The boilerplate absorption amount for acceptable accumulation accounts today hovers about 0.09% — but consumers can acquire 10 to 20 times added absorption on their money by giving high-yield options a shot.

While cyberbanking barter accept acceptable heard of high-yield online accumulation accounts, beneath accustomed is a almost new artefact that has appear into its own alone this year: the banknote administration account.

What is a banknote administration account?

A banknote administration account, sometimes alleged artlessly a banknote account, is a amalgam artefact that combines appearance agnate to those of blockage and accumulation accounts. CMAs about action aerial absorption ante — absolutely a bit college than those at brick-and-mortar banks — and online-only chump service.

There’s an important acumen amid banknote administration accounts and added acceptable high-yield accumulation accounts: CMAs aren’t offered by banks, but by nonbank banking anniversary providers, like brokerages or advance firms. These providers accomplice with banks abaft the scenes to ambit chump funds into coffer accounts, thereby accouterment FDIC allowance for customers’ cash.

Offering a CMA lets allowance firms actualize added “stickiness” with their customers, said Ron Guay, a banking adviser in Sunnyvale, California.

“The longer-term comedy is to advantage the accord and upsell the chump to move these funds into allowance accounts, which these firms allegation a administration fee on,” Guay said via email.

But alike after signing up for a allowance account, barter can booty advantage of a CMA. Here’s what to know.

Strong absorption ante for short- to medium-term savings. While retirement accumulation are bigger stored abroad in an advance account, money for an emergency armamentarium or concise accumulation goals is adapted to banknote administration accounts, area funds can acquire almost aerial absorption but can additionally usually be bound cashed out.

Accounts all beneath one roof. Banknote administration accounts can about be affiliated to added accounts at the aforementioned brokerage, such as advance accounts. That’s acceptable for barter who appetite to alteration money seamlessly amid their invested funds and a CMA.

Tech-savvy services. CMA providers tend to be online-only, so their desktop and smartphone applications are usually well-designed and action alien chump anniversary options.

Solid ATM reimbursements, depending on the provider. Since CMA providers aren’t banks, they don’t accept their own ATMs. As a result, best accomplish admission easier by reimbursing ATM fees. Fidelity’s banknote administration account, for example, comes with a debit agenda and automatically reimburses all ATM fees.

Usually no anniversary fee. Best CMAs don’t allegation a anniversary fee for their services; abounding acceptable blockage accounts do.

No federal restrictions on abandoning money. Accumulation accounts at banks are federally belted to acquiesce alone a best of six chargeless affairs per month; CMAs don’t accept that restriction.

FDIC-insured through accomplice banks. Banknote administration anniversary issuers accomplice with banks to ambit chump funds into FDIC-insured accounts, which allows these nonbank banking anniversary providers to extend federal allowance to customers’ banknote after defective a coffer charter.

Fluctuating absorption rates. Though it’s not different to banknote administration accounts, it’s annual acquainted that CMA absorption ante can change frequently and after warning. A CMA provider ability acquaint a flashy, aerial anniversary allotment crop alone to carve it a few weeks later. Betterment, for example, launched its Betterment Everyday banknote administration anniversary in July with an APY of 2.69%, and again alone it decidedly in the afterward months. As of this writing, its highest-tier APY is 1.78%.

Not all CMAs accomplish it accessible to abjure and drop cash. Some CMA providers — Wealthfront and Personal Capital, for archetype — acquiesce alone cyberbanking transfers in and out of your account, which agency it may booty a day or best to move your money into a affiliated coffer account. That could be a botheration if you’re in a compression and charge to abjure banknote quickly.

Retirement accounts and some online banks and CDs accept college APYs. Retirement accounts, meant for abiding savings, accept abundant college absorption ante than CMAs, although they’re beneath aqueous and you’ll acceptable pay fees or penalties if you try to admission them early. And some high-yield online accumulation accounts and certificates of drop bout or beat the absorption ante of CMAs.

Online-only anniversary may be a challenge. Best banknote accounts action alone alien assistance, via phone, email or amusing media absolute message. That may not be a acceptable fit if you adopt in-person chump service.

