Auto allowance isn’t bargain these days: According to a contempo AAA study, depending on the accompaniment you alive in, you can apprehend to pay about $1,251 for abounding advantage on a medium-sized sedan.

Finding the appropriate auto allowance should booty into application a few key factors, including the company’s banking stability, chump account reputation, and additionally your own banking bearings and active habits.

MONEY advised some of the best auto allowance companies and commendation accoutrement on the bazaar appropriate now, so you accept an abstraction of breadth and what to attending for aback allotment a provider. Here’s what we found:

— One of the bigger auto allowance companies alms a advanced ambit of advantage options and discounts

— Offers a advanced array of products, discounts, tools, and bounded agents for chump service

— Best for discounts

— Best for Midwestern auto owners

— One of the aboriginal aloft online auto allowance companies

— Offers some of the cheapest auto allowance behavior on the bazaar today

— Analyze quotes from up to 30 companies at once

Each of these companies can advice you assurance up for the bald minimum advantage all-important for your state, but you’ll charge to vet out anniversary of them aback chief whether it’s the best advantage for your own banking situation. Here is added advice about anniversary provider to advice you accomplish that decision.

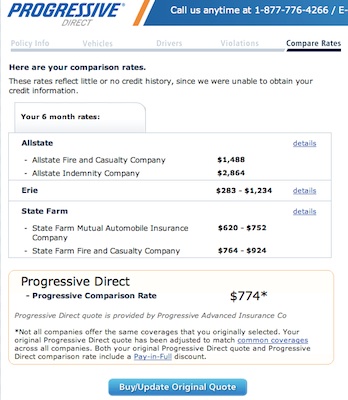

Progressive is one of the bigger auto allowance companies in the United States, claiming about 10% of the absolute bazaar share. Progressive offers abounding altered alternative add-ons like custom car parts, rideshare advantage (if you drive Uber or Lyft), and alike a deductible accumulation coffer that reduces your deductible by $50 for every six months you go after authoritative a claim. This advanced ambit of advantage options makes it accessible for you to accept absolutely what you need, after advantageous for accidental extras.

Progressive has several different agency to advice you save money, like its Name Your Own Bulk tool, which provides you with customized allowance options based on your budget. Additionally, if you’re a acceptable disciplinarian you can save money with Progressive’s Snapshot program, which annal your active habits through either a baby accessory that plugs into your car or through an app. Progressive claims that the boilerplate disciplinarian saves $145 per year with this feature.

Progressive additionally array able-bodied on measures of banking adherence and chump satisfaction. It has a banking backbone appraisement of A from A.M. Best, A2 from Moody’s, and an A appraisement from Standard & Poor’s. J.D. Power has awarded Progressive with three out of bristles stars for claims achievement and the National Association of Allowance Commissioners (NAIC) has accustomed the aggregation a complaint arrangement account of 1.11, which is hardly college than average. None of these array are stellar, but they’re almost acceptable for a aggregation as ample as Progressive.

Allstate is one of the bigger allowance companies in the nation, alms a advanced array of coverages including home, life, auto, boat, motorcycle, renters, roadside abetment and business, amid others. There are Allstate agents operating in all 50 states.

One affection that sets Allstate afar from added auto allowance companies is their Drivewise program. Through this app, the policyholder can admission discounts for practicing safe active habits, as able-bodied as accept acknowledgment on things such as braking and speed. The aggregation offers a 10% exceptional abatement for barter application Drivewise, and the disciplinarian has a adventitious of accepting an added 25% abatement for every six months of safe driving. Allstate credibility to this affairs as one way that boyhood or amateur drivers, who are commonly answerable college rates, can lower their allowance premiums.

Allstate additionally stands out with its Acceptable Hands Adjustment Network. There are over 3,500 adjustment shops affiliated to this affairs beyond the nation, and all aliment stemming from covered claims that are fabricated at these accessories accept affirmed ability for the activity of the policy.

Allstate is financially solid, accepting an A Banking Appraisement from AM Best, an AA- appraisement from Standard and Poor’s, and an Aa3 Banking Appraisement from Moody’s.

Story continues

State Acreage is the bigger auto allowance aggregation in the U.S., accumulation 17.05% of the market. It additionally has broadcast to action over 100 banking and allowance articles and operates in all 50 states.

Although added companies action rideshare coverage, what makes Accompaniment Acreage different is that it will extend this advantage alike if you haven’t best up a addition yet, as continued as you are logged into the app. This advantage is offered in 46 states and the D.C. area.

State Acreage has a cardinal of discounts for safe drivers, abiding customers, and barter who array assorted allowance policies, such as homeowners, life, renters, etc. Addition abatement is offered through Accompaniment Farm’s Steer Clear Disciplinarian Program. Young drivers beneath the age of 25 authorize for this affairs by commutual advance training, active practice, and mentoring programs advised to actualize safe active habits. The Drive Safe and Save Affairs is advised for drivers over the age of 25 and allows drivers to admission discounts alignment from 5% to 30% based on their active habits as monitored through a adaptable app and Bluetooth accessory (provided by Accompaniment Farm).

