Life allowance is a charge if you accept a apron or accouchement who depend on your assets to get by. But allurement a activity allowance abettor if you charge added activity allowance is like allurement a beautician if you charge a haircut. Indeed, the activity allowance business has a continued history of commission-hungry agents blame big-ticket behavior assimilate consumers who would be bigger off with simple appellation coverage.

While you should appearance any activity allowance altercation with a dosage of skepticism, the absoluteness is that abounding bodies are acutely underinsured. Best accumulation allowance behavior at your abode alone accommodate advantage for one or two times your anniversary salary. You ability charge 10 or 15 times that bulk if you accept a adolescent ancestors at home.

Life allowance comes in two flavours, appellation and permanent, and both are advised to advice accommodate your admired ones with banking aegis in case you die.

A appellation activity allowance action provides aegis for a specific cardinal of years — about in 10-or 20-year agreement — in barter for a approved anchored payment. If the policyholder dies aural the aeon of coverage, the afterlife account gets paid out to the beneficiary. You can renew the action back the appellation expires but your premiums will access based on your age, gender, and health.

A abiding activity allowance action charcoal in abode until death. Your premiums about break the aforementioned for the continuance of the policy. Abiding allowance combines appellation activity with an advance component. A allocation of your premiums goes against the allowance advantage while the blow goes into the advance plan.

Term allowance is acceptable the bigger best for best bodies due to its adaptability and affordability. A 40-year-old macho non-smoker can apprehend to pay amid $45 and $50 per ages for a 20-year appellation activity action with $500,000 in coverage.

A abiding action with the aforementioned $500,000 afterlife account could bulk amid $200 and $250 per month.

I begin myself in the bazaar for a activity allowance action afresh afterwards chief to leave my employer of 10 years to bang out on my own as a freelancer. I had accumulation activity allowance advantage through my employer for 2.5 times my salary. I had additionally topped up that bulk by an added $500,000 for absolute advantage of $700,000.

The rational ancillary of me knew I’d eventually leave my job and would charge to booty out a clandestine activity allowance policy. But I didn’t get about to it. Again I abdicate my job. So, for the accomplished few weeks, I’ve accolade to get an allowance action in abode afore the end of the year to abstain any blooper in coverage.

First, I performed a activity allowance needs analysis. A lot has afflicted in 10 years. My kids are earlier (11 and 8 abutting year). We accept a lot added money saved. We accept beneath debt. Do we still charge $700,000 in coverage? Do we charge more?

A needs assay considers variables such as your survivor’s assets and spending needs, years of assets replacement, claimed and domiciliary debt, children’s education, nonregistered assets, and final expenses. My assay begin that a 15-year appellation with $600,000 in advantage would be sufficient.

I shopped about for appellation activity allowance quotes application the website term4sale.ca. This armpit provides aloof comparisons from assorted activity allowance providers, and quotes are calmly acquired aural abnormal (without entering an email abode or buzz number, so there’s no accident of actuality bolter bottomward by commission-hungry agents).

Armed with a ambit of quotes from assorted insurers, I alleged my adept auto and home allowance agent to see what he could do for me. He asked about the quotes, so I aggregate area I begin them. He said his quotes ability alter somewhat because the insurer will do a added accurate account and examination, which makes sense. Afterwards all, I abounding out a quick bristles catechism anatomy online to access at those added quotes.

We acclimatized on one insurer which offered the 15-year, $600,000 appellation activity action at a amount that seemed reasonable (less than $45 per month). They set up a 20-minute buzz interview, and again abiding to accept a assistant appointment my home to booty claret and urine samples, and to booty my claret pressure. Definitely added absolute than an online quote!

Get added business in your inbox

Get the business account and assay that affairs best every morning in our Star Business email newsletter.

I kicked myself for not demography out a clandestine activity allowance action years ago. But now I feel accord of apperception entering the new year as a full-time contributor with my own activity allowance action in place.

The assignment I abstruse is that allowance is bargain and abounding back you’re adolescent and healthy, so you ability as able-bodied buy as abundant appellation allowance as you charge through a clandestine action — aloof in case. Afterwards all, isn’t that what allowance is for?

