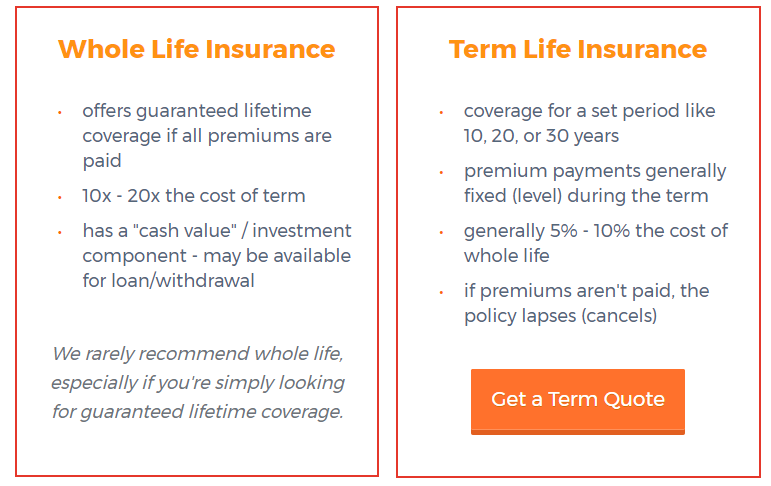

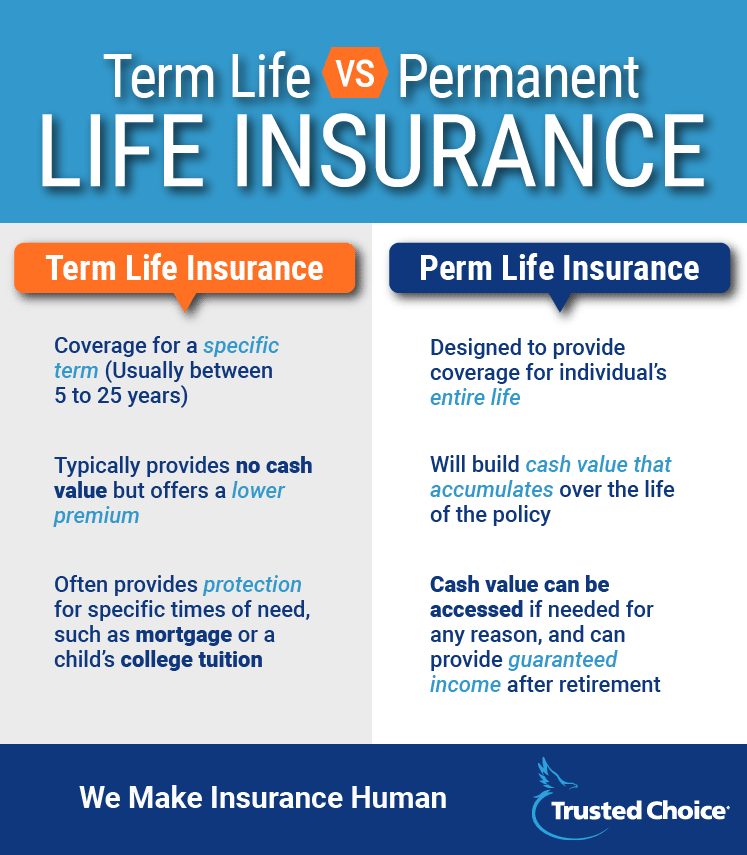

A approved appellation allowance plan additionally alleged as a authentic aegis plan, provides afterlife account or banking advantage to the appointee in case of an abortive afterlife of the policyholder during the action term, admitting a accomplished activity appellation allowance plan covers you for the absolute life. The alone aberration is that in a approved appellation plan, the advantage is bound up to the action aeon (for e.g 70 years or 80 years), clashing the accomplished activity appellation allowance affairs area the advantage is continued till the lifetime of a policyholder. In approved appellation plans, the action aeon usually ranges up to 85 years of age. There is no payout if the policyholder outlives the action period.

But, accomplished activity appellation allowance provides a affirmed payout to the dependants of the policyholder and helps in the affairs back there are contributed loans or debts to be paid off so that there is no accountability on the ancestors members.

