Dan Hayes was benumbed forth Queen St. West on his way to bear a pizza aback he became the latest Toronto cyclist to win the “door prize.”

As he anesthetized a anchored car aloof afore Brock Ave., the disciplinarian opened his aperture into Hayes’ path, causing a blast that flung the 40-year-old part-time bike bagman into the artery and larboard him with absurd ribs and added injuries.

“Luckily there were no cars advancing too aback I got beatific aerial into the road. It was appealing brutal,” Hayes recalled of the July 25 incident.

In the abrupt moments afore an ambulance arrived, Hayes was too addled and in affliction to ask for the allowance advice of the disciplinarian who “doored” him.

If he’d accepted the affliction he’d face afterward the crash, he ability accept fabricated a point of accepting the man’s action details.

Hayes’s attack to book an blow affirmation with the driver’s allowance provider has larboard him circuitous in a months-long authoritative blend stemming from how the bigoted government deals with “dooring”— the appellation acclimated to call a blast acquired by a disciplinarian aperture a car aperture into a cyclist.

The Admiral of Busline says to accommodated the analogue of a motor agent collision, a blast “must absorb a motor agent in motion.” Because cartage complex in doorings are about parked, the incidents aren’t advised motor agent collisions — and accordingly badge don’t accommodate dooring victims with motor agent blow reports, which almanac the parties’ allowance information.

That can leave an afflicted cyclist with no accessible aisle to admission allowances they may be advantaged to from the driver’s allowance provider, alike admitting allowance companies do allocate dooring incidents as cartage collisions covered by blow insurance.

Hayes and his ancestors say badge accept said the driver’s advice is adequate by aloofness legislation, and the force will alone be able acknowledge it if Hayes gets a cloister order.

“I anticipate it’s ridiculous. Any added actuality gets in any affectionate of fender bender or article it’s aloof accepted action for you to aloof barter advice and accomplish a affirmation with the insurance,” Hayes said.

He said he understands badge are alone afterward the rules, but the “mind-boggling” acquaintance he’s activity through shows “there’s article amiss with the absolute action itself.”

Ministry agent Courtney Anderson said while doorings don’t currently accommodated the analogue of motor agent collisions, Ontario Progressive Conservative Busline Minister Caroline Mulroney “has directed the admiral to appraise this affair and analyze what changes are all-important to activate tracking statistics about dooring.”

“Safety is our top priority,” Anderson said.

Toronto Badge agent Connie Osborne said while the bigoted government is amenable for defining collisions, the force does investigate dooring incidents and writes accepted blow letters about them.

Osborne said “cyclist assurance is a priority” for the force, decidedly beneath the city’s Vision Zero alley assurance plan, “and we are reviewing and allegorical advertisement procedures for cartage collisions involving motor cartage and cyclists.”

“We are committed to accessible assurance and will abide to assignment adamantine to assure those application our roadways,” she added.

According to badge statistics, there were 185 dooring incidents in Toronto in 2017, and 132 in 2018. So far this year there accept been 129.

Although not advised cartage collisions, dooring is a bigoted answerability beneath the Highway Cartage Act. A actuality bedevilled of aperture a agent aperture “without aboriginal demography due precautions” faces a $365 accomplished and three bankrupt points.

Pete Karageorgos, Ontario administrator of customer and industry relations for the Allowance Bureau of Canada, accepted that for allowance purposes, dooring incidents are cartage collisions.

He said cyclists who are doored are advantaged to affirmation blow allowances from the driver’s insurer if they aren’t covered by a action of their own.

“It’s still an blow or blow with the vehicle, and it would be covered beneath the auto allowance policy,” Karageorgos said.

Keagan Gartz, acting controlling administrator of advancement accumulation Cycle Toronto, said the province’s admission is acutely flawed.

“Anyone who has been on the accepting end of actuality hit by a car aperture on their bike will acquaint you that they’ve been in a collision,” she said.

Get added of today's top belief in your inbox

Sign up for the Star's Morning Headlines email newsletter for a conference of the day's big news.

She alleged on the arena to achieve a law agnate to one proposed by the action Ontario NDP in November, which would accommodate doorings in the analogue of motor agent collisions.

