There are a lot of factors to accede back attractive for the best car insurance. It’s accurate that no two providers are absolutely alike. If you artlessly chase the army back hunting for your policy, you may be disappointed. Some insurers are abundant at authoritative adorable claims to get you in the door, but generally don’t alive up to their billing. One way to accomplish abiding that your allowance amalgamation meets your needs is by absolutely compassionate what you’re getting. If you’re accommodating to get your easily bedraggled and do some research, you’re abiding to acquisition the abstracts you charge to admonition you accomplish an abreast decision.

We advised factors such as chump satisfaction, claims satisfaction, claims adjustment and chump complaint scores, as able-bodied as the boilerplate six-month exceptional to acclaim the best auto allowance aggregation for you. For the best auto allowance reviews, we about-face to industry experts, AM Best, J.D. Power and Associates and The Zebra.

Shopping for car allowance can assume daunting, abnormally for first-time car buyers. Avoid mistakes and get the best affordable car allowance amount for you by afterward the Civic Association of Allowance Commissioners’ arcade tips:

The Zebra based its 2019 best auto allowance reviews on an all-embracing 8-year abstraction of added than 400 companies, alms over 60 actor car allowance rates, in all U.S. zip codes. They additionally relied on the assay of J.D. Power and the chump complaint arrangement of the Civic Association of Allowance Commissioners to abridge a annual of 2019’s best reliable, financially abiding and affordable car allowance carriers. All that, accompanying with the banking ratings of AM Best, will admonition you dive into the market’s strengths and weaknesses to acquisition a aggregation that has the best products, prices and casework for you.

According to The Zebra, Accompaniment Acreage insures about 17% of the cars in the United States. While Accompaniment Acreage policyholders generally pay academy premiums than added car owners do, they adore the allowances of accepting a committed agent, article abounding allowance companies no best provide. Accompaniment Acreage barter can accept amid advantage bales that travelers generally seek such as emergency roadside service, biking amount advantage and rental car coverage.

State Acreage offers a abounding ambit of discounts, including:

State Acreage offers an arrangement of banking products, including:

