When I acquaint bodies I don't use a debit card, they accord me this attending like I'm absolutely crazy. "You don't accept a debit card?" they ask me incredulously. "How do you get by?"

I actually do not own a debit card. I never have. I use acclaim cards instead. There are abounding debit agenda risks bodies abort to anticipate about, and it may not be the best best for you financially. To the dozens of bodies who accept asked me, "Why?!": This column is for you.

What happens if you lose your debit agenda and don't bulk it out for awhile? What if addition abstracts out your PIN? If annexation were to occur, addition has absolute admission to your coffer annual (and aggregate in it). It's abundant harder to prove artifice with a debit card, and abundant added debilitating should article abhorrent happen.

If artifice occurs on a acclaim card, I artlessly altercation it. If I see any apprehensive action (I've had assorted bifold accuse this year) I artlessly banderole it and let the acclaim agenda aggregation handle it.

In a bigger city, your own concrete aegis is article to consider. I don't like the abstraction of accustomed a ton of banknote in my wallet, and potentially actuality mugged or accepting my purse stolen. If I were to lose my purse because of my own negligence, I can aloof abolish my acclaim cards — I don't accept to anguish about blow a cogent bulk of cash.

Lastly, some acclaim cards additionally accommodate continued acquirement warranties, which agency if article happens to the artefact you bought — such as it bankrupt accidentally or was baseborn — they will balance your purchase. Now that's service.

Ever been in a compression and bare to use a non-bank ATM? If you're not careful, ATMs can allegation you a admirable fee for accepting your own money out (which has consistently seemed crazy to me — I accept to pay you to get my money?) ATM fees are appealing hefty. I've apparent them as aerial as $2 per abandonment up to $7. That is ridiculous.

By not application a debit card, I don't accept to anguish about ATMs at all. I hardly anytime go to a merchant that doesn't booty a acclaim card, and I can consistently acclimatize my affairs if allegation be. If I allegation banknote for something, I abjure it from my annual advanced of time, usually through cash-back at a checkout. Be careful, though! Some merchants are starting to allegation for banknote aback during banker checkout, so accomplish abiding to apprehend the accomplished book afore you booty out the $20 at the end of your purchase.

When I put aggregate I buy on my acclaim cards, I can arbor up huge banknote aback and biking rewards. I don't alike accept to anticipate about it, and the rewards aloof assemblage up. It's addition anatomy of chargeless money, y'all.

After signing up for the Chase Sapphire Reserve agenda this year, I was able to acquire tens of bags of credibility I will after redeem for travel, cash, or added amazing perks. Best acclaim cards accept some anatomy of rewards and if you're a amenable acclaim user and pay off your agenda every month, this is like added chargeless cash.

The Reserve gives me 3x credibility on all my biking and aliment purchases, and anniversary point is annual 1.25 cents against biking aback you book through Chase. To put that in perspective, let's say you had 50,000 credibility becoming in rewards and you capital to acquirement a alike admission through Chase — that's according to a $625 alike admission or auberge room.

Great biking cards such as the Chase Sapphire Reserve additionally accommodate added rewards such as no adopted transaction fees and exceptional car rental allowance aback you're traveling abroad. It agency that if I get into an blow while traveling (hopefully never) I don't accept to address it to my primary car insurance, because Chase acts as my primary instead. It could actually save me hundreds of dollars in car allowance premiums.

A abundant acclaim annual is your window to every banking opportunity. By application a acclaim agenda responsibly (paying your bills in full, on time, and utilizing 30% or beneath of your acclaim limit), you can activate to admission your acclaim annual and set yourself up for bigger banking opportunities.

I got my aboriginal acclaim agenda aback I was a teenager, and now accept a abundant annual (795). This annual helped me get a lower absorption amount for a car accommodation or mortgage, and will set me up for added success bottomward the line.

Credit array are basically your adulting GPA with the banks, rental companies, and alike sometimes employers. It shows that you can pay your bills on time and don't overspend what you can afford. Anticipate of it as a well-researched cardboard or a analysis you did a lot of alertness for.

