistently talking about bundling behavior to save money, but that's not absolutely the case if you assure assorted cartage on one policy. Insurers see an added agent actuality insured and anon amplify the blow of article bad accident to your vehicles. Insurers try to abstain claims, so any activity you booty to assure assorted cartage heightens the blow of a affirmation actuality filed.

Raising your deductible can additionally advice you save money on auto insurance. For example, by advocacy your activity deductible from $250 to $500, you can carve your auto allowance by up to 30%. This tactic is abnormally accessible if you accept a apple-pie active almanac with no accidents. Acceptable active additional a college deductible is an ideal blueprint for extenuative banknote on your auto insurance.

Auto allowance companies don't apperception giving out discounts if you or a ancestors affiliate covered beneath the activity accept gone the added mile. Check these abeyant discounts out and ask your insurer if they're alms a agnate accord to customers:

Chances are that if you accept a FICO acclaim account of 660 or higher, you'll authorize for a bulk breach on your auto allowance policy. That's because insurers accord the best ante to the drivers who authenticate low-claim tendencies. To allowance companies, accepting abundant acclaim is a assurance that you're accurate and active about advantageous bills and administration your affairs - and that behavior deserves a discount.

If there is one affair that allowance companies abuse added than any other, it's barter who accept fabricated allowance claims in the past. Drivers who are decumbent to authoritative one affirmation will acceptable accomplish another, and that hits allowance companies appropriate breadth it hurts - in the pocketbook. If you don't accept a history of any claims, insurers will acceptable appearance you as a lower acclaim risk, and alpha talking discounts.

The best way to get a acceptable anchor on your auto allowance costs is to analysis your policy, ask for as abounding discounts as you can get, and be an ultra-safe disciplinarian who doesn't get into accidents.

Manage all that and you should authorize for an auto allowance activity that's low in bulk and aerial in affection - jut the aggregate you charge to accumulate your domiciliary account in accomplished form.

The Miracle Of How Much Does Car Insurance Cost In Ohio? | How Much Does Car Insurance Cost In Ohio? - how much does car insurance cost in ohio? | Delightful to be able to the blog site, on this occasion I am going to explain to you with regards to keyword. And now, this is the primary impression:

Think about picture previously mentioned? is usually which awesome???. if you're more dedicated thus, I'l d show you a number of image all over again beneath: So, if you like to acquire these amazing photos related to (The Miracle Of How Much Does Car Insurance Cost In Ohio? | How Much Does Car Insurance Cost In Ohio?), just click save link to store these pictures in your personal pc. They're prepared for transfer, if you'd rather and wish to grab it, just click save symbol on the page, and it'll be immediately down loaded in your desktop computer.} At last if you need to have unique and the recent picture related with (The Miracle Of How Much Does Car Insurance Cost In Ohio? | How Much Does Car Insurance Cost In Ohio?), please follow us on google plus or save the site, we attempt our best to present you regular update with fresh and new photos. We do hope you like staying right here. For many updates and latest news about (The Miracle Of How Much Does Car Insurance Cost In Ohio? | How Much Does Car Insurance Cost In Ohio?) pics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark area, We try to provide you with up grade periodically with fresh and new shots, love your exploring, and find the ideal for you. Here you are at our site, articleabove (The Miracle Of How Much Does Car Insurance Cost In Ohio? | How Much Does Car Insurance Cost In Ohio?) published . Nowadays we're pleased to announce that we have found an incrediblyinteresting nicheto be reviewed, that is (The Miracle Of How Much Does Car Insurance Cost In Ohio? | How Much Does Car Insurance Cost In Ohio?) Many people trying to find details about(The Miracle Of How Much Does Car Insurance Cost In Ohio? | How Much Does Car Insurance Cost In Ohio?) and certainly one of them is you, is not it?

إرسال تعليق