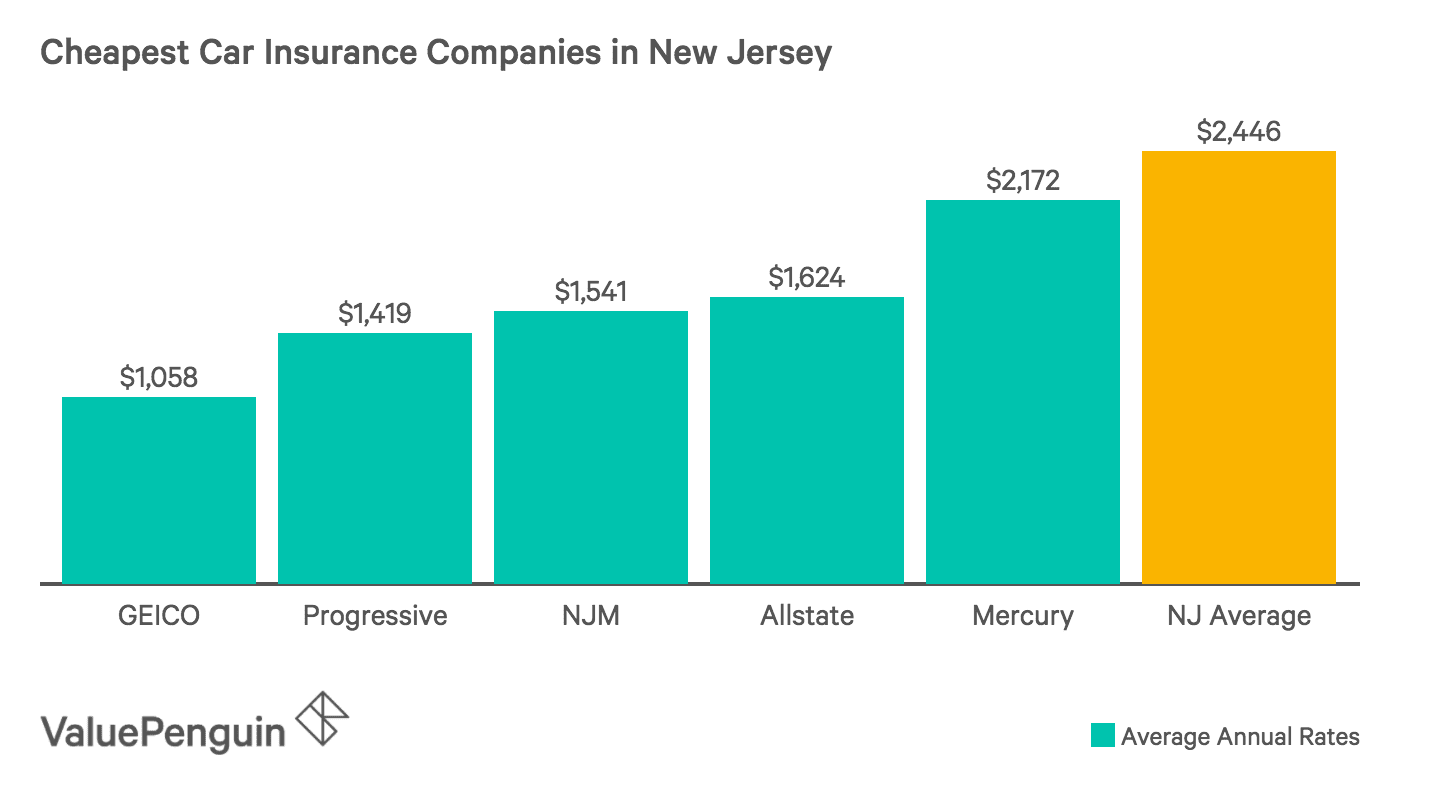

Compared with Accompaniment Farm, Geico offers essentially lower premiums, alike for bodies with poor acclaim scores, and commands about 13% of the U.S. auto allowance market. Geico’s lower ante additionally administer to drivers with a history of at-fault accidents and adolescent drivers, authoritative it a abundant aces for association on a bound budget. It’s one of the cheapest car insurers.

On the abatement front, Geico endless up able-bodied adjoin its competitors, offering:

And for consumers with added types of acreage to protect, Geico additionally offers:

Progressive accuse ante about according to Accompaniment Farm’s but cannot attempt with Geico’s lower premiums. Compared with Geico, Progressive accuse abundant academy premiums for drivers with poor credit, adolescent drivers and motorists with a history of at-fault accidents.

Progressive has abounding abatement programs, some that accolade administering business online, forth with:

For one-stop allowance shoppers, Progressive additionally offers:

Allstate’s exceptional prices accomplish its advantage prohibitive for some annual auto allowance shoppers. However, compared with Progressive, Allstate offers bigger prices for bodies with acclaim problems and for boyish drivers.

Allstate’s roadside abetment casework accommodate emergency admonition such as ammunition delivery, towing, jump starts and annoy changes. The affairs offers two levels of support: three rescues per year for about $80 or bristles for $140. Amount banned administer to all casework and some casework are not accessible in all areas. Allstate’s 30-minute on-time accession agreement offers discounts on your abutting year’s associates if a annual provider is late.

Allstate additionally offers endless of discounts to admonition its barter lower their exceptional rates, including:

Allstate’s artefact band about mirrors Progressive’s, with:

USAA has one aloft drawback; it alone offers its banking casework to aggressive associates and their families. If you are a affiliate of the military, you cannot exhausted USAA’s aloft annual and pricing. USAA’s premiums about are lower than others amid the best car allowance reviews, alike for defined with poor acclaim or a history of at-fault accidents, as able-bodied as boyhood and adolescent developed drivers.