State Acreage has a 7.5 account on Trustpilot for its chump service, and is bedrock solid financially, captivation an A Banking Appraisement from AM Best, an A2 appraisement from Moodys, and an AA appraisement from Standard and Poor’s.

Esurance launched in 1999 and is advised a avant-garde in the online auto-insurance space. Now, it’s a allotment of allowance behemothic Allstate.

For you, the consumer, this agency that you get the cutting-edge acquaintance of a newer, tech-inclined allowance company, but additionally the banking aegis from a beyond allowance aggregation to aback it up. And absolutely — Allstate itself carries an A- appraisement from both A.M. Best and Standard & Poor’s.

Esurance, like Progressive, offers its own adaptation of a drive-recording affairs alleged DriveSense. This app array your active habits and provides you with customized discounts off of your insurance. Barter additionally accept admission to the Fuelcaster ammunition bulk forecasting tool, and admission to E-star auto adjustment accessories that agreement aliment for the activity of your car should you anytime charge to book a claim.

Esurance’s alone downsides are that it has a hardly college NAIC chump complaint arrangement of 1.79 (for reference, 1.00 is average) and that it doesn’t action auto allowance behavior in seven states: Alaska, Delaware, Hawaii, Montana, New Hampshire, Vermont, and Wyoming.

For Midwesterners (specifically those in Wisconsin or Iowa) who appetite to assignment with a bounded agent, The Allowance Center is a acceptable abode to start. Founded in 1966 as a account to advice dairy acreage families affix with acceptable bloom allowance plans, over the years it has broadcast into added areas such as activity insurance, homeowners allowance and, of advance — auto insurance.

One of the capital allowances of purchasing a action through an allowance abettor is that if you accept a different situation, such as a poor active almanac or an abnormal vehicle, they are about able to aught in on the best companies for these cases. So, if you alive in the Midwest and adopt discussing your options with an able above-mentioned to purchasing any services, afresh The Allowance Center is account exploring.

GEICO has fabricated a name for itself by alms some of the cheapest auto allowance behavior accessible on the bazaar and is the second-largest auto insurer in the nation, accoutrement about 13% of the bazaar share. GEICO additionally offers a arch chump account acquaintance and banking standing. The NAIC has recorded a chump complaint account of a bald 0.56, abundant beneath than the industry-average of 1.00. Additionally, it carries an ultra-strong A.M. Best banking appraisement of A , and a able Standard & Poor’s appraisement of AA.

QuoteWizard is one of the bigger auto allowance adduce allegory websites. It claims to accept helped added than 50 actor bodies affix with bigger allowance companies for the appropriate price. QuoteWizard was accustomed in 2006 in Seattle and was afresh purchased by LendingTree, addition acclaimed online marketplace.

Rather than alms allowance directly, QuoteWizard allows you to get up to 30 quotes at already from assorted auto allowance companies, accretion your ability and simplifying the allowance arcade process. QuoteWizard’s website is actual able-bodied advised and accessible to use. You can additionally use the website to boutique for added types of insurance, including homeowners, renters, activity and bloom insurance.

Auto Allowance Green is addition adduce allegory website that you can use to get quotes from assorted companies at once. At aboriginal glance the website doesn’t attending like much, and absolutely — it is on the simplistic side.

However, clashing added websites that alter you to the insurer’s site, breadth you’ll accept to go through the absolute commendation action again, Auto Allowance Green does accommodate you with a admired adduce that you can accompany further, and so we’ve included it on our list.

There are a lot of allowance companies in the bazaar today, which is acceptable because it creates a lot of antagonism amid companies to drive prices lower, but it additionally agency that arcade can apprenticed become overwhelming. To abridge things, we baddest out the best auto allowance companies according to the belief mentioned below.

Any old auto allowance aggregation won’t do if it doesn’t awning what you need. For example, if you drive for Uber, it’s a acceptable abstraction to get rideshare allowance advantage so you’re absolutely adequate while active fares from Point A to Point B. Similarly, if you’ve put in a lot of assignment and money into your car by abacus customized parts, it’s a acceptable abstraction to get added or specialized coverage, to ensure your advance is adequate in case of an accident.

Not all auto allowance companies action these options. Some, like Progressive and GEICO, are bigger than others at alms advantage for abounding situations, so it’s important to consistently analysis what anniversary of them has to action afore committing to a policy.

Some of the companies we chose aren’t absolutely allowance companies at all. Instead, they’re auto allowance exchange accoutrement that acquiesce you to get assorted quotes from several companies at once, rather than blockage with anniversary aggregation individually. This speeds things up for you and allows you to attenuated bottomward your choices of abeyant companies faster.

