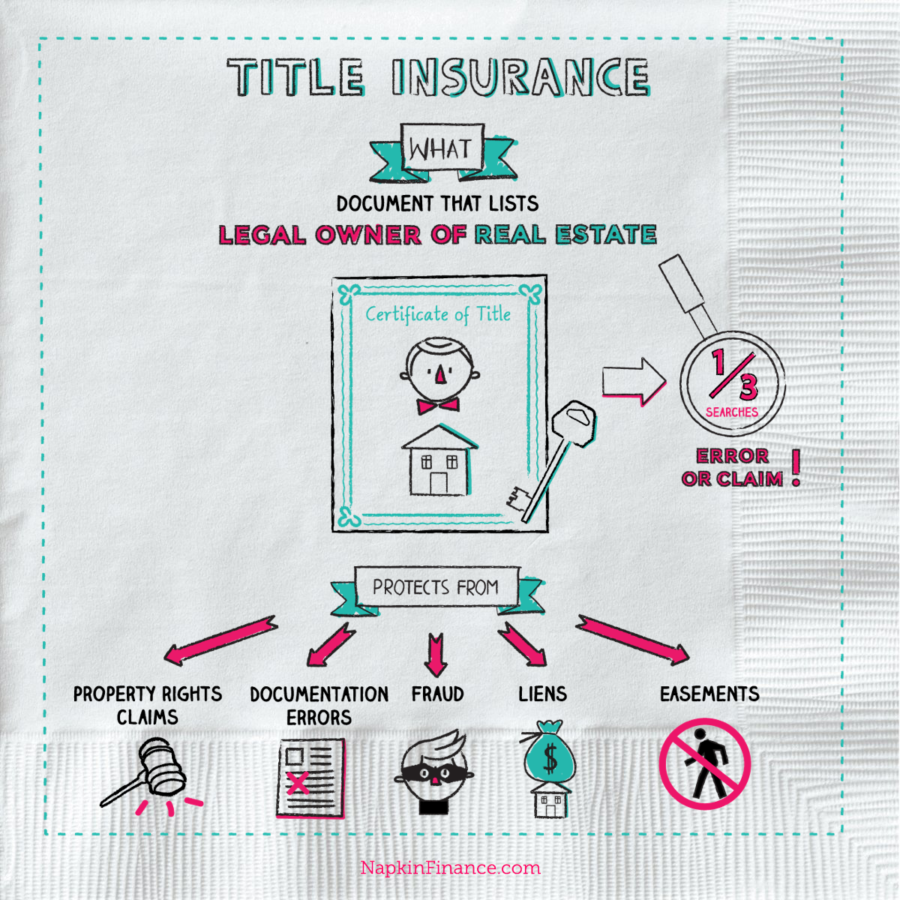

Title Insurance. Title insurance is crucial for a home buyer because it protects you and your lender from the possibility that your seller doesn't—or previous sellers didn't—have free and clear ownership of the house and property and, therefore, can't rightfully transfer full ownership to you. Getting title insurance is one of the standard steps home buyers take before closing on a home purchase.

Title insurance is crucial for a home buyer because it protects you and your lender from the possibility that your seller doesn't—or previous sellers didn't—have free and clear ownership of the house and property and, therefore, can't rightfully transfer full ownership to you.

If any liens or encumbrances are found, the title company might require that the home buyer take steps to eliminate them before issuing a title policy.

Title insurance insures against financial loss caused by defects in title to real estate. ALTA® members search, review and insure land titles to protect home buyers and mortgage lenders who invest in real estate. Title insurance is a type of insurance that protects mortgage lenders and/or homeowners against claims questioning the legal ownership of a home or property (i.e., the title to the property).

Post a Comment