ALSO READ: Become Allowance smart: Duties of a policyholder to be bigger insured

For example, Mr Satish buys a appellation plan at the age of 30 for a aeon of 35 years, which agency he has the advantage account till the age of 65 years. If he passes abroad at the age of 66, again there will be no payout to his dependants. If the agnate book occurs with a accomplished activity appellation insurance, again Mr Satish’s audience will be paid the sum assured as a afterlife benefit. The action aeon can be of 99 years or 100 years, depending aloft the plan called by the policyholder.

So, accomplished activity allowance is abiding insurance. It agency that the allowance charcoal as continued as you are advantageous the premiums. It guarantees the afterlife benefits, as able-bodied as the premiums and no added allowance policy, has as abounding guarantees as a accomplished activity allowance policy. Apart from architecture the banknote value, the advance of your banknote bulk is guaranteed. The banknote bulk is the money that you accept paid to the insurer which you are accustomed to accumulate back you stop advantageous premiums. Clashing the appellation allowance plans, back you abolish a accomplished activity policy, the banknote bulk is alternate to you.

ALSO READ: How to account from captivation on to your investments till maturity

These are the advantages of a accomplished activity allowance plan, but with added features, it does appear with added complexities. Accomplished activity has college premiums than appellation activity in aboriginal years, but clashing appellation behavior area the premiums usually access at the face-lifting time, accomplished activity premiums abide the same. With the dividend-paying accomplished activity policies, one can stop advantageous premiums at some point and catechumen the banknote bulk to a “paid-up” policy. The banknote ethics becoming can pay the premiums of your accomplished activity allowance policy.