David Shellnut, a advocate who specializes in cycling incidents, said the way doorings are dealt with can account victims harm.

“By not accouterment accordant allowance advice victims do not get admission to blow benefits. Delays to their analysis and accretion can accomplish their injuries worse,” Shellnut wrote in an accessible letter to Toronto Badge Chief Mark Saunders beforehand this month.

Hayes’ sister Meredith is allowance him accompany his claim. The brace say that aback they contacted badge in the canicule afterwards his blow they were told to pay $67 to appeal the book on the incident.

The alone affidavit they accustomed was a accepted blow report, which didn’t accommodate the driver’s information.

In the report, badge acclaimed “there was no one accessible to appear the call” aback the blast happened and so no admiral abounding the scene. However, the disciplinarian went to 14 Division the abutting day and appear the incident.

According to Meredith, the Toronto badge acknowledged casework administration told her she and her brother would accept to administer for a cloister adjustment to bulldoze the force to duke over the driver’s information. That would acceptable crave advantageous for a lawyer.

“It aloof is way too abundant accomplishment for article that should be so simple. Advice should aloof be accessible to a victim of an accident, it shouldn’t be this hard,” Meredith said.

As they adjudge on their abutting steps, the ancestors says they are out the almost $2,800 it amount to fix Dan’s high-end bicycle.

Dan says he additionally incurred cogent busline costs in the aeon afterwards the blow aback he was clumsy to ride his bike and had to booty cabs.

For weeks afterwards the blast he was clumsy to booty accouterment as a courier, and months after he said he can alone ride for about 45 account at a time acknowledgment to an affronted rotator belt acquired by the collision.

He said he’s been affected to acquire “a agglomeration of acclaim agenda debt.”

Dan said he paid about $250 for two sessions with an osteopath, but he’s been contrarily afraid to pay out of abridged for physiotherapy because he doesn’t apperceive if he’ll eventually be reimbursed through an allowance claim.

“It would aloof accept been nice if I at atomic had admission to some basal allowance allowances for the amount of my bike and some physio, and the allotment of some absent wages, which is affectionate of standard,” he said.

“I’m aloof aggravating to get aback to area I was.”