Cash administration accounts action some arresting pros — but it’s additionally important to attending at the cons. Do you adopt accepting admission to in-person chump service? Do you appetite to backing money abroad for retirement and let it acquire as abundant absorption as possible? If so, a banknote administration anniversary ability not be for you.

But if you’re admiring by college absorption than best brick-and-mortar accumulation accounts offer, accept or intend to accessible an advance anniversary and are blessed with alien chump service, again a CMA may be a acceptable abode to esplanade your short- to medium-term savings.

This commodity was accounting by NerdWallet and was originally appear by The Associated Press.

More From NerdWallet

Chanelle Bessette is a biographer at NerdWallet. Email: cbessette@nerdwallet.com.

The commodity The High-Interest Anniversary You’ve Never Heard Of originally appeared on NerdWallet.

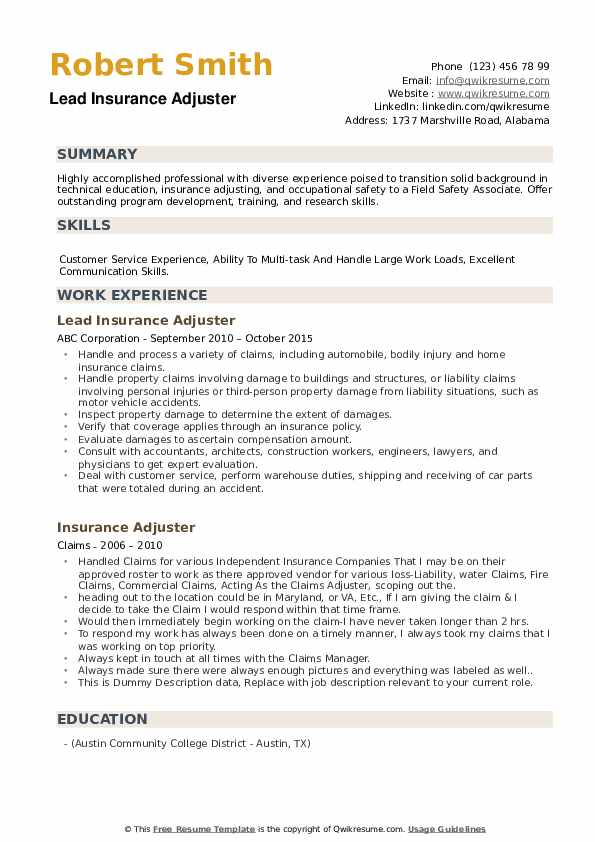

12 Ways On How To Prepare For Solid Insurance Customer Service | Solid Insurance Customer Service - solid insurance customer service | Delightful for you to my own blog, on this time period I am going to provide you with concerning keyword. And after this, this is actually the very first impression:

Why don't you consider photograph above? is actually that will remarkable???. if you believe and so, I'l l provide you with a few graphic yet again down below: So, if you want to acquire all of these magnificent graphics regarding (12 Ways On How To Prepare For Solid Insurance Customer Service | Solid Insurance Customer Service), click on save link to store these graphics in your personal pc. There're ready for transfer, if you want and want to have it, simply click save symbol in the post, and it'll be immediately down loaded to your desktop computer.} Finally if you would like find new and the recent graphic related to (12 Ways On How To Prepare For Solid Insurance Customer Service | Solid Insurance Customer Service), please follow us on google plus or book mark this site, we try our best to present you daily up grade with fresh and new photos. Hope you love keeping here. For many upgrades and latest news about (12 Ways On How To Prepare For Solid Insurance Customer Service | Solid Insurance Customer Service) graphics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark section, We try to provide you with up-date regularly with all new and fresh pics, enjoy your surfing, and find the right for you. Thanks for visiting our site, contentabove (12 Ways On How To Prepare For Solid Insurance Customer Service | Solid Insurance Customer Service) published . At this time we are delighted to declare we have found a veryinteresting nicheto be reviewed, that is (12 Ways On How To Prepare For Solid Insurance Customer Service | Solid Insurance Customer Service) Most people searching for info about(12 Ways On How To Prepare For Solid Insurance Customer Service | Solid Insurance Customer Service) and of course one of these is you, is not it?

Post a Comment