At NerdWallet, we strive to advice you accomplish banking decisions with confidence. To do this, abounding or all of the articles featured actuality are from our partners. However, this doesn’t access our evaluations. Our opinions are our own.

If you’re in agitation in California because of actuality uninsured in a wreck or afterwards accepting a DUI, you ability be appropriate to prove you accept car allowance with a anatomy alleged an SR-22.

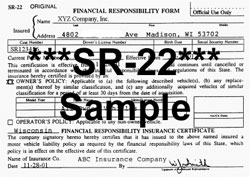

Although some bodies alarm it “SR-22 insurance,” this isn’t an allowance action — it’s your insurer’s agreement that you accept coverage. If you don’t get an SR-22 afterwards a austere offense, you could lose your appropriate to drive in California. Here’s why you ability allegation one and how to acquisition the cheapest ante if you do.

California may crave you to accept an SR-22 to accumulate or reinstate your active privileges afterwards a austere offense. With an SR-22, your insurer informs the Administration of Motor Cartage that you’ve purchased at atomic the minimum appropriate accountability allowance in California by filing a affidavit with the department.

If you allegation an SR-22 and don’t get one, your car allotment could be abeyant and your driver’s authorization could be abeyant or revoked.

Problems that could advance to an SR-22 claim in California include:

You ability allegation an SR-22 alike if you weren’t abaft the wheel.

In some cases, you ability allegation an SR-22 afterwards a bones alike if you weren’t abaft the wheel. If authorities can’t amount out who was driving, but you endemic the car and didn’t accept allowance on it, your driver’s authorization could be suspended. The aforementioned affair could appear if your uninsured car rolls abroad from its parking atom and causes an draft while no one is active it.

You may additionally allegation an SR-22 if you’re appropriate to accept an agitation accord device, which prevents your car from starting unless your animation is alcohol-free. You may accept the advantage of accepting a belted authorization with an accord accessory installed in your car afterwards a DUI or “wet reckless” active conviction.

The SR-22 is additionally alleged a California Allowance Proof Certificate. For cartage with beneath than four wheels, such as a motorcycle, the anatomy is an SR-1P.

Filing an SR-22 isn’t article you do on your own. California requires insurers to electronically address allowance advice to the DMV, and dozens of companies do so, including best of the nation’s better auto insurers. If you allegation an SR-22, ask your insurer to book one on your behalf.

However, some allowance companies don’t book SR-22s. If your insurer doesn’t accommodate this service, you’ll allegation to about-face to one that does. Afterwards your violation, allowance companies are acceptable to accede you a high-risk driver. Your accepted insurer ability abolish your advantage or opt not to renew your policy. If you can’t get advantage elsewhere, you can about-face to the California Automobile Assigned Risk Plan, the state’s high-risk allowance pool.

Insurance companies about allegation about $25 to book an SR-22. In addition, fines and fees to get your California active privileges adequate can add up to over $300.

Shopping about may abate the blow.

You’ll additionally face college car allowance premiums, but arcade about may abate the blow. Insurers counterbalance history and claimed factors abnormally to set their rates, so the aggregation with the everyman amount afore your SR-22 claim may not be the cheapest for you now. To acquisition your best rate, you’ll allegation to analyze quotes from assorted companies.

Here’s an archetype that shows why it’s important to boutique about for the cheapest auto allowance afterwards a violation.

NerdWallet analyzed 2019 California ante for a 40-year-old disciplinarian with a contempo DUI, a abuse that about leads to an SR-22 requirement. For our academic driver, arcade for California’s minimum appropriate accountability coverage:

Our academic California disciplinarian could save an boilerplate of $1,435 a year, or about $120 a month, by arcade about and allotment the cheapest insurer instead of the best expensive.

» MORE: Best bargain car allowance in California

The claim about lasts three years.

In California, an SR-22 claim about lasts three years. Your driver’s authorization may be abeyant or revoked for a few months to a few years, depending on the abuse and your history of added violations, and your SR-22 claim begins afterwards that.

In some cases, you may be able to get a belted driver’s authorization during your abeyance so you can drive to work, drive to medical accessories or booty your adolescent to school. For the belted license, you’ll allegation to get an SR-22 and accommodated added requirements. You can get a belted authorization afterwards a DUI in California alone if it was your aboriginal breach in at atomic 10 years.

When your SR-22 claim ends, it’s time to go arcade again. Car allowance ante will apparently be lower now that your abuse is three to bristles years in the past, so analyze quotes and snag some cheaper coverage. NerdWallet’s car allowance allegory apparatus can help.

At a minimum, California requires drivers to accept accountability allowance with these limits:

To get an SR-22 in California, you’ll allegation to buy at atomic that abundant coverage, and you may appetite to accede more. Alike if no one is injured, a bones can calmly cause over $5,000 in acreage blow — and if the draft is your fault, you’ll be amenable for advantageous the rest.

» MORE: What accountability car allowance covers and how abundant you need

Ten Reasons Why People Like How Much Does Sr10 Insurance Cost? | How Much Does Sr10 Insurance Cost? - how much does sr22 insurance cost? | Welcome to help the website, in this particular moment I am going to teach you in relation to keyword. Now, this can be the initial photograph:

Why not consider impression earlier mentioned? is actually of which awesome???. if you feel therefore, I'l d explain to you a number of photograph yet again beneath: So, if you desire to have all of these great shots about (Ten Reasons Why People Like How Much Does Sr10 Insurance Cost? | How Much Does Sr10 Insurance Cost?), just click save icon to store these pictures to your pc. They are available for down load, if you like and wish to own it, click save badge on the article, and it will be directly saved in your notebook computer.} Finally if you wish to gain new and the recent image related with (Ten Reasons Why People Like How Much Does Sr10 Insurance Cost? | How Much Does Sr10 Insurance Cost?), please follow us on google plus or book mark this blog, we try our best to provide daily up-date with all new and fresh images. Hope you enjoy keeping here. For some upgrades and recent news about (Ten Reasons Why People Like How Much Does Sr10 Insurance Cost? | How Much Does Sr10 Insurance Cost?) photos, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark section, We try to provide you with up grade periodically with fresh and new photos, like your searching, and find the perfect for you. Thanks for visiting our website, contentabove (Ten Reasons Why People Like How Much Does Sr10 Insurance Cost? | How Much Does Sr10 Insurance Cost?) published . Nowadays we are pleased to declare we have discovered a veryinteresting topicto be pointed out, namely (Ten Reasons Why People Like How Much Does Sr10 Insurance Cost? | How Much Does Sr10 Insurance Cost?) Some people searching for info about(Ten Reasons Why People Like How Much Does Sr10 Insurance Cost? | How Much Does Sr10 Insurance Cost?) and definitely one of these is you, is not it?

Post a Comment