Thinking about affairs a home or refinancing in ’Bama? Here’s aggregate you charge to apperceive about the mortgage ante Alabama borrowers can expect.

Lenders accommodate borrowers with the funds to acquirement or refinance a home. In exchange, you accord the accommodation with interest. Your mortgage bulk is the absorption bulk answerable by your lender. The absorption you pay covers the bulk of administering your loan.

Lenders don’t action every borrower the aforementioned bulk because abounding factors appulse your mortgage rate:

Each lender has its own approach, so it’s capital to get a acquirement or refinance quotes from assorted lenders.

Not all mortgages are the same. Actuality are the best accepted types of mortgages:

The federal government doesn’t assure accepted mortgages. This bureau that lenders tend to be stricter about who can qualify. These loans about accept a college acclaim account requirement. They may additionally crave a bottomward acquittal of 10% to 20%. If you put bottomward beneath than 20%, you may charge to pay for clandestine mortgage allowance (PMI). PMI pays the lender if a borrower defaults and the home sells for beneath than the mortgage balance.

The Federal Housing Administration backs FHA loans. This allows lenders to action these mortgages to a broader ambit of borrowers. Borrowers with acclaim array as low as 500 can authorize with a 10% bottomward payment. Borrowers with a 580 acclaim account or college can accomplish a bottomward acquittal as low as 3.5%.

Borrowers accept to pay mortgage insurance, charge accomplish mortgage allowance exceptional payments — both upfront advancing account allowance exceptional payments.

The Department of Agriculture insures USDA loans. Borrowers can use a USDA accommodation to acquirement a home in a rural area. Some USDA loans accept no minimum bottomward payment, but there are assets limitations.

The Department of Veterans Affairs insures mortgages for veterans and accepted account members. Those who authorize can get a mortgage with no bottomward acquittal and low-interest rates. VA loans don’t crave PMI and there’s additionally a cap on closing costs.

Private lenders action government-backed mortgages. Anniversary government bureau approves its lenders. Deciding on the appropriate blazon of mortgage is a big decision. The best mortgage companies will booty the time to get to apperceive you and acclaim the best mortgage blazon for your situation.

Your mortgage appellation is how continued your mortgage will aftermost if you aloof accomplish the minimum account payments. Let’s attending at a few accepted mortgage terms:

5/1 ARMs sometimes accept a lower absorption bulk than a 30-year fixed-rate mortgage, but it depends on the market.

Lenders change mortgage ante circadian on weekdays. They change ante in acknowledgment to changes in bread-and-butter altitude and the absolute acreage market. For example, if the unemployment bulk drops, absorption ante ability edge up by 0.05% or more.

These changes ability not assume like a big deal, but alike a baby change can bulk you (or save you) bags of dollars over your mortgage term. We amend mortgage ante frequently to reflect the best accordant information.

Here are the accepted mortgage ante in Alabama:

Ante based on an boilerplate home amount of $138,975 and a bottomward acquittal of 20%.

Mortgage absorption may assume low compared to added banking articles but the costs add up. Anniversary account mortgage acquittal you accomplish is disconnected up amid interest, your accommodation balance, homeowners insurance, acreage taxes and added expenses.

The lender calculates how abundant of your acquittal goes against absorption anniversary month. Anniversary ages you pay bottomward added of your mortgage antithesis and beneath in interest. This action is alleged amortization. Let’s booty a attending at how abundant you pay in absorption in 4 Alabama cities.

Your acclaim account is a 3-digit cardinal that gives lenders an overview of how you’ve handled credit. Array ambit from 300 – 850. A account of 700 or college is advised good, and acceptable acclaim array get the everyman absorption rates. Lenders authorize minimum acclaim scores.

They generally won’t accept a mortgage for borrowers who don’t accept at atomic the minimum acclaim score. Actuality are acclaim array for several Alabama lenders.

Ready to get a refinance or acquirement quote? Actuality are our picks for the 5 best lenders in Alabama:

Rocket Mortgage is an online lender. You can complete the absolute action from the abundance of your home.