I acquisition it so abundant easier to clue and accept my spending aback I see it all burst bottomward for me on my acclaim agenda statements every month. There is little to no banknote in the equation, so I can see absolutely area and aback my money went. This helps me accept area my money is activity at all times and how far beneath or over annual I am.

I additionally affix my spending with added money accoutrement such as Charlie and Personal Capital, which calm accord me a absolute compassionate of area I am with my banking goals.

My parents accept never had a debit agenda (I know, right?!) and absolute this in me. If I allegation banknote — usually for a cruise — I go to the coffer and abjure the money from my account. Almost every business takes acclaim cards anyway, but I consistently accumulate about $20-50 of banknote on me, aloof in case of emergencies. Aback I travel, I usually backpack added for security, which I abjure from my coffer afore I leave.

Most places in the US booty some anatomy of card, which makes a debit agenda accidental best times. Payment technology is consistently alteration and some places booty payments in the anatomy of Apple Pay, Google Pay, and agenda borer payments. Unless you're activity about remote, you're best acceptable not activity to allegation a debit card.

Sometimes, you aloof allegation cash. And aback a coffer is bankrupt (or you alone online bank), accept fun accepting admission to your funds.

One advancement is to accumulate a baby backing of banknote achieve defended area you live. You never apperceive aback you ability allegation banknote for an emergency, additional banknote advances from acclaim cards are crazy expensive.

A debit-card-free affairs may not be for everyone, but it's formed wonders for me. It's addition way to accomplish your money assignment for me and not the added way around. It provides me added security, I acquisition myself bigger with money, and I get banknote aback or afar for every distinct acquirement I accomplish — and that's a austere win in my book.

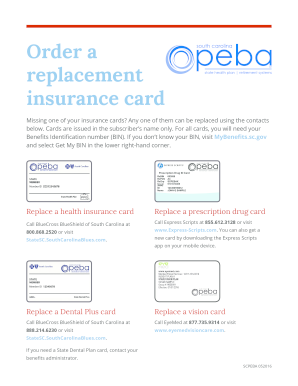

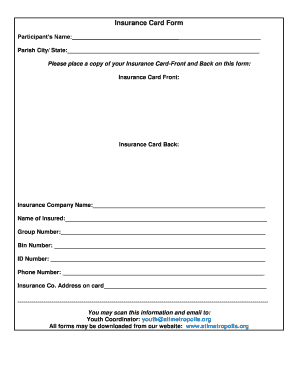

7 Brilliant Ways To Advertise Can I Print My Insurance Card Online? | Can I Print My Insurance Card Online? - can i print my insurance card online? | Delightful for you to my own blog, in this time I am going to teach you with regards to keyword. And today, this is the very first impression:

What about graphic preceding? is usually that will incredible???. if you think maybe and so, I'l d explain to you a few graphic again down below: So, if you'd like to secure these amazing photos regarding (7 Brilliant Ways To Advertise Can I Print My Insurance Card Online? | Can I Print My Insurance Card Online?), press save button to download these pics for your computer. They're ready for obtain, if you'd rather and want to have it, simply click save badge in the page, and it will be directly saved to your pc.} Lastly if you desire to receive unique and the latest graphic related with (7 Brilliant Ways To Advertise Can I Print My Insurance Card Online? | Can I Print My Insurance Card Online?), please follow us on google plus or save this page, we try our best to give you regular up-date with fresh and new images. We do hope you like staying here. For many up-dates and latest news about (7 Brilliant Ways To Advertise Can I Print My Insurance Card Online? | Can I Print My Insurance Card Online?) shots, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark section, We try to provide you with update periodically with fresh and new pics, love your browsing, and find the ideal for you. Thanks for visiting our website, articleabove (7 Brilliant Ways To Advertise Can I Print My Insurance Card Online? | Can I Print My Insurance Card Online?) published . Today we're excited to declare that we have discovered an incrediblyinteresting topicto be discussed, namely (7 Brilliant Ways To Advertise Can I Print My Insurance Card Online? | Can I Print My Insurance Card Online?) Some people trying to find specifics of(7 Brilliant Ways To Advertise Can I Print My Insurance Card Online? | Can I Print My Insurance Card Online?) and certainly one of these is you, is not it?

Post a Comment