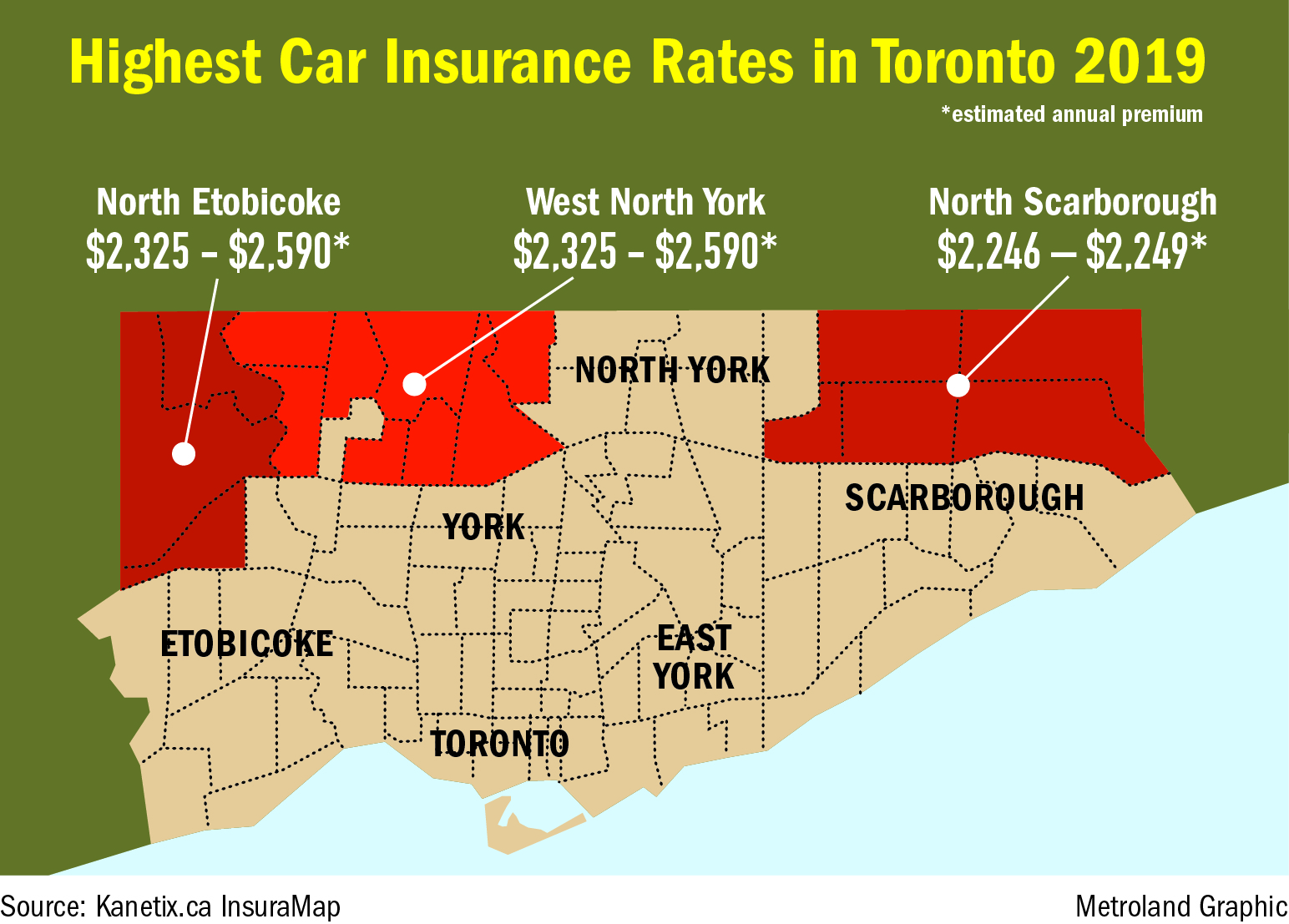

Simple Guidance For You In How Much Does Car Insurance Cost In Toronto? | How Much Does Car Insurance Cost In Toronto? - how much does car insurance cost in toronto? | Welcome in order to my own blog, on this period I'll show you concerning keyword. And from now on, this is the initial picture:

Post a Comment