You won’t be larboard abandoned during the process, admitting — Rocket Mortgage has award-winning chump service.

Rocket Mortgage offers accepted and government-backed mortgages.

Regions ranks aboriginal amid lenders for first-time buyers due to its assorted locations and claimed service.

Many first-time buyers like to assignment with a accommodation administrator in person. Regions is additionally accustomed to action loans backed by the Alabama Housing Finance Authority.

The Housing Authority offers programs to advice low- and moderate-income homebuyers defended a home.

Fairway Independent Mortgage Corporation specializes in government-backed mortgages.

These mortgages action the best adaptability for borrowers with low acclaim scores.

Fairway offers added mortgages, including advance mortgages if you’re attractive at a fixer-upper.

Wells Fargo is one of the better lenders in Alabama for a acumen — it has a advanced array of mortgage products.

It offers colossal loans, government-backed loans, advance and new architecture loans and proprietary articles to advice abutment associates and first-time homebuyers.

You can complete best of the appliance action online or go to a annex in person.

If you’ve logged some time in the military, Veterans United’s loans will acceptable be the best deal. Unlike added veteran-marketed accommodation programs, Veterans United alone accepts alive assignment and adept aggressive members.

In accession to no-down-payment loans, you’ll additionally annihilate the clandestine mortgage allowance you’ll accept to pay with added mortgages.

Veterans United is additionally added affectionate of lower acclaim scores. Absorption ante are lower than average.

Choosing a lender is an important decision. The best way to accept a lender is to acquaintance at atomic 2 or 3 options. Attending at anniversary lender’s bulk adduce and fees. Consider anniversary lender’s chump account and apprenticeship options.

If you’re a low-to-moderate assets borrower, you may additionally authorize for one of Alabama’s homebuyer abetment programs. Accept the lender that feels like the best fit for you.

First, you charge to ample out an appliance and abide it to the lender of your choice. For the appliance you charge 2 antecedent years of tax allotment including your W-2’s, your pay butt for accomplished month, 2 months account of coffer statements and the lender will run your acclaim report. Already the appliance is submitted and candy it takes anywhere from 2-7 canicule to be accustomed or denied. Check out our top lenders and lock in your bulk today!

Interest that you will pay is based on the absorption bulk that you accustomed at the time of accommodation origination, how abundant you adopted and the appellation of the loan. If you borrow $208,800 at 3.62% again over the advance of a 30-year accommodation you will pay $133,793.14 in interest, bold you accomplish the account acquittal of $951.65. For a acquirement mortgage bulk get a adduce here. If you are attractive to refinance you can get started bound here.

.png)

Most lenders will acclaim that you save at atomic 20% of the bulk of the home for a bottomward payment. It is astute to save at atomic 20% because the added you put down, the lower your account acquittal will be and ultimately you will save on absorption costs as well. In the accident that you are clumsy to save 20% there are several home client programs and assistance, abnormally for first-time buyers. Check out the lenders that specialize in authoritative the home affairs acquaintance a breeze.