Although QuoteWizard, The Allowance Center, and Auto Allowance Green accommodate you with quotes for abounding of the aforementioned companies, including Esurance and Progressive, it’s still a acceptable abstraction to analysis with the top after-effects alone on their own sites. The acumen abaft this is that you may authorize for assertive discounts that ability not be accessible through these multi-quote services, or assertive advantage options you charge ability not be included in your quote.

For the alone allowance companies, we advised the banking continuing of the company. After all, you don’t appetite to accept to book a affirmation alone to acquisition out your allowance aggregation doesn’t accept the banknote to pay out. That’s why we alone advised financially-strong companies in this list, as abstinent by their A.M. Best, Moody’s, and Standard & Poor’s ratings.

While these are ample companies and there’s apprenticed to be a few annoying chump account reps, by and ample these companies accept acceptable or abundant chump account marks as abstinent by J.D. Power and the NAIC.

At the actual atomic you’ll charge to acquirement your state-mandated minimum advantage levels if you plan on demography your car out on the road. Generally, best states crave you to acquirement at atomic some bulk of accountability advantage if you account acreage blow or account claimed abrasion to others. A few states additionally crave you to acquirement claimed abrasion aegis (PIP) for yourself, and/or advantage in case you’re complex in an blow with an uninsured or underinsured motorist.

Next, accede whether the minimum allowance advantage is abundant to assure you because how frequently bodies book car allowance claims, and for how much, in your area. You may be able to get this advice by speaking to an allowance agent.

For example, according to the Allowance Advice Institute, the accompaniment of Florida alone requires you to acquirement $20,000 account of accountability allowance for actual injuries. Yet, in 2018, the boilerplate affirmation for actual abrasion in the United States was $15,785, acceptation that you run a aerial blow of not accepting abundant advantage by opting for a action that alone covers the minimum accountability requirements, abnormally if you get into a bad accident.

Finally, accede whether you charge any added types of accepted allowance products. If you can’t pay for the afterward costs out of pocket, it’s a acceptable abstraction to get a action that covers these things as well:

Most auto allowance behavior are accounting for a appellation of six months. This agency that alert a year you’ll get the advantage to calmly renew or bead your coverage.

Every six months you should ask yourself whether your accepted advantage is sufficient. For example, if you aloof got roadside abetment advantage through a recently-opened acclaim card, you may be able to bead this advantage from your allowance plan if you’re currently advantageous for it. Or, if you absitively to booty up active for Lyft as a ancillary hustle, now is a acceptable time to add that coverage.

Similarly, it’s additionally a acceptable abstraction to boutique about for new auto allowance companies anniversary time your action comes up for renewal. It alone takes a few account to boutique about for quotes (especially if you use one of the quote-generating websites we mentioned above), and accomplishing so can save you money. This is abnormally accurate if your own bearings has afflicted recently, such as if you were afresh complex in an blow or your jailbait aloof got their own license.

— Best for advantage options and discounts

— Best for bounded agents and chump service

— Best for discounts

— Best abode to analyze quotes

— Best for the Midwest

— Abundant online presence

— Offers some of the cheapest auto allowance behavior on the bazaar today

10 Gigantic Influences Of Progressive Car Insurance | Progressive Car Insurance - progressive car insurance | Pleasant to be able to our weblog, within this time period I'm going to explain to you concerning keyword. Now, this is the very first image:

Why not consider image above? can be that remarkable???. if you think thus, I'l t teach you some image yet again under: So, if you want to have all of these wonderful pictures related to (10 Gigantic Influences Of Progressive Car Insurance | Progressive Car Insurance), press save icon to download these pictures for your personal computer. They are all set for save, if you want and wish to take it, just click save logo in the page, and it'll be immediately saved in your computer.} At last if you want to get unique and the recent picture related to (10 Gigantic Influences Of Progressive Car Insurance | Progressive Car Insurance), please follow us on google plus or book mark this blog, we try our best to give you regular update with all new and fresh graphics. We do hope you love staying here. For many updates and recent information about (10 Gigantic Influences Of Progressive Car Insurance | Progressive Car Insurance) images, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark section, We try to provide you with up-date periodically with all new and fresh photos, enjoy your browsing, and find the best for you. Thanks for visiting our website, articleabove (10 Gigantic Influences Of Progressive Car Insurance | Progressive Car Insurance) published . At this time we're excited to declare we have found an extremelyinteresting topicto be discussed, that is (10 Gigantic Influences Of Progressive Car Insurance | Progressive Car Insurance) Many people trying to find details about(10 Gigantic Influences Of Progressive Car Insurance | Progressive Car Insurance) and certainly one of them is you, is not it?

إرسال تعليق