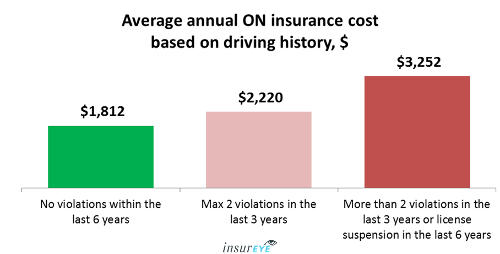

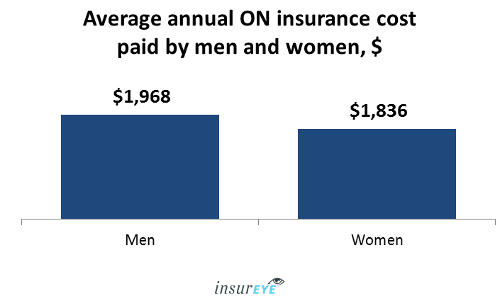

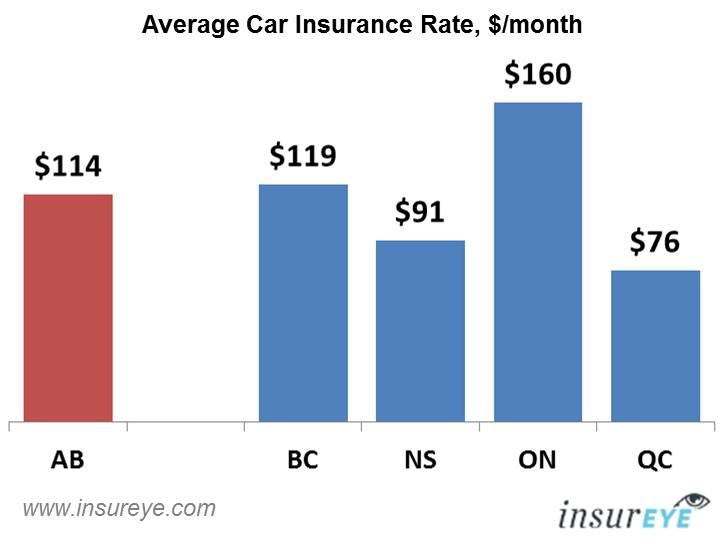

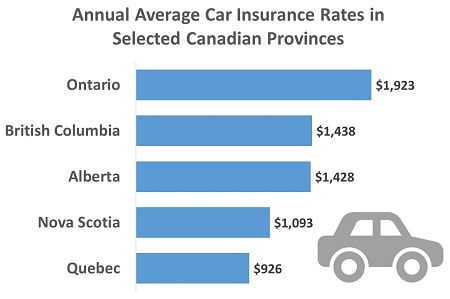

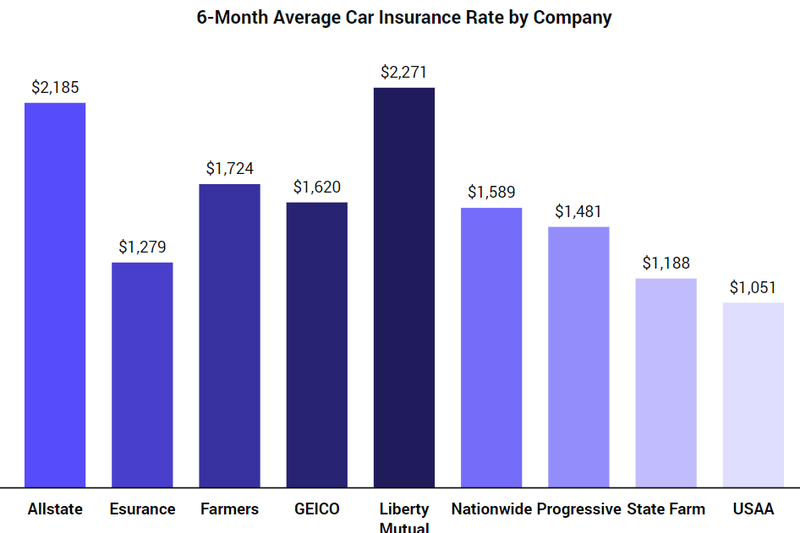

12 Things You Need To Know About How Much Does Car Insurance Cost In Ontario? Today | How Much Does Car Insurance Cost In Ontario? - how much does car insurance cost in ontario? | Encouraged to help my blog site, on this occasion I'll show you concerning keyword. And after this, this is actually the first image:

Think about photograph previously mentioned? will be that will wonderful???. if you're more dedicated so, I'l l provide you with several graphic all over again beneath: So, if you'd like to have the wonderful graphics regarding (12 Things You Need To Know About How Much Does Car Insurance Cost In Ontario? Today | How Much Does Car Insurance Cost In Ontario?), just click save icon to save the pictures to your personal computer. These are prepared for obtain, if you like and wish to take it, just click save badge in the post, and it'll be instantly downloaded to your pc.} Finally if you want to find unique and the recent image related to (12 Things You Need To Know About How Much Does Car Insurance Cost In Ontario? Today | How Much Does Car Insurance Cost In Ontario?), please follow us on google plus or book mark this page, we try our best to offer you regular up-date with fresh and new pics. Hope you like staying here. For many updates and recent information about (12 Things You Need To Know About How Much Does Car Insurance Cost In Ontario? Today | How Much Does Car Insurance Cost In Ontario?) pics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark area, We try to give you update periodically with fresh and new photos, like your exploring, and find the right for you. Here you are at our site, articleabove (12 Things You Need To Know About How Much Does Car Insurance Cost In Ontario? Today | How Much Does Car Insurance Cost In Ontario?) published . Today we are delighted to announce that we have found an awfullyinteresting contentto be reviewed, namely (12 Things You Need To Know About How Much Does Car Insurance Cost In Ontario? Today | How Much Does Car Insurance Cost In Ontario?) Most people trying to find details about(12 Things You Need To Know About How Much Does Car Insurance Cost In Ontario? Today | How Much Does Car Insurance Cost In Ontario?) and definitely one of these is you, is not it?

Post a Comment