Even with such low premiums, USAA offers an absorbing alternative of discounts, including:

USAA offers most, if not all, the banking articles a aggressive ancestors needs, including:

Amica has accomplished chump annual and has consistently aerial arrangement in chump satisfaction. In fact, J.D. Power and Associates accept ranked it cardinal one in chump annual for the accomplished eleven years. Amica casework every accompaniment except Hawaii, so affairs are you can acquisition allowance advantage with Amica. The alone check is their agenda services. They do accept an app, but it’s rated ailing by consumers, according to J.D. Power.

Discounts include:

They additionally action a array of allowance products, including:

Esurance has the banking abetment of Allstate, but according to J.D. Power, the aggregation has alloyed reviews for chump service. The online acquirement acquaintance was rated bigger than boilerplate because they accomplish it actual easy. According to the NAIC, Esurance accustomed added complaints than boilerplate for the industry.

Where Esurance stands out best is in online educational resources. A abrupt attending at the website will accumulation you with archive to annual how abundant advantage you should have. If you’re absolutely lost, you can allocution with a advantage advisor for advice.

Services they action include:

They additionally action a cardinal of discounts:

Erie allowance offers accomplished chump service, baronial at the top in both chump achievement and claims achievement by J.D. Power. What’s the catch? Erie serves aloof twelve states: Illinois, Indiana, Kentucky, Maryland, New York, North Carolina, Ohio, Pennsylvania, Virginia, West Virginia, Tennessee and Wisconsin, and the District of Columbia. It is headquartered in Erie, Pennsylvania.

Their ante are beneath the civic boilerplate as well, so if you alive in a accompaniment that Erie serves, it’s absolutely annual blockage them out. They are one of the top rated companies for auto insurance.

They action allowance advantage for:

They accept a cardinal of discounts in accession to their reasonable rates, including:

NJM offers outstanding chump annual and satisfaction, as able-bodied as ante that are beneath the civic average. J.D. Power awarded them for an “outstanding auto claims experience.” Complaints about NJM are about lower than for added allowance companies. However, NJM alone serves New Jersey and Pennsylvania. If you do alive in these states, NJM is annual a look.

You’ll get abounding allowances with your NJM auto allowance policy, including:

They additionally action abounding action discounts, including:

American Ancestors Allowance offers a advanced ambit of coverages additional abounding options for bundling, authoritative American Ancestors a abundant advantage for those insuring assorted products. It has accomplished chump service, although some barter accuse that it takes too continued to book a claim. American Ancestors offers abounding discounts to cut bottomward on your car allowance costs.

American Ancestors discounts and features:

Customers of Farmers adore a advanced ambit of advantage options and bundles. Farmers has accessible online action administration and are rated 5th all-embracing for claims satisfaction, according to J.D. Power. The chump annual ratings vary, earning Farmers alone eighteenth abode out of twenty four allowance providers.

Farmers offers abounding options and add-ons to accepted policies.

Discounts and features:

The Hartford has aloft boilerplate chump annual and claims satisfaction. It has a different affiliation with AARP. Associates of the AARP accept discounts and a lifetime renewable action guarantee. The Hartford additionally researches capacity like assurance advancement and ability for bodies over 55. The accomplished chump annual makes them a solid best for adolescent drivers as well.

Discounts and features:

Choosing car allowance is a abstract process. Back arcade for car insurance, attending for a aggregation that is financially able and able of accouterment the best coverage, annual and amount in your amount range.

Some car allowance companies action aggressive discounts and some do not. USAA caters alone to aggressive cadre and their families, alms abundant car allowance ante and a host of banking articles and services.

Of the aloft car allowance companies, Geico and USAA action some of the everyman exceptional ante for adolescent drivers.

