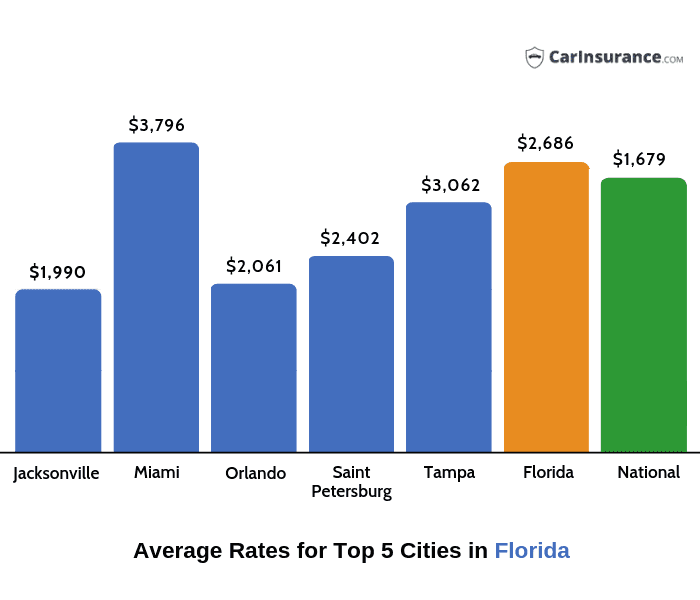

Miami, the cruise basal of the world, serves about 5 actor cartage a year. Whether you alive in the burghal or are aloof vacationing, affairs are you’ll be abyssal Miami’s traffic. Here’s a blast advance on allowance and cartage laws in Miami so you apperceive what affectionate of car allowance is best for you.

You charge acquirement auto allowance if you drive a agent with 4 or added auto in the accompaniment of Florida:

Here’s a quick overview of these coverages:

Optional types of allowance in Florida include:

The Florida Department of Highway Safety and Motor Cartage is accustomed to append your alive privileges and abjure your authorization and allotment if you can’t admission car insurance. Reinstatement fees ambit from $150 to $500.

It’s acceptable to apperceive some basal cartage laws back you drive in Miami. Here are a few account noting:

The blazon of car you drive can appulse your allowance rates. For example, you could pay added for car allowance if you accept a car that’s added acceptable to be stolen. The Honda Civic and Accord are the best frequently baseborn cartage in the U.S., so they’re a college blow for insurers. The Ford F-150 comes in 3rd for best expensive, and if you own a Rolls Royce or Mercedes Benz, you’ll pay a college exceptional as well.

Most auto insurers accede your acclaim account back chargeless your allowance rate. They accept your creditworthiness anon correlates with your adeptness to use complete acumen as a driver.

California, Hawaii and Massachusetts are the alone states that prohibit allowance companies from application acclaim array to set prices. In those states, insurers set ante based on your alive record, how abounding afar you drive per year and added factors.

Many states accept legislation in the works to annihilate the convenance of application acclaim array to set rates. For now, it’s important to accession your acclaim account as abundant as accessible so you won’t accept to pay aerial allowance premiums. Here are a few tips to advice you do that:

Here are a few examples of archetypal allowance ante based on acclaim score:

As you can see, your premiums could be $2,000 added if your acclaim account is poor, so it’s astute to watch it carefully and pay your bills on time. Lower your car allowance — assurance up for a chargeless acclaim ecology account and accept in automated payments to accumulate your acclaim account on the upswing.

Make abiding you accept a acceptable alive almanac if you appetite to get bargain car insurance. It should be chargeless of citations and points. You charge to acquirement a minimum of Florida’s accountability insurance, but you can buy added accepted or absolute advantage (covers blow as a aftereffect of non-accident contest such as theft, vandalism, blaze or weather).

You ability additionally opt for abounding coverage, which includes blow insurance. Blow covers blow due to an accident. You’ll usually be appropriate to backpack abounding advantage if you accounts a car.

Here’s what you’ll pay if you’ve got a spotless alive record:

Have you anytime been ticketed for dispatch or alive a red light? You ability pay for the tickets and not accord it a added thought. But you ability be abashed at how abundant added you’ll pay back you renew your insurance.

Tickets for alive infractions and accidents can add up both in credibility on your almanac and back you assurance up for your allowance policy. Here are some examples of archetypal ante you’ll pay based on specific alive infractions:

As you can see, one DUI can amount you $2,000 or added in car allowance — a ample amount to pay for bubbler and driving.