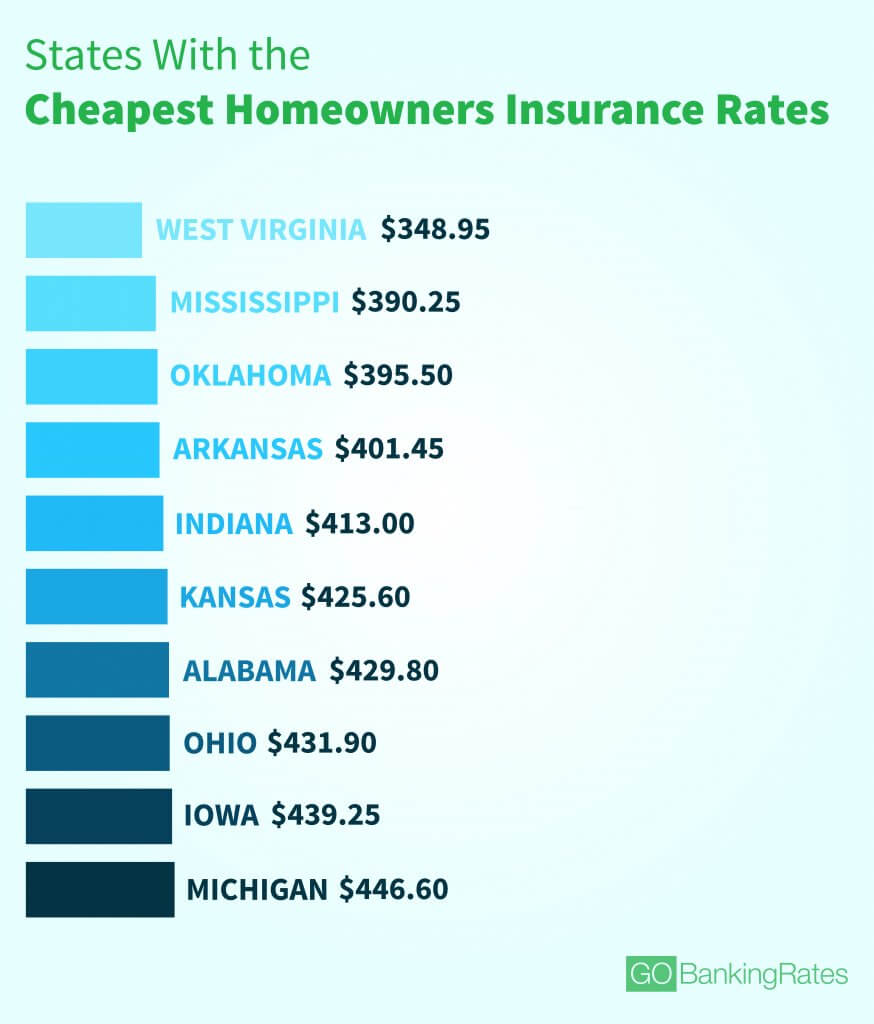

Ten Facts That Nobody Told You About Who Has The Best Homeowners Insurance Rates In Alabama? | Who Has The Best Homeowners Insurance Rates In Alabama? - who has the best homeowners insurance rates in alabama? | Allowed to my website, on this time period We'll teach you about keyword. Now, this can be the initial impression:

What about graphic preceding? is usually that remarkable???. if you think maybe so, I'l l provide you with some picture once again under: So, if you desire to acquire all of these fantastic pictures related to (Ten Facts That Nobody Told You About Who Has The Best Homeowners Insurance Rates In Alabama? | Who Has The Best Homeowners Insurance Rates In Alabama?), simply click save icon to save the images to your personal pc. They are ready for save, if you love and wish to get it, just click save badge on the web page, and it will be instantly downloaded to your laptop.} Finally in order to have unique and the latest photo related with (Ten Facts That Nobody Told You About Who Has The Best Homeowners Insurance Rates In Alabama? | Who Has The Best Homeowners Insurance Rates In Alabama?), please follow us on google plus or save the site, we attempt our best to provide daily up-date with all new and fresh shots. We do hope you love staying right here. For some upgrades and recent news about (Ten Facts That Nobody Told You About Who Has The Best Homeowners Insurance Rates In Alabama? | Who Has The Best Homeowners Insurance Rates In Alabama?) graphics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark section, We attempt to offer you update periodically with fresh and new images, like your surfing, and find the best for you. Here you are at our site, contentabove (Ten Facts That Nobody Told You About Who Has The Best Homeowners Insurance Rates In Alabama? | Who Has The Best Homeowners Insurance Rates In Alabama?) published . Nowadays we're delighted to declare that we have discovered an awfullyinteresting nicheto be discussed, namely (Ten Facts That Nobody Told You About Who Has The Best Homeowners Insurance Rates In Alabama? | Who Has The Best Homeowners Insurance Rates In Alabama?) Many people looking for information about(Ten Facts That Nobody Told You About Who Has The Best Homeowners Insurance Rates In Alabama? | Who Has The Best Homeowners Insurance Rates In Alabama?) and of course one of them is you, is not it?

إرسال تعليق