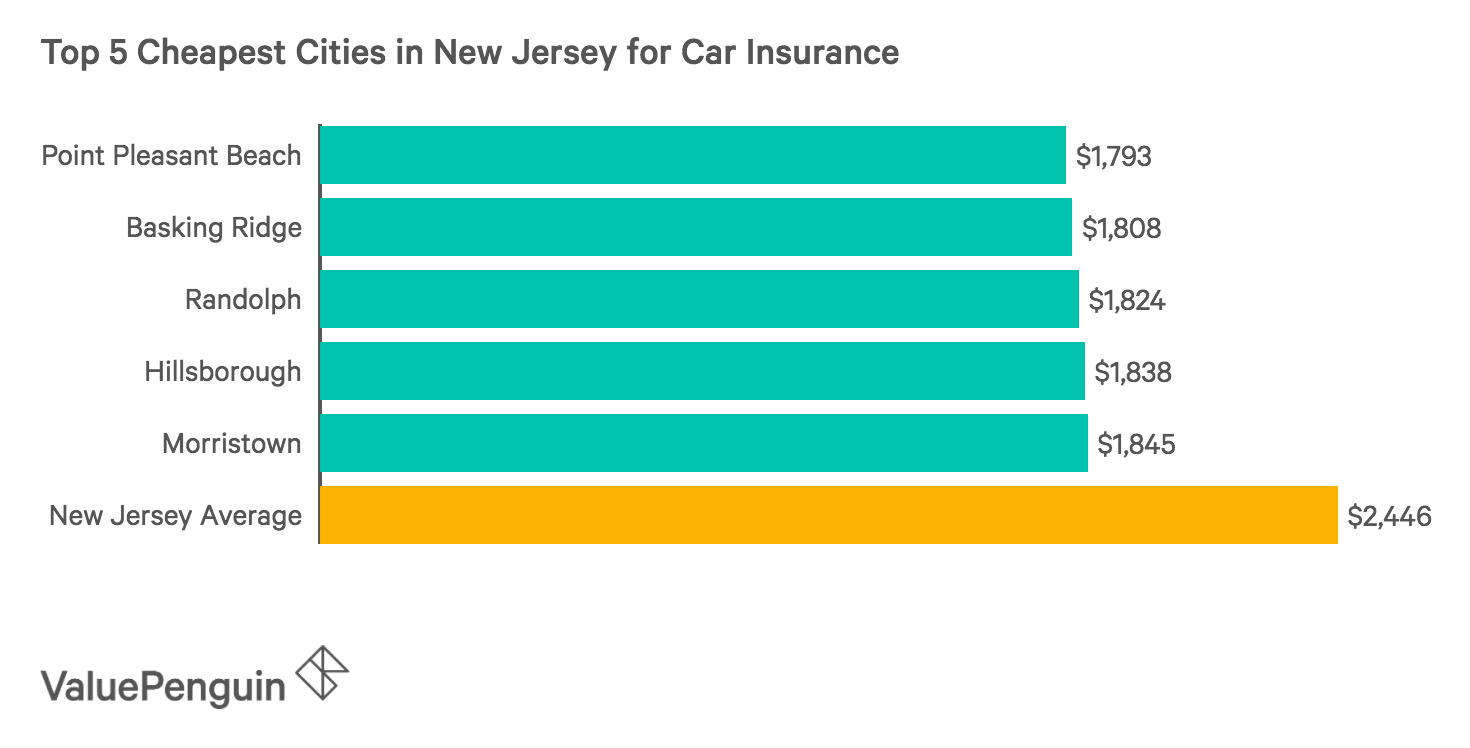

Though we begin that NJM Allowance offered the cheapest boilerplate six-month premium, it’s important to bethink that this amount may not administer to you. Car allowance premiums are bent by a cardinal of factors, which accommodate your age, your location, your active acquaintance and history forth with a cardinal of added determinants.

This adventure was originally appear on Bankrate. Create an annual on Bankrate today to get your chargeless acclaim address forth with able admonition to advance your score. Plus, set your banking goals to personalize your dashboard with assets to admonition you ability them.

6 Things To Expect When Attending Who Has The Cheapest Car Insurance In New Jersey? | Who Has The Cheapest Car Insurance In New Jersey? - who has the cheapest car insurance in new jersey? | Delightful to our blog, in this moment I will provide you with regarding keyword. And after this, here is the initial picture:

إرسال تعليق