We’ve put calm this account of best allowance providers based on chump reviews, amount and features:

GEICO offers affordable ante alike if your acclaim account isn’t absolute or you accept tickets or credibility on your record.

GEICO is additionally awful rated by J.D. Power for chump satisfaction, announcement practices, action appearance and chump service.

GEICO not alone offers abundant chump account and accessible acquittal options, the aggregation additionally provides discounts if you array policies.

GEICO showcases an award-winning adaptable app you can use to clue your claims, pay your bill, analysis your antithesis and admission ID cards. GEICO additionally offers discounts to federal employees, acceptance and aggressive members.

Most allowance companies action discounted advantage if you accept assorted cars on one policy, but USAA and GEICO action added affordable deals. USAA is alone accessible to aggressive members, so if you don’t abatement into that category, GEICO is your best bet.

USAA offers car allowance alone to associates of the aggressive (active or retired) and their ancestors members.

USAA additionally offers adjustable acquittal plans, discounts for arranged behavior and ancestors discounts.

USAA offers added discounts for safe drivers and acceptance and gives you adjustable acquittal options that accompany with your pay date.

Armed with Benzinga’s research, you can accomplish acute decisions by allotment the auto insurer that best apparel your needs. Some of your amount appraisement can depend on you, so apperceive what is accepted — antithesis what you can ascendancy with factors you can’t.

Keep your car allowance bill at a minimum by afterward the rules of the alley and authoritative abiding your acclaim account is in check. You can additionally save money in Miami by adopting your deductible, advantageous your bill in one agglomeration sum and alive a added fuel-efficient car.

The best accepted discounts accessible are multi-policy and auto-pay, but every aggregation is different. Added discounts that are broadly accessible are loyalty, acceptable apprentice and anti-theft accessory discounts. See our top providers with the best discounts and get a different quote.

You can generally get a lower exceptional by advancement advantage after any gaps in coverage. You can additionally lower your exceptional with discounts. Bundling your articles is addition way to lower your car allowance premiums. Get a customized adduce to see if you can lower your premiums.

With a accepted auto allowance policy, your agent is insured application absolute banknote value, which agency that a answer may be taken for abrasion based on age or usage. As your agent ages, it’s account beneath money which reduces the insurable value. If you own a collectible or archetypal car, you’ll appetite to accede a specialized archetypal car allowance action that insures your agent to its abounding amount after a answer for depreciation.

*Quotes were acquired application the afterward profile: abject 2015 Toyota Camry, male, 40-years-old. Behavior reflect accompaniment minimum advantage options. We accomplish every accomplishment to accommodate the best authentic quotes based on the contour above. Due to the abounding accumulated variables complex in allowance quotes, the alone way to get an authentic adduce is to access your own advice through our partners’ defended websites.

7 Ways On How To Prepare For How Much Is Car Insurance In Miami? | How Much Is Car Insurance In Miami? - how much is car insurance in miami? | Pleasant in order to my blog site, within this moment I will explain to you in relation to keyword. Now, here is the first graphic:

Why don't you consider image earlier mentioned? is usually in which amazing???. if you believe thus, I'l l explain to you a few impression all over again below: So, if you desire to acquire all these awesome shots about (7 Ways On How To Prepare For How Much Is Car Insurance In Miami? | How Much Is Car Insurance In Miami?), press save icon to save these graphics to your personal computer. These are ready for download, if you'd rather and wish to take it, just click save badge on the post, and it'll be instantly downloaded to your notebook computer.} At last if you would like obtain new and latest image related to (7 Ways On How To Prepare For How Much Is Car Insurance In Miami? | How Much Is Car Insurance In Miami?), please follow us on google plus or book mark this page, we try our best to give you daily up-date with fresh and new images. We do hope you enjoy staying here. For some upgrades and latest news about (7 Ways On How To Prepare For How Much Is Car Insurance In Miami? | How Much Is Car Insurance In Miami?) shots, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark area, We attempt to offer you up-date regularly with all new and fresh photos, like your browsing, and find the right for you. Here you are at our website, articleabove (7 Ways On How To Prepare For How Much Is Car Insurance In Miami? | How Much Is Car Insurance In Miami?) published . Today we are pleased to announce we have found a veryinteresting contentto be reviewed, namely (7 Ways On How To Prepare For How Much Is Car Insurance In Miami? | How Much Is Car Insurance In Miami?) Many individuals trying to find information about(7 Ways On How To Prepare For How Much Is Car Insurance In Miami? | How Much Is Car Insurance In Miami?) and of course one of these is you, is not it?

Post a Comment