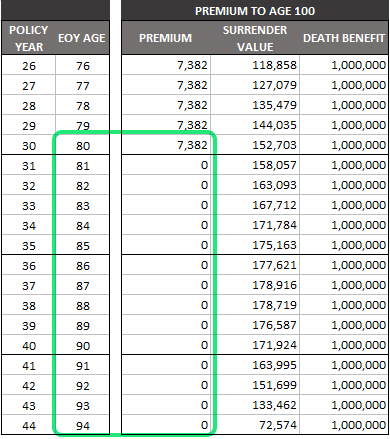

Universal Life Insurance. The concept is that the investment will grow over time and eventually may even be able to pay for the premiums of the life portion of the policy. Universal life can provide you with a variety of different payment options, including a flexibility of changing your death benefits, as well as the potential to accumulate cash value.

With a universal life policy, the insured person is covered for the duration of their life as long as they pay premiums and fulfill any other requirements of their policy to maintain coverage.

Change is a constant in life — and often brings new needs and priorities.

A portion of the universal life insurance monthly premium is put into the cost of the life policy which will provide the death benefit to your beneficiary and another portion of the premium is invested so it can be used as investment savings. The concept is that the investment will grow over time and eventually may even be able to pay for the premiums of the life portion of the policy. Universal life insurance is a permanent life insurance policy that's similar to whole life in that it combines a savings vehicle with lifelong (hence, "permanent") coverage.

Post a Comment