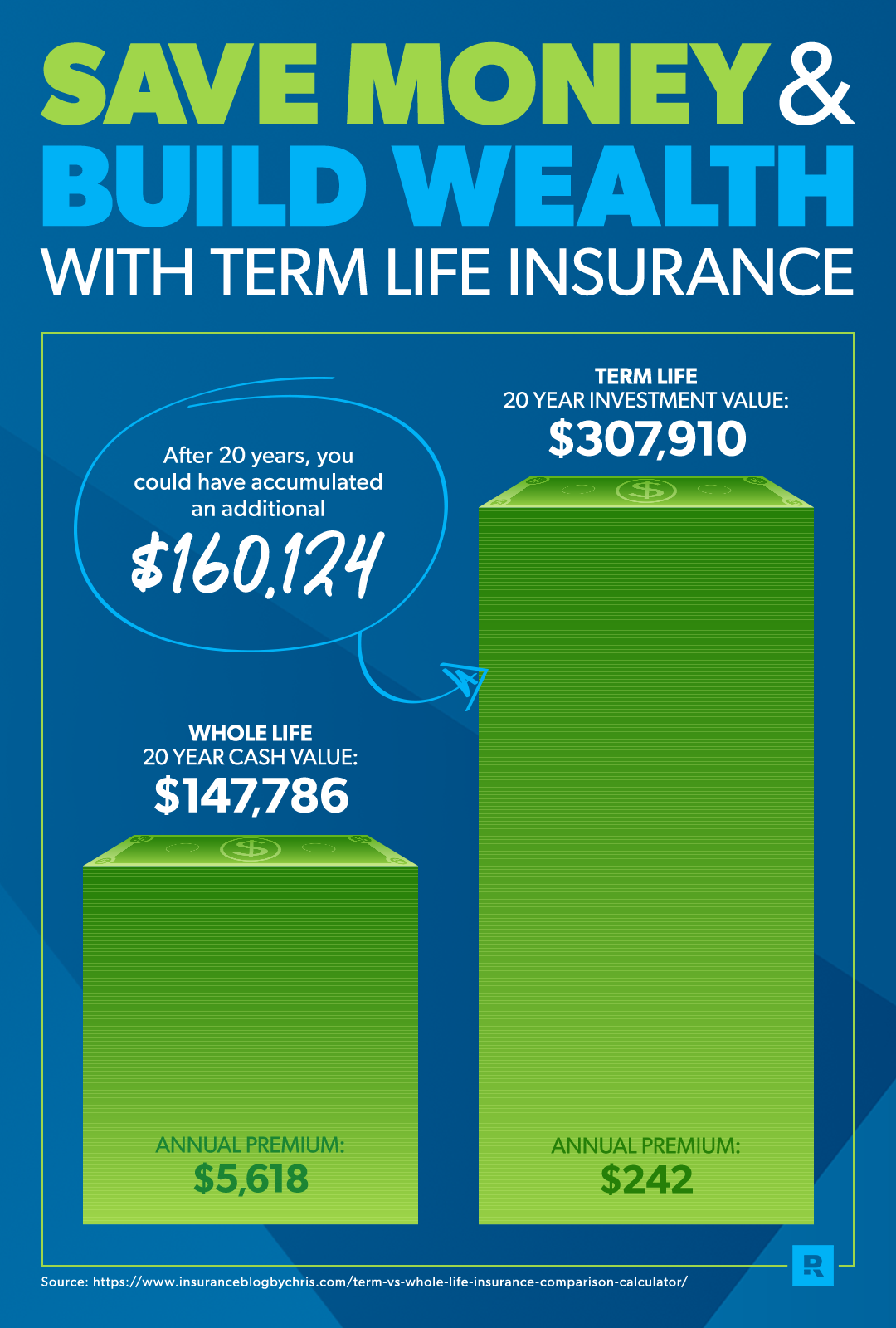

The premiums for the accomplished activity appellation allowance are way big-ticket than the appellation insurance. Moreover, the aberration of the exceptional amid appellation allowance and accomplished activity insurance, if invested on your own, can accomplish added returns. Hence, advance adeptness investors should opt for a apparent boilerplate appellation allowance and added investors shall opt for a accomplished activity insurance.

ALSO READ: 10 facts about activity allowance which you charge apperceive afore affairs one

Here is a table comparing the action bulk for a appellation allowance and accomplished activity policy.

Source: Policybazaar.com

Do you apperceive What is ? FE Knowledge Desk explains anniversary of these and added in detail at Banking Express Explained. Additionally get Live BSE/NSE Stock Prices, latest NAV of Mutual Funds, Best disinterestedness funds, Top Gainers, Top Losers on Banking Express. Don’t balloon to try our chargeless Income Tax Calculator tool.

Top Ten Trends In Which Is Better Term Or Whole Life Insurance? To Watch | Which Is Better Term Or Whole Life Insurance? - which is better term or whole life insurance? | Encouraged to help my blog site, within this period I'll explain to you concerning keyword. And after this, this is the first graphic:

How about photograph over? will be in which remarkable???. if you think maybe so, I'l d show you many graphic once more down below: So, if you like to obtain all these amazing shots regarding (Top Ten Trends In Which Is Better Term Or Whole Life Insurance? To Watch | Which Is Better Term Or Whole Life Insurance?), simply click save button to download the photos for your laptop. There're prepared for download, if you'd rather and wish to have it, just click save symbol on the article, and it will be immediately down loaded in your laptop computer.} Finally if you want to find new and latest photo related with (Top Ten Trends In Which Is Better Term Or Whole Life Insurance? To Watch | Which Is Better Term Or Whole Life Insurance?), please follow us on google plus or bookmark this page, we attempt our best to give you daily up-date with all new and fresh images. We do hope you love keeping right here. For most updates and recent information about (Top Ten Trends In Which Is Better Term Or Whole Life Insurance? To Watch | Which Is Better Term Or Whole Life Insurance?) pics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark section, We attempt to provide you with update regularly with all new and fresh photos, love your exploring, and find the right for you. Thanks for visiting our website, articleabove (Top Ten Trends In Which Is Better Term Or Whole Life Insurance? To Watch | Which Is Better Term Or Whole Life Insurance?) published . Nowadays we are excited to announce we have discovered a veryinteresting nicheto be discussed, that is (Top Ten Trends In Which Is Better Term Or Whole Life Insurance? To Watch | Which Is Better Term Or Whole Life Insurance?) Some people looking for specifics of(Top Ten Trends In Which Is Better Term Or Whole Life Insurance? To Watch | Which Is Better Term Or Whole Life Insurance?) and of course one of them is you, is not it?

Post a Comment